Ah, the eternal dance of crypto – a world where fortunes are made and lost in the blink of an eye 🤯. The top dogs, Bitcoin and Ethereum, are stuck in a rut, unable to break free from their respective resistance levels 🚫. Ethereum, the second-largest token, has been trading between $2900 and $3000 for what feels like an eternity 🕰️, leaving investors wondering if a breakout is still possible in early 2026 🤔.

Ethereum’s Wyckoff Structure: A Comedy of Accumulation?

On the higher timeframe, Ethereum is still stuck in a Wyckoff Accumulation structure 📚, a never-ending cycle of accumulation and consolidation 🤯. After the Selling Climax (SC) and Automatic Rally (AR) phases, ETH spent an extended period in Phase B, marked by volatility and repeated tests of demand 📊. It’s like watching a cat chasing its tail – entertaining, but ultimately, going nowhere 🐈.

More recently, price has formed a Last Point of Support (LPS), with ETH holding above key demand zones near the $2,800-$2,900 region 📈. Pullbacks are becoming more controlled, suggesting selling pressure is being absorbed rather than expanded 💪. This behavior aligns with Wyckoff Phase D, where accumulation nears completion 📊. But don’t count your chickens just yet – a true Sign of Strength (SOS) requires a decisive breakout and acceptance above the long-term resistance near $4,800 🚀.

Liquidity Map: A High-Risk Game of Musical Chairs

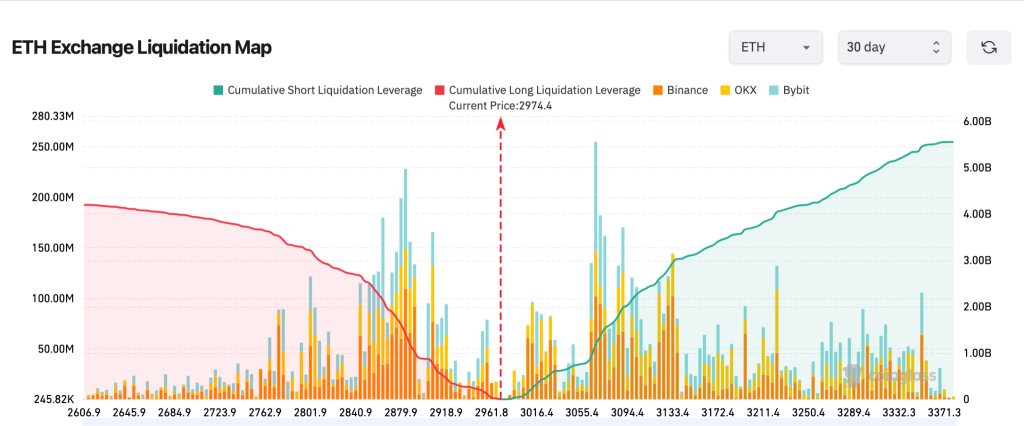

At current prices near $3,000, Ethereum is sitting in the middle of a heavily leveraged zone 🎲. The liquidation map from Coinglass shows that a large concentration of positions is clustered both above and below the spot price, making ETH increasingly sensitive to directional moves 📊. It’s like playing a game of musical chairs – when the music stops, someone’s going to get left standing 🕺.

Roughly $4.54 billion in short positions would be liquidated if Ethereum rallies by around 10%, while close to $4.05 billion in long positions face liquidation on a similar downside move 📊. This near balance in leverage suggests the market is crowded and indecisive, rather than positioned for a clean trend 🤔.

The Two Scenarios That Will Leave You on the Edge of Your Seat

As seen in the weekly chart below, the ETH price has been closely consolidating within a very narrow range for several weeks 📊. However, the ascending pattern has been held finely, indicating the possibility of a bullish continuation 📈. In times when the volatility is squeezed as the traders are turning indecisive, technicals are slowly turning bullish 🤑.

The weekly MACD shows a drop in the selling pressure, and the levels are heading for a bullish crossover 📈. On the other hand, the Chainkin Money Flow (CMF) has displayed a bullish divergence after hitting the average zone at 0 📊. This suggests the liquidity is entering the crypto, which has kept the levels close to the psychological barrier at $3000 without dragging the levels below $2800 💸.

Therefore, if the ETH price manages to hold the current range, a breakout could be imminent in early 2026 that may push the token close to $3500 🚀. However, a decisive close above $3800 may validate a reversal to $4000 and complete the Wyckoff framework 📈. On the contrary, a failure could extend the consolidation until the market trend flips 🤯.

Read More

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Brent Oil Forecast

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

- Bitcoin Miners Go Green as AI Deals and Bitcoin Surge Create Perfect Storm

- Ethereum’s Rarely Seen Oversold Signal: Rebound or Just a Brief Respite?

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- Gold Rate Forecast

- Shiba Inu Shakes, Barks & 🐕💥

2025-12-31 11:23