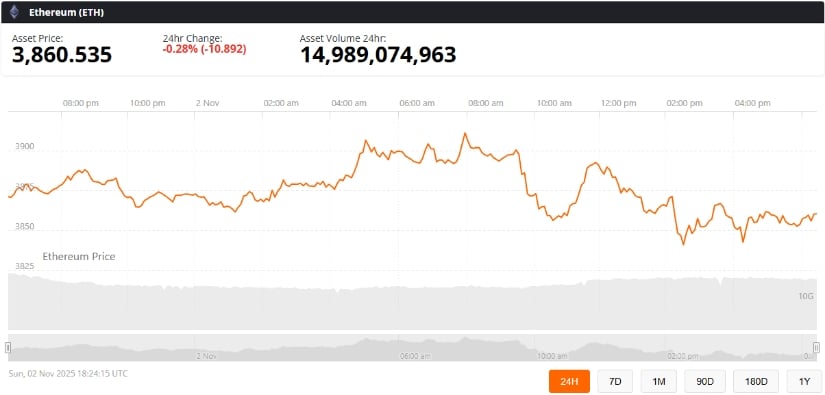

Behold, Ethereum-our digital jester in the crypto circus-has once again donned its cap of chaos. After a month of sly consolidation, ETH now pirouettes around $3,860, a price so modest it makes a beggar’s hat look like a treasure chest. Analysts, those modern-day soothsayers, whisper of a “breakout” as if the coin is trapped in a gilded cage. Ah, but what is a cage when the key is a bullish divergence and the jailer is a $3,800 support level? Let us not forget the grandmasters of institutional inflows, who pour gold into this pot with the enthusiasm of a drunkard at a distillery. 🤑

Technical Analysis: Bullish Divergence and Momentum Indicators

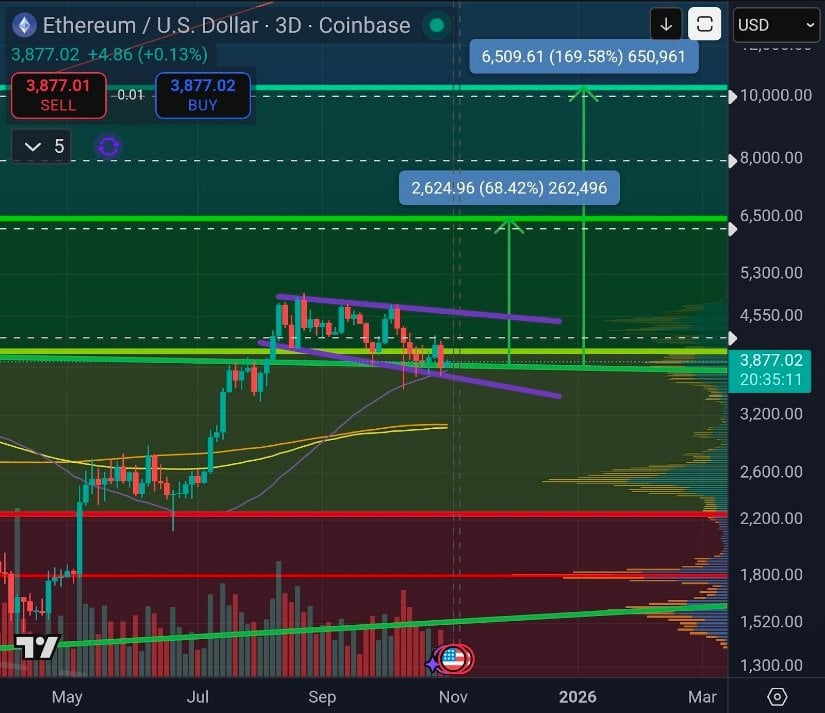

The Stochastic RSI, that ancient oracle of overbought and oversold realms, now croons at 3.76-a number so pitiful it could weep. Yet history, that fickle mistress, reminds us that such lows birthed a 165% rally in 2023. Imagine: $1,550 to $4,100 in five months! A feat so bold, it would make a phoenix blush. But let us not forget the descending triangle-a geometric love letter to chaos, forming around $3,500. Mister Crypto, our crypto Cassandras, declare: “Breakout near $3,850! Whale accumulation? Oui! On-chain activity? Oui-oui!” 🐳

Traders, those modern gladiators, now eye $4,600 as a hurdle. A hurdle? More like a red carpet for a coronation. But tread carefully, dear reader-the gods of volatility are capricious. 🌪️

On-Chain Insights: Supply Shock Boosts Ethereum Outlook

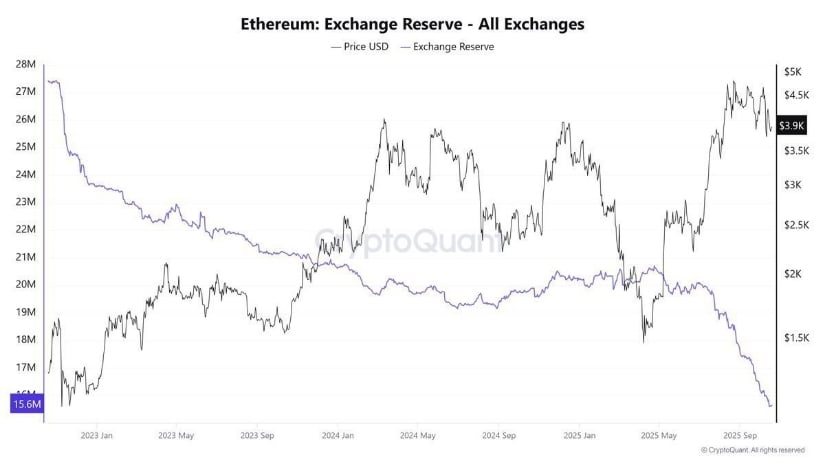

Ethereum’s on-chain data now sings a hymn of bullish glory. Exchange reserves? A paltry 15.6 million ETH-a number so low, it could be the population of a village. Staking? A staggering 35.7 million ETH, locked away like a dragon’s hoard. And fee burns? They outpace issuance with the zeal of a monk at a bonfire. CryptoGoos, our crypto bard, declares: “Supply growth under 1% annually? High staking? Favorable conditions for a bullish run? Yes, and a side of confetti!” 🎉

Exchange outflows, those silent assassins, have slashed supply by 41% since 2022. A 41% reduction! What madness is this? History suggests such contractions precede rallies. Could $10,000 be next? Or is this merely a mirage in the desert of hope? 🔮

Market Sentiment: Community Optimism and ETF Prospects

The Ethereum community, a theater of clowns and philosophers, debates with the fervor of a bar fight. Micro2Macr0 and Mister Crypto, our crypto oracles, predict $6,500 with the confidence of a man who’s never lost a bet. Yet social media buzzes with a mix of bullish cheer and cautious sighs. A healthy debate? Perhaps. But remember: in crypto, even the optimists have panic attacks. 😅

Institutional interest? A flood of $18 billion in October! Such sums could buy a small island-or fund a few more ETFs. Analysts, those crypto seers, predict a “clean breakout” above resistance. But will it trigger buying frenzies? Or will it collapse like a soufflé in a hurricane? Only time, that cruel puppeteer, will tell. 🕰️

Ethereum Price Prediction: Could ETH Reach $6,500?

If ETH maintains support near $3,800 and dances past $4,600, the coin could waltz toward $6,500. A target so lofty, it would make a skyscraper blush. But beware the “death cross,” that grim reaper of markets, and short-term volatility, which bites harder than a rabid raccoon. 🐾

Yet the outlook remains “constructive,” a word so overused it deserves a Nobel Prize. With technical bounces, supply shocks, and institutional backing, Ethereum’s trajectory could define 2025. But remember: markets are a masquerade ball. One moment, you’re king; the next, you’re wearing a clown nose. 🎩

$3,859

Read More

- US Crypto Regulators Finally Decide What They Actually Mean – Time to Buy?

- Tether’s Big Heist: $500B Valuation or Just a Stablecoin’s Wild Dream? 💸

- Altcoins? Seriously?

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- Shocking! Genius Act Gives Crypto a Glow-Up – Jokes, Dollars & Digital crazy!

- 🐳 Crypto Whales Drive Memecoins to New Heights – Floki, Pepe, SHIB!

- ETH’s Descent: Will $2.5K Become Its New Country Club? 🐻📉 #CryptoDrama

- 🚨 Crypto Chaos: PI’s Drama, XRP’s Moon Shot, ETH’s Wild Ride 🚀💸

2025-11-03 03:29