Oh dear, oh dear! It seems that Floki, the token that once brought joy to the hearts of many, has slipped back into a rather narrow and dreary consolidation range 📉. The bearish momentum is building, and it’s a bit like watching a big, grey cloud looming over the horizon ⛅️. The indicators are showing weakening buyer strength, and the market is waiting with bated breath for a clearer directional move 🤔.

A Soggy Saga of Intraday Compression

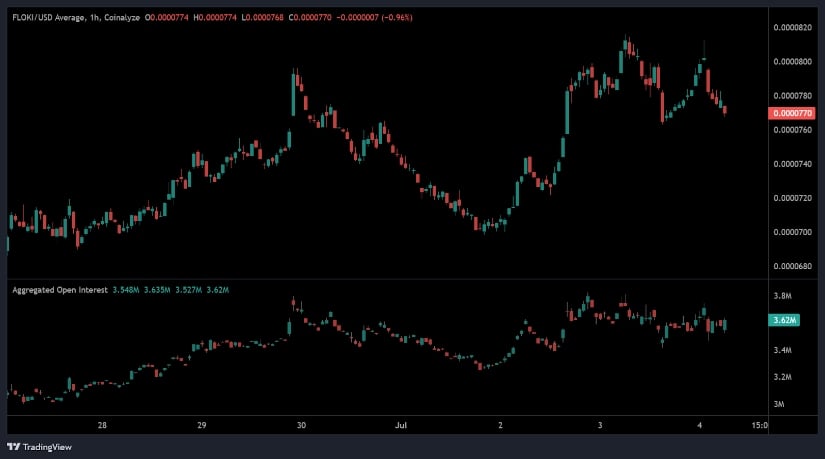

On the 1-hour chart, FLOKI/USDT is exhibiting a gradual loss of bullish momentum, rather like a deflated balloon 🎈. After a recent upswing from below $0.0000700 to a peak near $0.0000820, the price began forming lower highs, eventually stabilizing around $0.0000770, marking a 0.96% drop in the last hourly candle 🕰️. This price behavior resembles a rounded top formation, often indicative of diminishing bullish strength and potential short-term reversals 🔄.

Intraday volatility has been as jumpy as a kangaroo on a pogo stick 🐨, with sharp impulses followed by steeper corrections. These cycles suggest that profit-taking is outweighing fresh buying activity, especially near key resistance zones 🚫. A recent failed breakout above $0.0000800 further emphasizes the cautious tone, as the price fell sharply afterward 😳.

Meanwhile, aggregated open interest remains as steady as a sleepy sloth 🐻, signaling that traders are not significantly adding or exiting positions. This flat behavior during a price pullback implies weak conviction from bears, as well as a lack of enthusiasm from bulls 😐.

A Volume Drop that’s as Dull as a Butter Knife

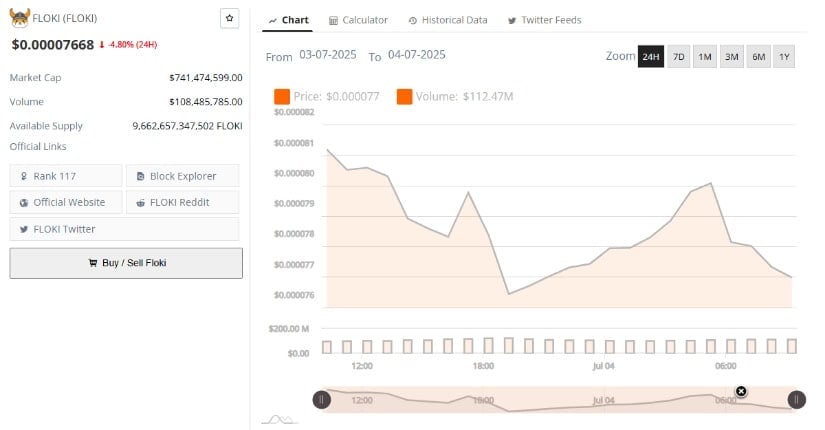

FLOKI’s 24-hour chart from July 3 to July 4, 2025, shows a clear pullback in price from a high near $0.000081 to a low of $0.000076, resulting in a 4.80% daily loss 📉. The session began with price holding above $0.000080, but selling pressure quickly led to a retracement that persisted through the day 🕰️. While a modest bounce was observed near the $0.000078 level, it failed to spark sustained recovery 😔.

Trading volume peaked during the early part of the session but fell below $112 million by close, confirming waning participation from buyers 👋. This fading volume, despite notable price fluctuations, indicates that the market lacked the conviction to support a rally 🤷♂️.

Floki’s market cap now stands at $741 million, with a circulating supply exceeding 9.66 trillion tokens 🤯. This large supply makes the price highly responsive to shifts in demand 📊. Unless the price breaks above $0.000081 on renewed volume, the range between $0.000076 and $0.000080 may persist 🔁. A failure to hold $0.000076 could open room for further downside 😬.

Indicators as Weak as a Kitten

As of July 4, 2025, FLOKI is trading at $0.00007699, recording a 2.95% intraday decline 📉. The daily chart shows price consolidating below key resistance levels, with recent candles reflecting indecision 🤔. FLOKI price remains confined within a narrow horizontal band, lacking a clear directional bias 📊. Traders appear to be awaiting confirmation before initiating strong positions 📝.

Technical indicators remain as neutral as a referee in a boxing match 🥊. The Relative Strength Index (RSI 14) is at 49.88, hovering near the neutral line, with the RSI-based moving average at 43.98 📊. This suggests mild upward pressure, but not enough to shift sentiment 😐.

The MACD is also as inconclusive as a puzzle with missing pieces 🤔. While the MACD histogram reads +0.00000135, the MACD line (-0.00000174) remains below the signal line (-0.00000309), indicating that the recent bearish trend is losing strength but not yet reversed 🔄. A decisive crossover and sustained volume increase would be necessary to support any upward breakout from current levels 🔓. Until then, FLOKI’s price action may remain constrained below the resistance zone 🚫.

Read More

- USD CNY PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- USD VND PREDICTION

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- GBP MYR PREDICTION

- Shiba Inu Shakes, Barks & 🐕💥

- OP PREDICTION. OP cryptocurrency

2025-07-04 20:24