It so happens, according to the CME Fedwatch contraption and those prediction markets of uncertain virtue, that the wagerers in the vast circus of Wall Street are nearly unanimous: the august Federal Reserve, in its solemn convocation tomorrow, shall reduce the rates. And, as fate would have it, Stephen Miran-the economic sage once closest to the enigmatic Donald Trump-has secured Senate’s blessing on the fifteenth day of September, 2025, to join the hallowed Board of Governors of the Fed.

Stephen Miran’s Fed Appointment: Shall Trump’s Monetary Orchestra Play a New Tune?

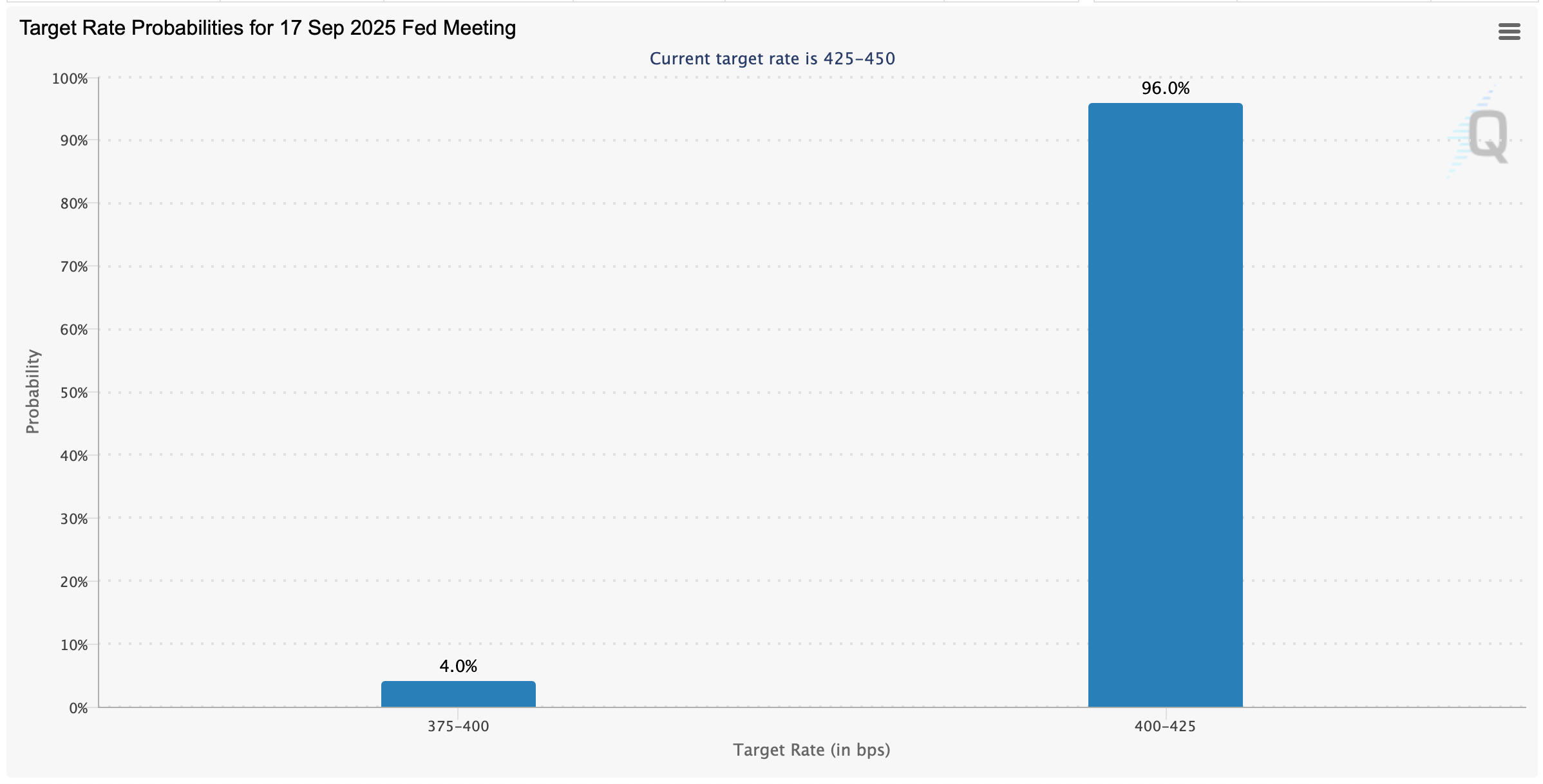

The market’s confidence is almost baked to perfection. By nine o’clock on a Tuesday morning, the CME Fedwatch tool proclaims with a majestic 96% certainty that the Federal Reserve shall trim a mere quarter point, a modest slice of 25 basis points-barely enough to notice unless one is a hawk-eyed speculator or a caffeine-fueled economist. Yet, a whisper lingers: a 4% chance that the cut will be twice as grand, a bold 50 basis points. Dare the FOMC risk such audacity? The gods of finance are skeptical.

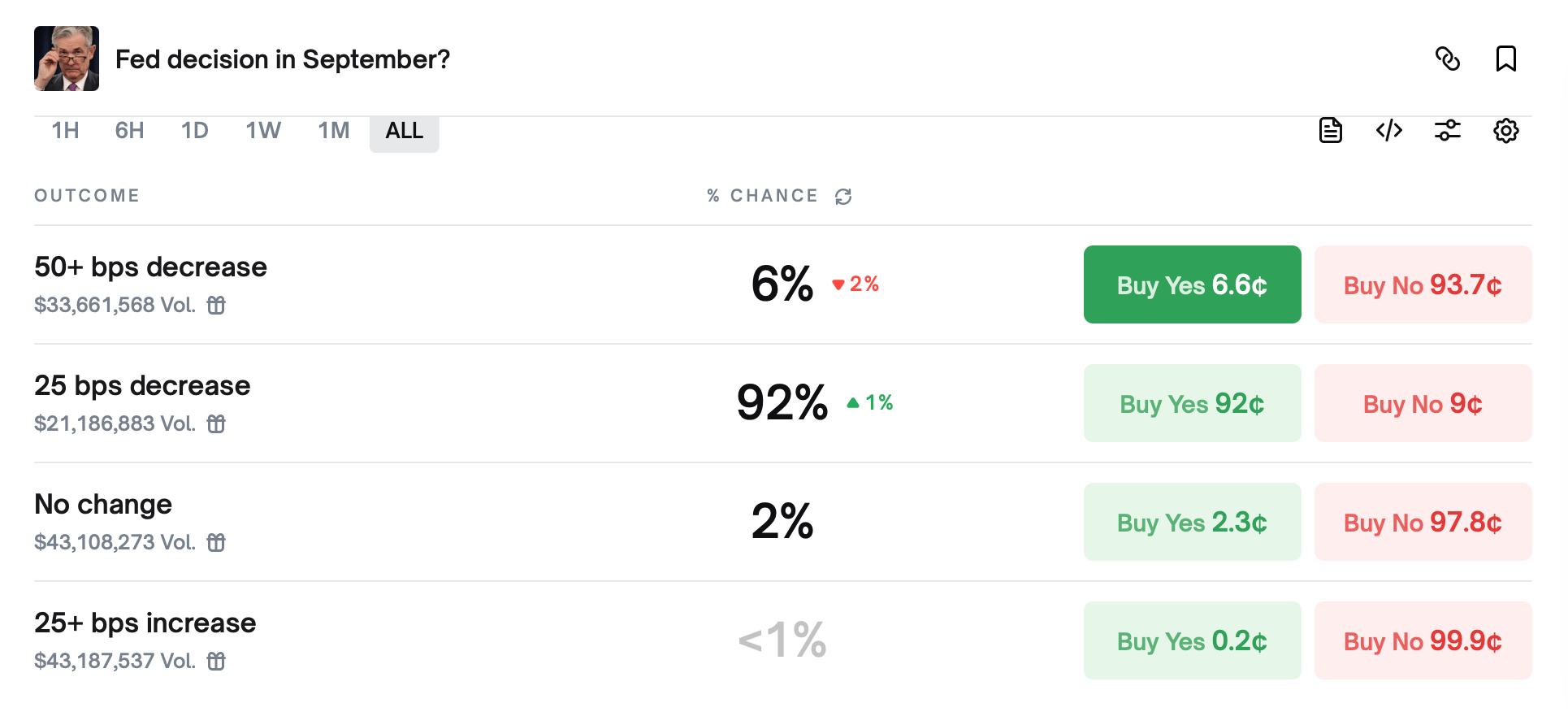

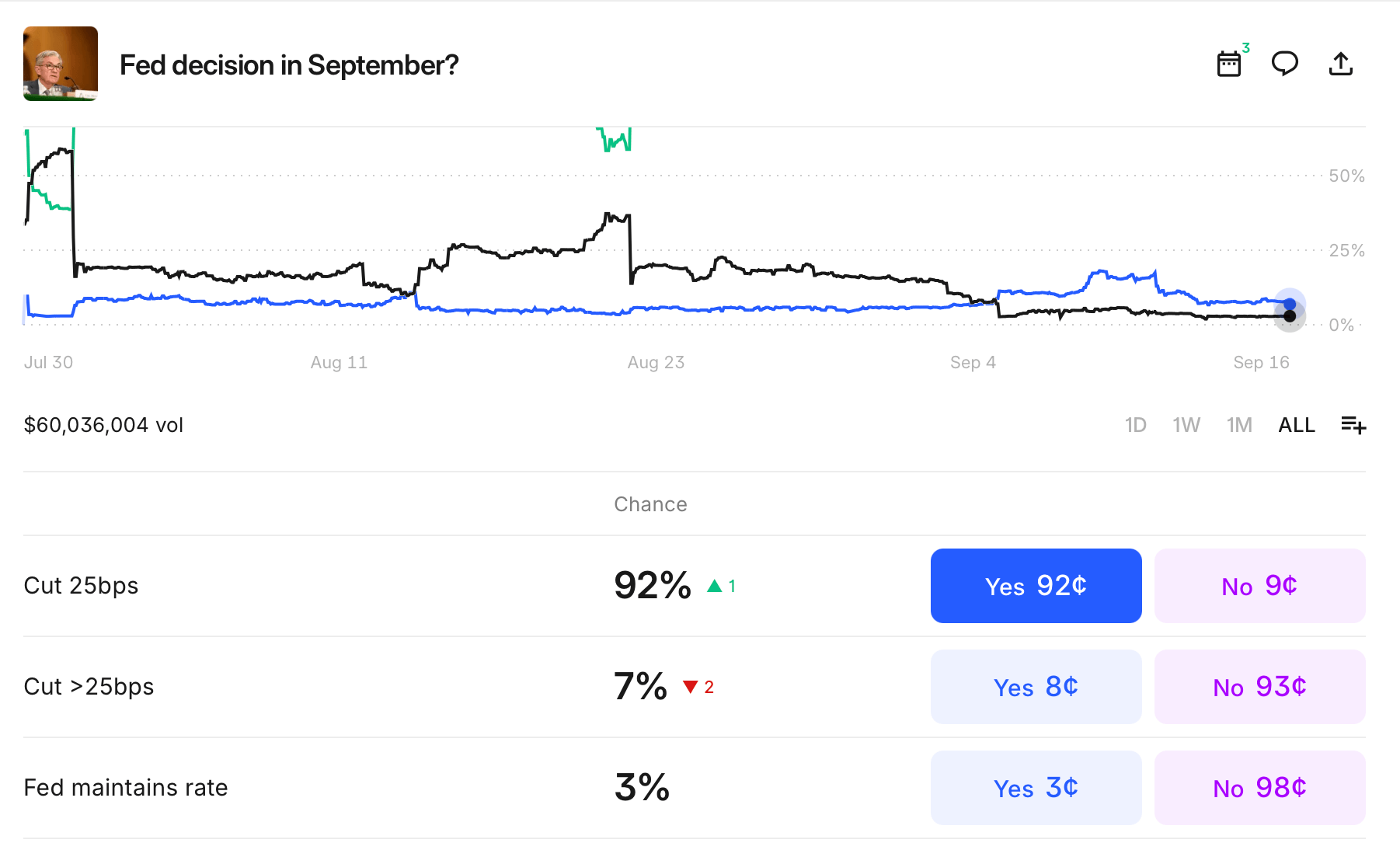

Meanwhile, the psychic oracles at Polymarket stare into their crystal balls and agree, yielding a 92% prophecy of a quarter-point cut. They bestow a mere 6% chance to the grander half-point chop and a scant 2% that the FOMC might shrug and do nothing, the latter being as unlikely as a banker buying a Tesla on a whim.

Kalshi, that mirroring marketplace of bets and hopes, joins the chorus: 92% for the quarter-point and an 8% mischievous chance for something bigger-because what is finance without a little gamble? Walter Bloomberg’s X account, ever the herald of Wall Street gossip, spilled the tea on how the titans of money-laden kingdoms are placing their wagers with the solemnity of chess masters or perhaps children throwing dice.

As for Bank of America, it appears less interested in tomorrow’s modest ballet of figures and more in Mr. Powell’s rhetoric recital; whispers say December shall bring a trim, with encore performances in the years following. Citi contemplates the scales and deems risks “dovish,” though it entertains the possibility that Miran and his cohort Bowman might pound the table for a half-point cut, like drummers demanding louder beats at a tea party.

Deutsche Bank, ever the cautious oracle, calls these rate cuts “risk management,” penciling gently 25 bps trims in the months September, October, and December. Goldman Sachs watches the labor market as one might observe a hawk eyeing its prey, hinting that the tightening of quantitative belts might cease by October, with further cuts to follow-or a dramatic 50 bps slice, should jobs begin to tumble like autumn leaves in a blustery Russian winter.

JPMorgan foresees a small rebellion among dissenters-two or three brave souls pleading for a deeper rate sacrifice-but still expects the usual fare of 25 bps cuts before a pause ensues. Wells Fargo, not to be outdone, as per Walter Bloomberg’s proverb-laden X post, bets on a parade of labor-driven cuts stretching well into next summer, for the economy loves drama as much as any noble house in the annals of old Russia.

And now, Stephen Miran-once the White House’s economic czar and foremost hand to the mercurial President Trump-steps into the Federal Reserve’s sacred chambers. The market watchers and moneyed seers alike perceive his arrival as a possible express train on the rails laid by Trump’s own monetary master plan. Shall this usher in a new era, or merely be a dance of shadows? Time, as always, will tell. Or not. 🤷♂️

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- USD THB PREDICTION

- Brent Oil Forecast

- Bitcoin Plummets Below $98K: Fear Grips Market Like a Bad Soap Opera 🎭

- Bitcoin Wakes Up, Pretends It Has Its Life Together ✨📉🚀

- DeFi Meltdown: Yearn Finance’s yETH Pool Drained by a Rogue Algorithm 🤖💸

- Bitcoin’s Bizarre Bull Run: ETFs, Elves, and Explosive Tokens! 🚀

- 7-Year-Old Crypto Tycoon Ditches Bitcoin for Ethereum: A Tale of Digital Fortunes 🤑💰🚀

- DOGE’s Wild Ride: Whales, Flags, and Golden Crosses 🌊🚀

2025-09-16 18:18