In a most remarkable turn of events, dear readers, we find ourselves observing traders with bated breath, as the esteemed price of Ethereum mounts a spirited endeavor to breach the illustrious $3,470 threshold in the not-too-distant future.

ETH Doth Flourish Above $3K: An Exquisite OTC Purchase and ETF Revelations

On a delightful Friday morn, Ethereum did indeed leap beyond the hallowed $3,000 mark, attaining a splendid increase of over 8% within a mere 24 hours, spurred by a renewed flurry of institutional engagement. This delightful upturn follows the announcement by SharpLink Gaming, regarding their acquisition of 10,000 ETH through an over-the-counter transaction from the Ethereum Foundation, a purchase valued at a staggering $25.72 million. How laudable, as this acquisition swells SharpLink’s treasury to a princely 215,957 ETH, now worth in excess of $600 million—impressive! 🌟

“This isn’t mere speculation,” quoth Joseph Lubin, Chair of SharpLink and CEO of Consensys, in a stately press pronouncement, “but a dedicated commitment to our grand vision!” The Ethereum Foundation graciously confirmed that the sales proceed to aid in the evolution of the protocol, grants, and sundry operational needs.

Market observers did dub this transaction clever, framing it as a stratagem to alleviate the disquieting ramifications of EF sales on Ethereum’s pricing. “Well, it seems that’s one way to remedy the EF selling frenzy,” remarked Nansen’s own wittiest oracle, Alex Svanevik, on the curious platform known as X.

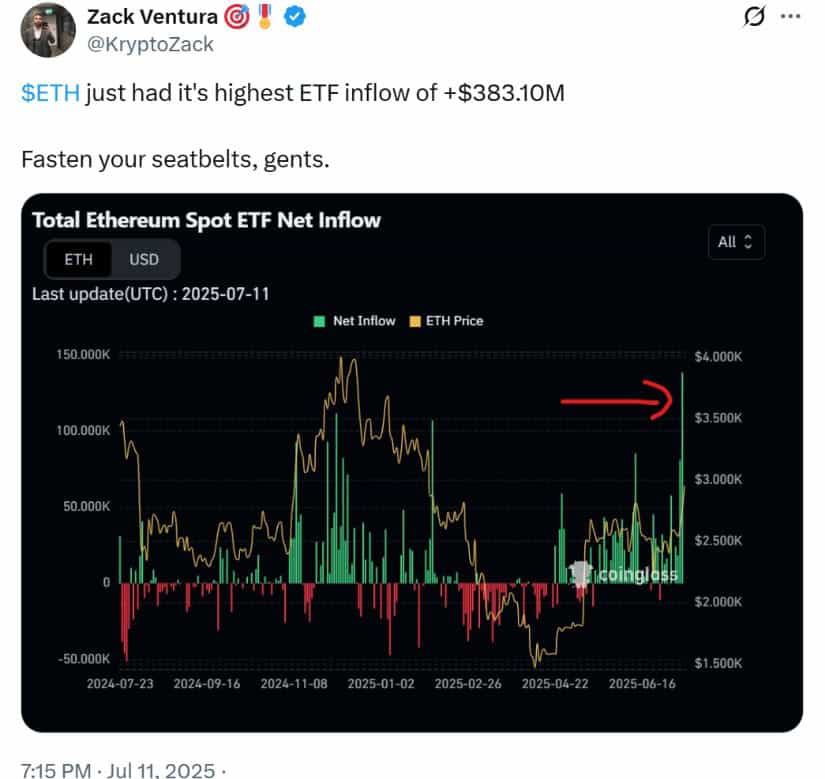

Hot on the heels of this announcement came news of $383.1 million pouring into U.S.-listed spot ETH ETFs in a single day — why, that is the second-highest influx ever recorded! Our data esteemed from SoSoValue reveals that the illustrious BlackRock’s iShares Ethereum Trust (ETHA) was the glimmering star of this influx, attracting a staggering $300.9 million in just one splendid session. 💸 The world of ETH ETFs hath now surpassed a remarkable $5 billion in cumulative net inflows, all whilst preparing for a gala celebration of their one-year anniversary on July 23.

Technical Exposition: ETH Gazes Longingly at $3,470, Should the Stars Align

Ethereum hath triumphantly emerged from a protracted period of resistance, establishing a higher perch at $2,850. On Friday, our beloved ETH even flirted with a delightful $2,998, before retreating beneath the psychologically woven enchantment of $3,000. Presently, it is coveted to challenge the upper confines of a rather flamboyant ascending broadening wedge pattern.

Should it achieve a successful breakout above $3,080— a number of notable significance, aligning with Fibonacci retracements from the November highs of the year 2024— then a jubilant rally of some 17% toward $3,470 should surely follow. Alas! More formidable resistance lies in wait at $3,525, which serves as the zenith of a long-standing symmetrical triangle tracing its lineage back to the year 2022.

Immediate support, bless its sturdy heart, now resides at $2,945, while more profound retreats might find solace at $2,710 and $2,500—those grand establishments where over 3.45 million ETH were previously amassed, according to word from the esteemed Glassnode.

Furthermore, the realm of ETH derivatives markets is seeing vibrant activity indeed! Reports from CoinGlass indicate a dazzling $256 million in ETH liquidations within the last 24 hours, alongside $194 million in shorts being hastily closed—oh, how this amplifies the upward surge!

Currently, the Relative Strength Index (RSI) finds itself comforted by an overbought position—perhaps suggesting fleeting exhaustion in the short term. Nonetheless, the bullish structure of daily candles and the decline in exchange reserves, which now hover around a mere 18.9 million ETH, grants continued optimism to the technical outlook.

Fundamental Underpinnings: Rising ETF Demand, Treasury Allocations, and Layer 2 Momentum

Ethereum’s recent unyielding ascent is founded upon a canopy of macroeconomic phenomena and ecosystem dynamics. The SharpLink acquisition joins an illustrious roster of public firms in embracing Ethereum treasury strategies—alia BitMine, BTCS, Bit Digital, and GameSquare. SharpLink hath also recently secured a remarkable $425 million in a Consensys-led private placement, supporting its ETH-focused undertakings. Now, isn’t that flourish splendid? 🕊️

On the ETF frontier, these delightful ETH products have displayed unrelenting enthusiasm since their inception. According to Nate Geraci, the esteemed President of the ETF Store, “For eighteen continuous days, inflows into the spot ETH ETFs have manifested… with nearly $250 million today alone. And yet, we find ourselves devoid of staking or in-kind creation/redemption. Quite early in this splendid game.”

Meanwhile, the Ethereum Layer 2 ecosystems, particularly Arbitrum and Optimism, continue a fervent dance, showcasing increased transactional vigor and total value locked. Recent enhancements, including the Dencun proto-danksharding improvements, have further mitigated gas fees and augmented data availability—how efficient and delightful! 🎉

The Prognosis: Ethereum’s Luminary Case Stronger Beyond $3K

Ethereum’s exalted ascendance beyond $3,000 marks not merely a psychological milestone but a technical celebration worthy of its own ball. With ETF flows on the rise, corporate treasuries multiplying, and Layer 2 activity pulsating with life, the landscape favors the sanguine bulls. A daily closure beyond $3,080 shall affirm a critical breakout, ushering in a potential gambol toward $3,525 or, dare I say, even $4,075—an exhilarating prospect for 2024!

Yet, should it fail to sustain this illustrious echelon, ETH may well retreat into the familiar confines of $2,800–$3,000, with sturdy structural supports beckoning below. Thus, traders shall be wise to heed the RSI conditions and the prevailing macro sentiment, as Ethereum approaches these thrilling potential breakout levels.

Key ETH Levels to Contemplate:

- Immediate Resistance: $3,080 → $3,220 → $3,470

- Support Zones: $2,945 → $2,865 → $2,710 → $2,500

- Bullish Breakout Target: $3,525–$4,075

- Bearish Breakdown Risk: $2,500 → $2,110

Read More

- USD CNY PREDICTION

- Gold Rate Forecast

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

- USD VND PREDICTION

- Silver Rate Forecast

- Shiba Inu Shakes, Barks & 🐕💥

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Ethereum’s Rarely Seen Oversold Signal: Rebound or Just a Brief Respite?

2025-07-12 14:58