Once upon a time in the land of digital gold, Ethereum—yes, that sneaky little blockchain—decided to throw a party. The kind where whales swim in pools of ETH and investors dance on the tables, all while the price does the cha-cha, heading past $3,800 with all the grace of an intoxicated ballet dancer. It seems that the big brains—those institutional giants—are finally noticing, lining up to plunk down billions like kids at a candy store, due to this newfangled ETF craze. If the gods of momentum are kind, we might even step into the $5,000 zone, perhaps even chuckling at past skeptics. 😂

Ethereum Rallies on ETF Momentum, Strong On-Chain Metrics: The Tale of the Bull and the Bears

Picture Ethereum charging ahead past a modest $3,800, fueled not by fairy dust but by a tsunami of interest in spot ETH ETFs, record inflows from the mighty institutions, and some technical magic that suggests a monster move is brewing. According to the wise analyst Ali Martinez (@ali_charts, who probably sleeps with charts under his pillow), Ethereum might flirt with $4,220—and if it’s feeling particularly adventurous—hit $5,140—mind you, if the sacred support at $3,300 holds firm. The MVRV Pricing Bands are whispering secrets that only cryptic prophets can decipher. 🧙♂️

The MVRV indicator—think of it as Ethereum’s health report—tells tales of over- and undervaluing, flashing bullish signs like Christmas lights on a city street. Historically, these patterns have been the telltale signs of mighty rallies, like a siren song to traders intoxicated by the siren call of profits.

Technical Overview: Ethereum Builds Toward Breakout—The Calm Before the Storm

After a stint of mediocre consolidation between $3,700 and $3,900 during the July doldrums, Ethereum is now sharpening its claws, ready for a leap beyond $4,000 and $4,200. CoinCodex, that oracle of prediction, forewarns a climbed to roughly $4,192 by August 2, a number that sounds suspiciously like a precocious child’s guess but probably isn’t far off. A breakout seems imminent, like a bear cub trying to reach its mother’s embrace. The RSI buzzes with enthusiasm, and exchanges are showing low leverage—healthier than a gym rat on protein shakes. If the stars align and the momentum persists, Ethereum will blast into the stratosphere, probably chucking its old resistance at over $4,200 and embarking on a high-speed chase for $5,000, perhaps shouting “Yahoo!” all the while. 🎯

And if you think that’s enough—oh no, my friend—it’s just the beginning. The real fun begins once the Ethereum rocket exhausts at $5,000, with visions of $10,000 winking behind the nebula of charts.

ETF Inflows Near 5% of Circulating Supply: The Vault Is Overflowing

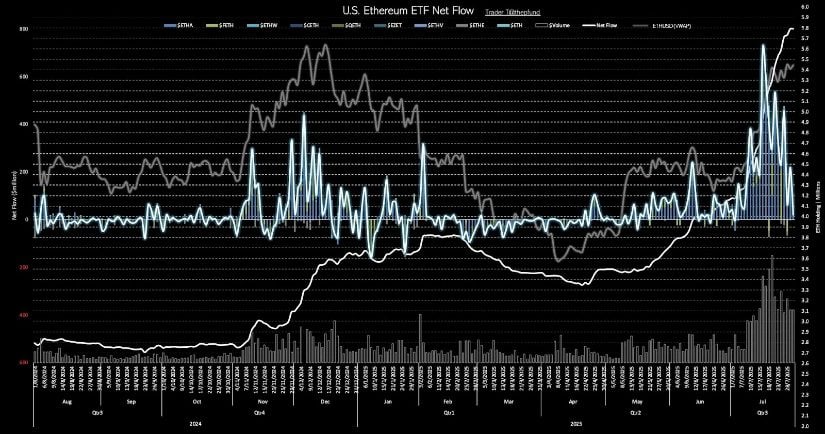

In the grand scheme, Ethereum’s fundamentals are doing the jig—especially the institutional crowd, who have been pouring in money like drunken sailors at a tavern. The ETFs, those magical boxes filled with ETH, have racked up a record 19-day net inflow, totalling a cool $5.4 billion, enough to make even the most hardened cynic raise an eyebrow. They now hold nearly 5.7 million ETH—that’s quite a hoard, enough to make even the dragons envious.

Leading this charge, BlackRock’s ETHA product is tossing in over $4 billion—probably feeling like the king of the hill on Wall Street. Soon, the U.S. regulators might decide to stop playing hide-and-seek and declare that ETH ETFs are “good enough,” which will only embolden the investors further.

Whale Accumulation: The Giant’s Feast Continues

Meanwhile, the whales—those giant investors who move among us like silent shadows—are gobbling up ETH like it’s hot pies at a fair. SharpLink, a gaming and investment firm, bought 77,210 ETH—more than was mined in the last month! Their total haul? Near a billion and a half dollars, sitting quietly in the vaults, waiting for the inevitable fireworks.

This hunger for ETH hints at a looming supply squeeze that rivals the most dramatic soap operas. The demand is swelling, and the supply is limping behind, promising a wild ride for early risers.

Ethereum Price Outlook: Momentum to $5,000 and Possibly $10K—Will It Make It?

From the shadows of $1,471 in April, Ethereum has exploded 170%, and it’s less than 23% away from smashing through its all-time high of nearly $4,871. The path to $5,140 seems inevitable, like a train speeding toward sunset. If the current frenzy persists—thanks to institutional money, ETF love, and technical wizardry—$5,000 might just be the beginning. And whispers in the dark suggest that, by late 2025, $7,800 or even $10,000 could be within reach—if you believe in fairy tales and charts that dance.

Final Buzz: Ethereum at a Crossroads, or a Slip ‘n Slide?

Ethereum’s short-term zwieback of technical signals and its long-term sugar rush of fundamentals are aligning almost too perfectly—like a romance in a novel by Gogol himself. Keep that $3,300 support line close; if Ethereum can cling to it like a toddler to his mother’s apron, the sky’s the limit—or at least, the $5,140 horizon. If not, well, it might turn into a pancake of regret, but let’s not dwell on that. The stage is set, the actors ready, and the market is just waiting for the final act. Who’s in for the show of a lifetime? 😂

Read More

- Altcoins? Seriously?

- Silver Rate Forecast

- Gold Rate Forecast

- USD VND PREDICTION

- Brent Oil Forecast

- Shocking! Genius Act Gives Crypto a Glow-Up – Jokes, Dollars & Digital crazy!

- USD CNY PREDICTION

- EUR USD PREDICTION

- IP PREDICTION. IP cryptocurrency

- Bitcoin’s Bounce: A Bullish Ballet or Just a Blip? 🎭💰

2025-07-31 19:08