Ah, Ethereum, that slippery scoundrel of the crypto world, finally decided to take a breather after bouncing off the $4,000 wall like a rubber ball over the weekend. It was all fireworks and fanfare earlier this month, but then—wham!—it got the boot from that mental milestone, sparking worries of a grand exodus. Blame it on the flagging fan club (that’s buying pressure to you and me) and volatility dozing off, courtesy of those crystal-ball on-chain stats. Some traders, bless their greedy little hearts, are treating this snub as a golden ticket to pocket their winnings after ETH‘s slow dance upward. 😂

Ethereum’s Volatility Drops Below 50%

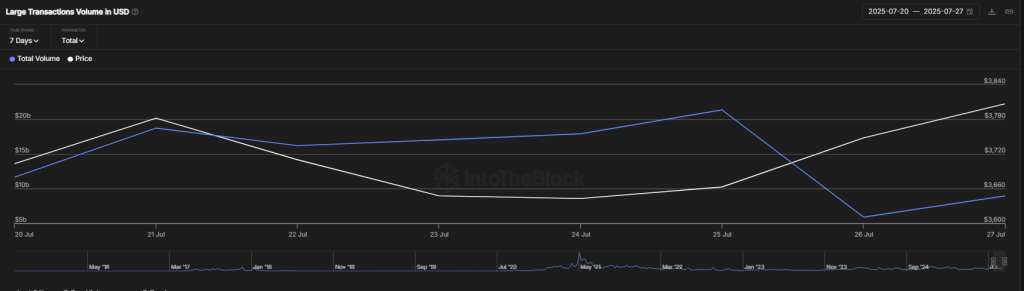

In the last day, Ethereum’s been throwing a proper tantrum with price jumps that’d make a kangaroo jealous. Coinglass reports a whopping $124.5 million in ETH positions got wiped out, hitting longs and shorts alike—fair’s fair in love and liquidations, I suppose. This chaos followed a snooze-fest of low volatility, with IntoTheBlock’s data showing ETH’s wild swings calming from a manic 53.9% down to a more sedate 47.6%. Meanwhile, the big fish—whales, if you will—have gone quiet, their transaction volumes plunging from a boastful $21.3 billion to a measly $5.9 billion in a week. It’s like they all decided to take a holiday at once. 😴

This dip in the excitement meter has killed the buzz for buyers; long-term holders aren’t stockpiling anymore, and many are lounging on their profits, probably eyeing the exit door. But hold on, not all doom and gloom—Ethereum’s spot ETFs are still partying hard, raking in $452 million on July 25 alone, marking the 16th day of gains in July. Institutional bigwigs are keeping the faith too, with ETH-tied companies flexing their stocks. So, while the little guys might be tapping out, the suits could be the ones propping up the price for a glorious comeback. Wink wink. 😉

Overall, with short-term hype fizzling and volatility on a coffee break, the long game still looks perky for Ethereum—because in crypto, as in life, what’s a little rejection between friends? 🚀

What’s Next for ETH Price?

Ethereum’s currently duking it out with sellers camped at $4,000, but credit where it’s due, buyers aren’t rolling over just yet. Right now, ETH is hovering at $3,807, down a cheeky 0.37% in the past day—small potatoes in the grand scheme. When a price clings to a stubborn resistance without a full meltdown, it’s often a setup for a breakout, or so the charts whisper. Crack $4,000, and ETH might sprint to $4,100, then who knows, maybe a victory lap at $4,900. But if it stumbles, the EMA20 trend line is the first pit stop, and below that? $3,500 could turn into a bargain bin or a bear trap.

The RSI is dropping faster than my enthusiasm for Monday mornings, now sitting at 51, giving sellers a slight edge. Yet, this dip is luring in the bargain hunters, and if ETH bounces back above that 23.6% Fibonacci line, we might see a rebound that’s more springy than a Discworld witch’s broom. Fingers crossed, or crossed toes—whatever works. 😜

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Brent Oil Forecast

- USD THB PREDICTION

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- UFC & Polymarket: Fists, Foresight, and Frenzy!

- Gold Rate Forecast

- SEC’s Quantum Quandary: Is Your Bitcoin Bristling with Risk?

2025-07-28 20:37