You know how people who buy $500.00 ruffled collars usually end up drowning in regret? Well, in the crypto market, today isn’t about regales. Today, it’s about buying the dip, Nov. 23, as everyone scrambles to avert their financial misadventures, kind of like how I buy designer socks I never wear. 💰👟

- The crypto market is up today, with Bitcoin kissing $86,000. Who knew it shared bathroom similarities with reality TV stars? 🤦♀️

- This so-called “rally” occurs as brave souls leap at each recent dip. Oh, the bravery! 🙄

- Meanwhile, futures open interest and stablecoin supply in exchanges loiter around longer than a sarcastic family reunion. 🎉🥂

Bitcoin (BTC), our most beloved digital gold, soared to $86,000, up about 8% from its lowest moans this year. And the underdog altcoins like Zcash (ZEC), Cronos (CRO), Monero (XMR), and Aerodrome Finance, they fancy a 10% climb over the past 24 hours as if gravity got bored and vanished for the day. 📈❤️

According to data compiled by CoinMarketCap (a gospel I consult when the IRS inches close), the total market cap of all coins lumbered up by nearly 3% to a whopping $2.9 trillion. With numbers like these, who could argue? Not me, trust me on that.

Crypto Market Skyrockets? How Again?

Apparently, this surge is because investors, acting like they used to own the Brooklyn Bridge, are swooping in to buy the dip after a dramatic, multi-day swoon. Hoping to snatch up a bargain akin to finding a $5 bill in your gym bag. 🧗♂️🥇

In a sweet twist, American stocks grinned to the neon green finish line this week. The Dow Jones jumped by 493 points, S&P 500, and Nasdaq 100 sequences scratched 65 and 195 points, respectively. It’s as if they smirked and said, “Catch up, nerds!” 🌟

Although, let’s ponder the possibility that this might be a dead-cat bounce or a bull trap, where a falling asset relents for a trice before resuming its sad descent. It’s like when you watch a movie late at night, and hope against hope the plot improves before your dreams start betraying you. 💤🎬

Crypto Prices Bounce Back While Open Interest Soars

It seems the crypto rebound was fertilized by a surge in the futures market. CoinGlass reports that futures open interest jumped a hefty 3.3% in the last day to over $125 billion. Meanwhile, 24-hour liquidations took a nosedive, sinking by 88% to $207 million. This dynamic duo of high leverage and low liquidations often promises fireworks, at least until Sunday rolls back around. 🎇💥

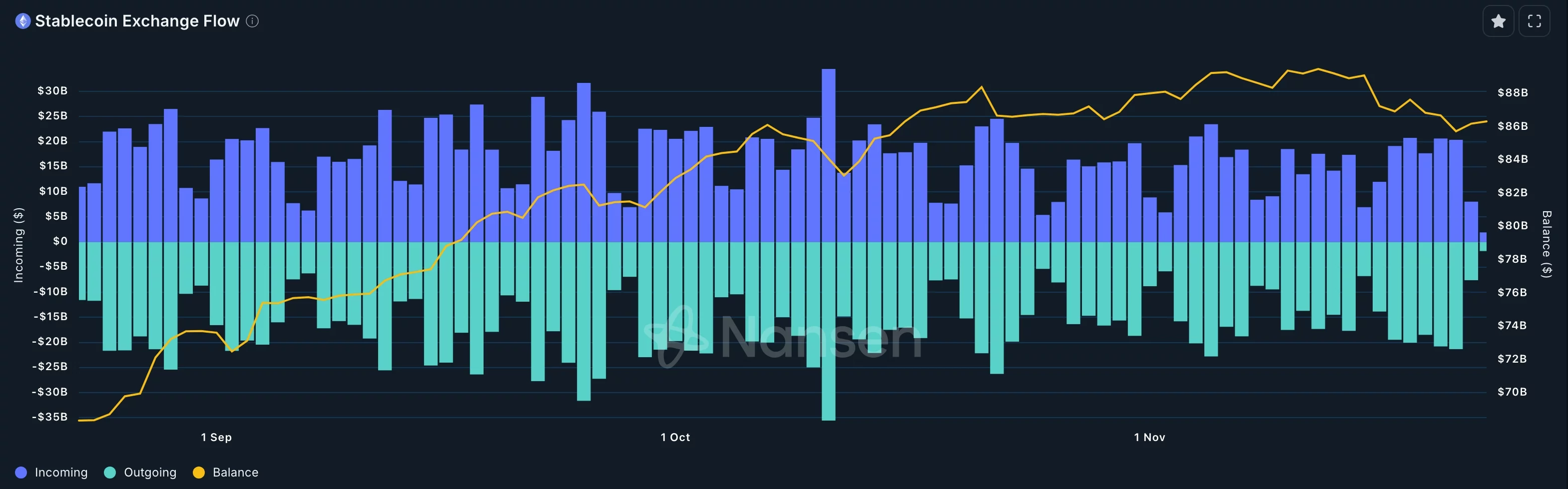

In another plot twist, Nansen data whispers that stablecoins are flouncing back to exchanges, teetering at $86 billion from $85 billion the day before. As melodramatic as swapping roles in a soap opera at midnight. 🎭💸

Oh, and the cherry on this topsy-turvy cake? Some highfalutin altcoin ETF approvals loom this week. Graycale, 21Shares, and Franklin Templeton will introduce their XRP ETFs, adding to the shimmer. Apparently, you’ll also find their Dogecoin ETFs. Need I say more about irony?

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Bitcoin Miners Go Green as AI Deals and Bitcoin Surge Create Perfect Storm

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- Gold Rate Forecast

- Steak ‘n Shake & Bitcoin: Utterly Baffling!

- Trump’s Family Buys Wild Amount of Bitcoin Mining Machines?! ASIC Madness!

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Bitcoin ETFs Make It Rain While Ether Buys a One-Way Ticket Out 🪙📉

- Shiba Inu Shakes, Barks & 🐕💥

2025-11-23 14:52