In the vast expanse of the crypto bazaar, where fortunes are made and lost quicker than a sneeze, SUI seems to be finding its footing at a modest $0.94. One might say it’s like a slightly deflated balloon, hovering just below the resistance ceiling, watching with bated breath as a new institutional tale unfolds in the shadows.

Ah, but here enter two U.S. listed ETFs, both prancing into the market like peacocks, integrating staking yield into their very fabric. While Ethereum’s ETF aspirations languish in a haze of uncertainty, SUI boldly strides forth, flaunting its yield from the get-go, as if to say, “Look at me, world!”

The pressing question is no longer whether SUI can rally. No, dear reader, it’s whether the intricate dance of supply mechanics and price structure is choreographed beneath the surface, waiting for its moment to shine.

The Grand Entrance of Institutional Access into the SUI Stage

The unveiling of Grayscale’s GSUI on NYSE Arca and Canary Funds’ SUIS on Nasdaq signifies nothing short of a seismic shift for SUI. These delightful concoctions provide direct exposure while slyly embedding staking yields into the ETF framework. Unlike those passive trackers that merely mimic the price, these vehicles are like hungry bears accumulating SUI in the spot market, allowing yields to flow through as if they were the very lifeblood of the ecosystem.

@CanaryFunds has launched SUIS, the first U.S. spot ETF for Sui on @Nasdaq.

Regulated public market exposure to SUI is here.

As Sui scales across stablecoins and global payments, where money moves as freely as messages, SUIS expands access for traditional finance.

– Sui (@SuiNetwork) February 18, 2026

Now, consider this: a staggering seventy-four percent of SUI’s circulating supply is already staked. It’s like trying to find a needle in a haystack that has all but vanished! The liquid float is much thinner than those inflated market cap figures would have you believe. When ETF inflows arrive, they may translate into accumulation faster than one can say “supply tightening” – oh, what a drama unfolds!

Bitcoin once required a veritable flood of multi-billion-dollar ETF inflows to turn its ship around. But SUI, being the pint-sized hero, needs far less to create ripples. Even a mere trickle could spark a frenzy when the float is so constrained. This isn’t merely speculation driven by daydreamers; we have regulated capital waltzing with locked supply.

SUI’s Price Chart: A Nostalgic Echo of Expansive Days Gone By

A glance at SUI’s price chart reveals echoes of yesteryear’s macro waves. Historically speaking, SUI has danced through cyclical waves starting with descending wedge compressions. In its inaugural performance, it consolidated within a wedge, swept up liquidity near the lows, reclaimed resistance, and then expanded by a staggering five hundred percent. The sequel was even more dramatic, delivering over a thousand percent upside. The audience gasped as volatility contracted, only to witness a ferocious impulsive move follow.

What a familiar scene we find ourselves in! SUI has recently wrapped up another corrective wedge, leaving behind a visible liquidation wick – quite the theatrical flourish! Since reclaiming the descending resistance, the price has stabilized rather than plummeting like a lead balloon, now squishing beneath the $1.00 to $1.05 barrier. This zone represents the structural pivot; a sustained break above $1.05 could confirm a new expansion wave, akin to the curtain rising on a long-awaited encore.

Until that glorious moment arrives, SUI remains in a holding pattern, with support resting comfortably around $0.88 to $0.90, and deeper structural backing at $0.82. As long as these levels hold, we can maintain our higher-low recovery framework – technically constructive, if not a touch mundane.

The Liquidity Corridor: A Delicate Balancing Act

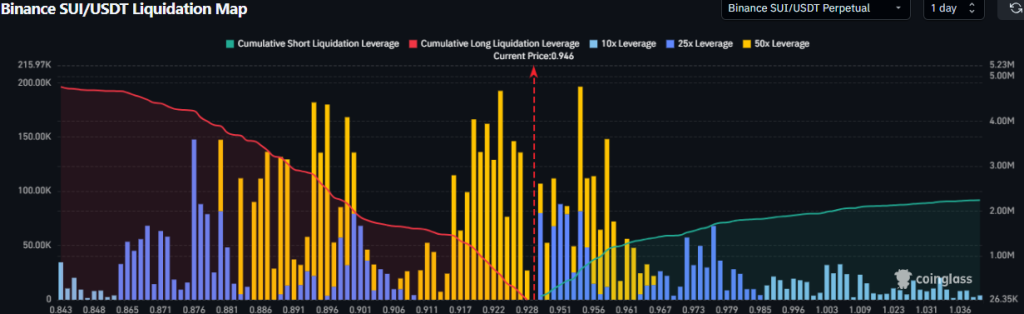

Ah, but derivatives positioning adds yet another layer to this intricate setup. Liquidation map data reveals short leverage building above the $1.00 mark, while long liquidation clusters lounge lazily below the $0.90 region. What a tangled web we weave! This creates a liquidity corridor where price is trapped between opposing forces, akin to a cat caught between two chairs. When leverage builds on either side, resolution often arrives with a bang rather than a whisper.

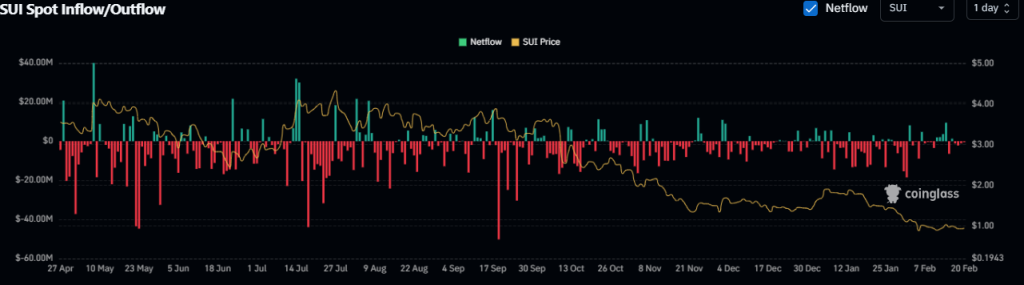

Spot inflow and outflow data suggest that during these tranquil stabilization phases, outflows, rather than indicating panic, imply accumulation or staking – how delightfully counterintuitive! This reinforces our tightening supply narrative. When spot demand quietly absorbs supply while derivatives positioning builds tension, volatility expansion tends to follow like a well-timed punchline.

The pivotal moment lies in a confirmed breakout above $1.05. Should that level be breached with conviction, the macro wave thesis gains the technical validation it desperately craves, and the market may begin to recalibrate SUI’s tightening supply dynamics.

Until that moment arrives, SUI holds its breath, building pressure beneath the resistance. And when the threads of compression, institutional flows, and constrained float align, one must assume that price will not remain silent for long; after all, the stage waits for its star!

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- USD THB PREDICTION

- 7-Year-Old Crypto Tycoon Ditches Bitcoin for Ethereum: A Tale of Digital Fortunes 🤑💰🚀

- Bitcoin Wakes Up, Pretends It Has Its Life Together ✨📉🚀

- DOGE’s Wild Ride: Whales, Flags, and Golden Crosses 🌊🚀

- DeFi Meltdown: Yearn Finance’s yETH Pool Drained by a Rogue Algorithm 🤖💸

- Bitcoin Plummets Below $98K: Fear Grips Market Like a Bad Soap Opera 🎭

- Bitcoin’s Bizarre Bull Run: ETFs, Elves, and Explosive Tokens! 🚀

2026-02-20 14:14