What to know:

By Francisco Rodrigues (All times ET unless indicated otherwise)

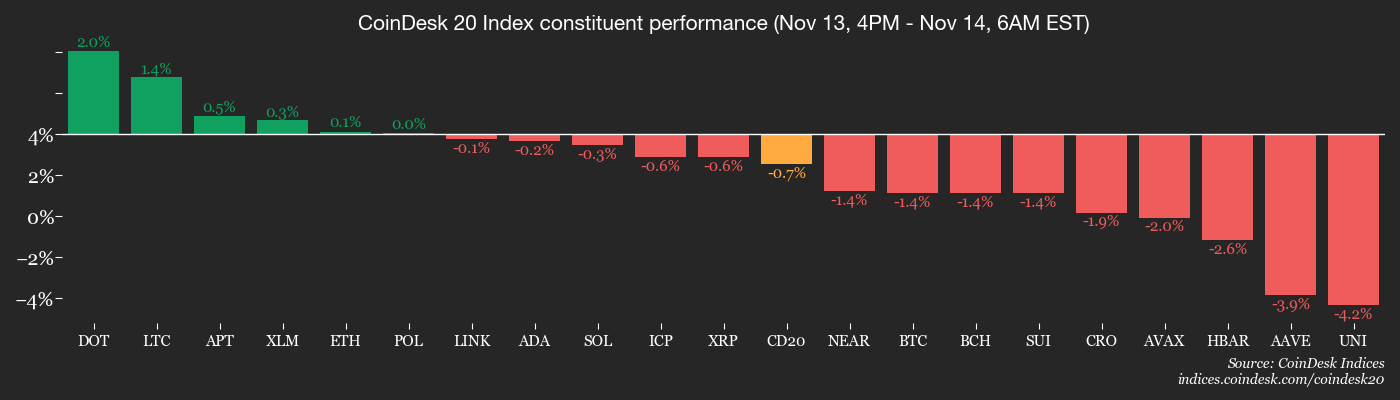

The Czech National Bank became the world’s first central bank to buy bitcoin, and a spot XRP ETF debuted in the US with an impressive trading volume. Naturally, this coincided with bitcoin falling below $100,000 and a crypto market crash so dramatic, it could make a dragon weep. The CoinDesk 20 (CD20) index slumped 8.35% in 24 hours, while the Dow Jones and Nasdaq joined the party with losses of 1.65% and 2.29% respectively. Classic.

Spot bitcoin ETFs? They’re currently experiencing outflows so severe, it’s like a bank run… but with digital coins and fewer actual queues. Investors pulled $869 million on Thursday alone, and over three weeks, we’re talking $2.64 billion lost to the void. Wintermute, a crypto market maker, noted: “We’re seeing steady interest in owning long-dated BTC vol around 80-120k, paired with selective short-term call selling (classic covered call activity).” In other words, everyone’s playing it safe like it’s a board game and the board just caught fire.

Ether options? Traders are hedging downside risks “into year-end” and selling calls like they’re discount vouchers for a post-apocalyptic barter system. Wintermute’s take: “Positioning leans neutral-to-cautious but shows no appetite to chase big downside.” Translation: Everyone’s got their heads in the sand, but at least the sand is slightly less dangerous than the current market.

The sell-off triggered $1.11 billion in liquidations in 24 hours. Meanwhile, U.S. rate-cut hopes are cooling like a panini left in the snow, and AI bubble fears are bubbling like overpriced kombucha. The CME’s FedWatch tool says December rate cuts are a 50-50 gamble, while Polymarket traders are still clinging to a 52% chance-down from 90% last month. Clearly, optimism is as rare as a sunny day in Ankh-Morpork.

And just to spice things up, the White House hinted that October inflation data might not see the light of day due to a government shutdown that’s now ended… but not forgotten. Wintermute’s final thought: “Now that the AI excitement is cooling and more questions are raised around spending, concerns around the K-shaped economy in the US are raised again.” A K-shaped economy? Sounds like a graph that’s been through a blender.

Despite all this chaos, the crypto sector is hitting milestones-spot ETFs, central bank BTC purchases, and more. But macro headwinds are still strong enough to blow a dragon’s hat off. Stay alert! Or don’t. Either way, you’ll probably lose money. 🌪️

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

- Crypto

- Nothing scheduled.

- Macro

- Nothing scheduled.

- Earnings (Estimates based on FactSet data)

- Nov. 14: American Bitcoin (ABTC), pre-market.

- Nov. 14: Hive Digital Technologies (HIVE), post-market.

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

- Day 3 of 3: Blockchain Summit Latam 2025 (Medellin, Colombia)

- Day 2 of 2: Bitcoin Amsterdam

- Nov. 14: ICAEW’s Crypto and Digital Assets Conference (London)

- Day 1 of 2: Adopting Bitcoin 2025 (San Salvador, El Salvador)

Market Movements

- BTC is down 1.87% from 4 p.m. ET Thursday at $104,909.52 (24hrs: -6.05%)

- ETH is down 0.56% at $3,160.31 (24hrs: -9.6%)

- CoinDesk 20 is down 1.17%at 3,096.79 (24hrs: -8.14%)

- Ether CESR Composite Staking Rate is up 2 bps at 2.88%

- BTC funding rate is at 0.0082% (8.944% annualized) on Binance

- DXY is up 0.2% at 99.36

- Gold futures are down 0.56% at $4,170.90

- Silver futures are down 1.08% at $52.60

- Nikkei 225 closed down 1.77% at 50,376.53

- Hang Seng closed down 1.85% at 26,572.46

- FTSE is down 1.35% at 9,675.09

- Euro Stoxx 50 is down 1.01% at 5,684.85

- DJIA closed on Thursday down 1.65% at 47,457.22

- S&P 500 closed down 1.66% at 6,737.49

- Nasdaq Composite closed down 2.29% at 22,870.36

- S&P/TSX Composite closed down 1.86% at 30,253.64

- S&P 40 Latin America closed down 1.32% at 3,103.60

- U.S. 10-Year Treasury rate is up 1.8 bps at 4.129%

- E-mini S&P 500 futures are down 0.23% at 6,744.50

- E-mini Nasdaq-100 futures are down 0.48% at 24,974.25

- E-mini Dow Jones Industrial Average Index are down 0.15% at 47,476.00

Bitcoin Stats

- BTC Dominance: 59.77% (-0.67%)

- Ether-bitcoin ratio: 0.0327 (0.84%)

- Hashrate (seven-day moving average): 1089 EH/s

- Hashprice (spot): $40.31

- Total fees: 2.96 BTC / $300,582

- CME Futures Open Interest: 140,275 BTC

- BTC priced in gold: 22.8 oz.

- BTC vs gold market cap: 11.46%

Technical Analysis

- The chart shows daily moves in Volmex’s 30-day bitcoin implied volatility index, BVIV.

- The index has formed a pennant pattern, marking a triangular consolidation following the recent bullish trendline breakout.

- Such patterns usually indicate a temporary pause that refreshes higher. Therefore, the pennant could soon resolve bullishly, paving the way for more gains in the index.

- In other words, BTC price volatility expectations could continue to rise in the near-term.

Crypto Equities

- Coinbase Global (COIN): closed on Thursday at $283.14 (-6.86%), -1.82% at $277.99 in pre-market

- Circle Internet (CRCL): closed at $82.34 (-4.59%), -0.62% at $81.83

- Galaxy Digital (GLXY): closed at $27.24 (-12.89%), -3.34% at $26.33

- Bullish (BLSH): closed at $41.02 (-9.85%), -2% at $40.20

- MARA Holdings (MARA): closed at $12.78 (-11.31%), -2.11% at $12.51

- Riot Platforms (RIOT): closed at $13.88 (-10.22%), -2.59% at $13.52

- Core Scientific (CORZ): closed at $15.16 (-7.79%), -2.97% at $14.71

- CleanSpark (CLSK): closed at $11.98 (-10.13%), -3.09% at $11.61

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $41.97 (-12.07%)

- Exodus Movement (EXOD): closed at $18.15 (-8.84%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $208.54 (-7.15%), -1.89% at $204.59

- Semler Scientific (SMLR): closed at $23 (-10.61%)

- SharpLink Gaming (SBET): closed at $10.99 (-5.01%), -2.37% at $10.73

- Upexi (UPXI): closed at $3.22 (-4.73%), -0.62% at $3.20

- Lite Strategy (LITS): closed at $1.9 (-5.47%)

ETF Flows

Spot BTC ETFs

- Daily net flows: -$866.7 million

- Cumulative net flows: $59.33 billion

- Total BTC holdings ~1.34 million

Spot ETH ETFs

- Daily net flows: -$259.6 million

- Cumulative net flows: $13.33 billion

- Total ETH holdings ~6.48 million

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Brent Oil Forecast

- USD CAD PREDICTION

- Gold Rate Forecast

- UFC & Polymarket: Fists, Foresight, and Frenzy!

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- USD THB PREDICTION

2025-11-14 15:39