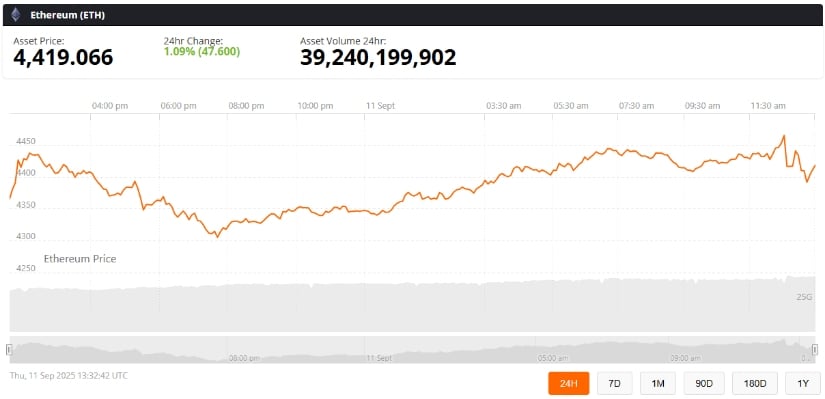

Ah, Ethereum. The cryptocurrency that makes Bitcoin look like the responsible older sibling who always remembers to call Mum on her birthday. Today, ETH is lounging comfortably at $4,419, having gained a modest 1.09% in the last 24 hours. Trading volume? Oh, just a casual $39.24 billion. No big deal. 😎 Bulls are flexing their muscles near $4,496-$5,000, while bears are lurking around the $4,300 support zone like overly cautious bouncers at a club. Analysts? They’re dreaming of $5,000 by next week and $7,000 before Christmas. 🎄

Ethereum Price Holds Range Support (Or Does It?)

Behold the 4-hour chart, where ETH is stuck in a game of financial limbo between $4,300 and $4,500. Repeated defenses at the $4,268-$4,300 zone have turned it into Fort Knox for buyers. Or maybe it’s just a stubborn toddler refusing to move from its favorite spot on the carpet. Either way, momentum indicators are starting to perk up. The RSI has climbed to 58, which is about as optimistic as a cat staring at a bird through a window. 🐱 A break above $4,536 could unleash chaos-or just another rally. Who knows? That’s the beauty of crypto.

And let’s not forget the Fibonacci retracement levels, because apparently, medieval mathematicians are still relevant in 2025. ETH is currently wrestling with the 0.382 level at $4,496. Victory there could open the gates to $4,584 and $4,672. But if it falters, we might see a retreat to $4,268, or worse, $4,211. Sell-offs are like gremlins-they start small but can quickly spiral out of control. 🐲

Analysts Draw Cycle Comparisons (Because Why Not?)

Market strategist Ted Pillows (not his real name, but it should be) says Ethereum is mimicking Bitcoin’s 2020-21 accumulation phase. “ETH is showing signs of entering a mid-cycle correction,” he declared, probably while sipping an overpriced latte. ☕ His prophecy? A rally toward $8,000-$10,000 within three to four months. Bold words, Ted. Meanwhile, Twitter luminaries like @crypto_goos and @Karman_1s are throwing numbers around like confetti at a parade, predicting targets of $7,000 and $5,000 respectively. Ah, the power of tweets. 🐦

Institutional and Long-Term Drivers (AKA Big Money Moves)

Beyond the charts and memes, institutions are piling in like guests at an all-you-can-eat buffet. BitMine recently splurged $204 million on ETH, aiming to control 5% of the total supply. Their treasury now sits at $9.2 billion, making them either geniuses or gamblers. Probably both. 🎲 Fundstrat’s Tom Lee even predicts a 10-15 year supercycle for Ethereum, fueled by Wall Street adoption and AI integration. “Ethereum will become a cornerstone asset,” he said, presumably while wearing a monocle. 🔍

ETF Developments: SEC Delays BlackRock Ethereum Proposal (Boo!) 👎

Regulatory drama alert! The SEC delayed decisions on several crypto ETF applications this week, including BlackRock’s Ethereum staking ETF. Cue collective groans from traders everywhere. However, Bloomberg analyst James Seyffart hints that October might bring good news. Fingers crossed! 🤞 If approved, these ETFs could unleash a flood of institutional cash, turning Ethereum into the financial equivalent of a rock star. 🎸

Looking Ahead: Will Ethereum Go Up? (The Eternal Question)

Ethereum stands at a crossroads, like a hero in one of those cheesy fantasy novels. On one hand, rising inflows, bullish comparisons, and institutional backing suggest a breakout. On the other, macroeconomic pressures and geopolitical tensions loom like storm clouds. If Ethereum holds above $4,300, expect fireworks-or at least a nice little rally toward $5,000. Fail, and we might see a retreat to $3,800-$4,200. Such is life in the crypto world. 🎢

So, dear reader, strap in and hold tight. Whether Ethereum soars to $7,000 or crashes back to $3,800, one thing is certain: the ride will be anything but boring. And really, isn’t that why we’re all here? 🚀

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- 7-Year-Old Crypto Tycoon Ditches Bitcoin for Ethereum: A Tale of Digital Fortunes 🤑💰🚀

- STETH PREDICTION. STETH cryptocurrency

- Top 10 Fast-Growing Blockchains of 2025 – Who’s Gaining Users? 🎯

- Bitcoin Wakes Up, Pretends It Has Its Life Together ✨📉🚀

- Bitcoin Faces ‘Nation-State Rug Pull’ Risk, Warns Willy Woo

- DOGE’s Wild Ride: Whales, Flags, and Golden Crosses 🌊🚀

- Why Your Crypto is a Disaster (And Why You’re Still Buying)

2025-09-12 00:04