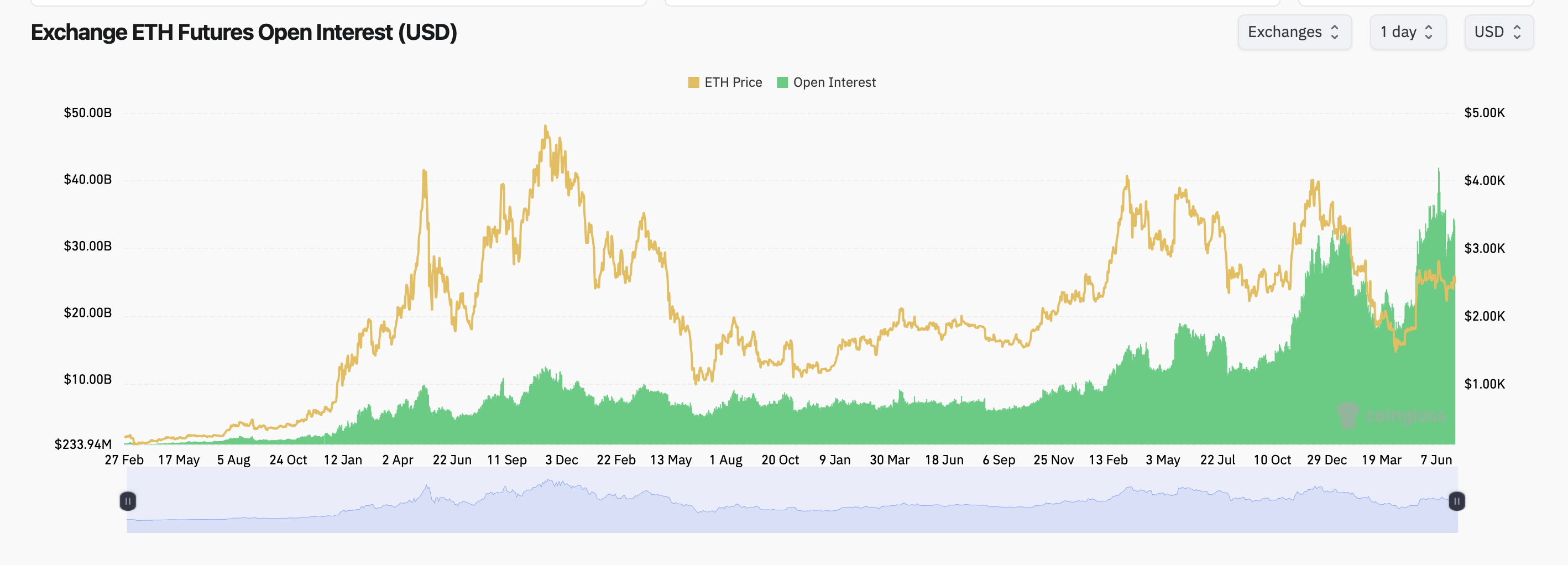

If you ever wanted to see $33 billion doing a slow-motion waltz, look no further than Ethereum futures open interest, which has remained stubbornly perky—despite a market that behaves like it’s had one gin and tonic too many. Meanwhile, options traders are all but waving pom-poms for late-2025 prices. Go team ETH!

CME and Binance: Where $33 Billion Pretends to Know What It’s Doing

In the shadowy world of Ethereum futures, everyone gets to speculate on ETH’s future price without the bothersome task of owning any actual Ethereum. It’s a bit like betting on horses without having to feed them, or explain cryptocurrency to your parents at dinner. The running tally of contracts—open interest, if you want to sound clever—rests comfortably at $33.09 billion (that’s 13.29 million ETH for the mathematically inclined) across a jostling landscape of exchanges.

On the “mood swings” front, the overall market managed a 2.79% decline in just 24 hours—the financial equivalent of a slightly irritated sigh. Still, Gate.io and Bitget apparently hadn’t read the memo, clocking up 1.17% and 0.86% gains, which surely led to celebratory emails somewhere. The big beasts—CME Group and Binance—continue to jostle for alpha status, CME gripping $3.19 billion (9.64% market share for those keeping score), and Binance lording it over everyone else with $6.26 billion (18.9% market share, or “look at me” territory).

The open interest-to-daily-volume ratio (0.6366, for stat-lovers with a fondness for decimals) says trading is humming, but not exactly at Coachella-level frenzy. A few platforms took the “OI decline” a bit too seriously: Kucoin tumbled 17.37% and OKX tripped by 6.27%. Crypto markets—never boring, always slightly confusing.

Switching lanes to the glamorous world of options: these handy creatures give you rights to buy (calls) or sell (puts) ETH at specific prices. Right now, everyone’s feeling chirpy about calls, which make up a lopsided 65.87% of all open contracts (that’s 1,717,477 ETH, or enough digital loot to buy several small islands if only you could). The standout wishful thinking includes a December 25, 2025 $6,000 call and a July 25, 2025 $3,000 call—clearly, some traders are writing letters to Santa.

🤔 But here’s where the plot thickens: in 24-hour options trading, the puts muscled in, with 55.58% of volume (527,705 ETH traded). It’s as if everyone’s hedging their bets, or their therapists suggested “embracing your bearish side.” In short, the battle between open interest and trading volume has a real soap opera vibe—bulls planning the wedding, bears plotting the dramatic twist.

The most frantically traded contracts have nearer-term expiration dates, with shout-outs to July 25, 2025’s $3,000 call and December 25, 2025’s $4,000 call. Futures data tells a story of a hefty, mildly shrinking market. Options, meanwhile, scream “moon shot!” for late 2025—especially that intoxicating $6,000 December call.

And yet, those puts? They refuse to be ignored. With 55.58% of options volume, there’s a whole cast of traders prepping in case things go sideways—think of it as packing an umbrella and sunscreen for the same holiday.

So, what’s the verdict? Open interest says everyone’s long-term bullish, dreaming of ETH yachts and futuristic sunglasses, but the put frenzy suggests the parade route still has a few banana peels. The optimism is loud, but the caution is just as persistent—and probably plotting a twist ending just when everyone least expects it. 🦄📉📈

Read More

- Brent Oil Forecast

- Silver Rate Forecast

- Gold Rate Forecast

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- 🚀 Stellar Plummets Like a Discworld Turtle Off a Cliff! 🌪️

- SEI PREDICTION. SEI cryptocurrency

- Bitcoin’s Chaotic Ballet: Inflation Data Looms, Traders Bite Nails 🍿

2025-07-05 03:32