In a display of financial gymnastics that would make even the most seasoned acrobat raise an eyebrow, Galaxy Digital has set the online world ablaze! And all this fuss stems from their flagged wallet, which has been busily dishing out thousands of bitcoin (BTC) onto exchanges like a generous uncle on his birthday. Remarkably, a good helping of this bitcoin buffet can be traced back to an enigmatic whale of 2011, who had a rather expansive appetite for 80,000 BTC that Galaxy collected rather surreptitiously.

Binance, Bybit, and Ghost Wallets Gobble Up Galaxy’s Bitcoin Deluge

Earlier this month, the illustrious TopMob reported on this ancient whale that decided to rearrange its financial furniture, moving over 80,000 BTC into two new addresses—before wittily sending this treasure trove to wallets linked with none other than Galaxy Digital. In the past day, onchain digit detectives have identified a veritable flood of bitcoin—some estimates suggest it could be as dramatic as 30,000—cascading into the eager arms of several of Galaxy’s trading associates.

During a rather frenetic 14-hour soirée of BTC outflows, we managed to extract a staggering 26,971.916 BTC from that exuberant 30,000+ that took a little jaunt. Our trusty TopMob sleuths discovered that 12,355.315 BTC, valued at a whopping $1.43 billion, mysteriously landed in wallets that appear unflagged, like an undercover agent in a spy novel. These destinations could represent anything from cold storage to some discreet OTC dealings, or perhaps simple clerical errors by someone who forgot to put on their reading glasses. Among places we could identify, Binance reigned supreme, pulling in a delectable 5,500 BTC.

Bybit followed suit with 3,754 BTC, while OKX nabbed a well-deserved 2,880 BTC, Bitstamp added a modest 2,469.001 BTC, and even the more staid Coinbase Prime bagged a few smaller deposits. Not to be outdone, the largest single transfer in this whirlwind was 515 BTC, extracted from a delightful soup of over 40 separate transactions that occurred during this frenetic 14-hour escapade. To add to the suspense, bitcoin (BTC) promptly dipped about 3% in price—which led to rampant speculation about whether these transfers had an inkling of influence over market dynamics, though the jury is still out.

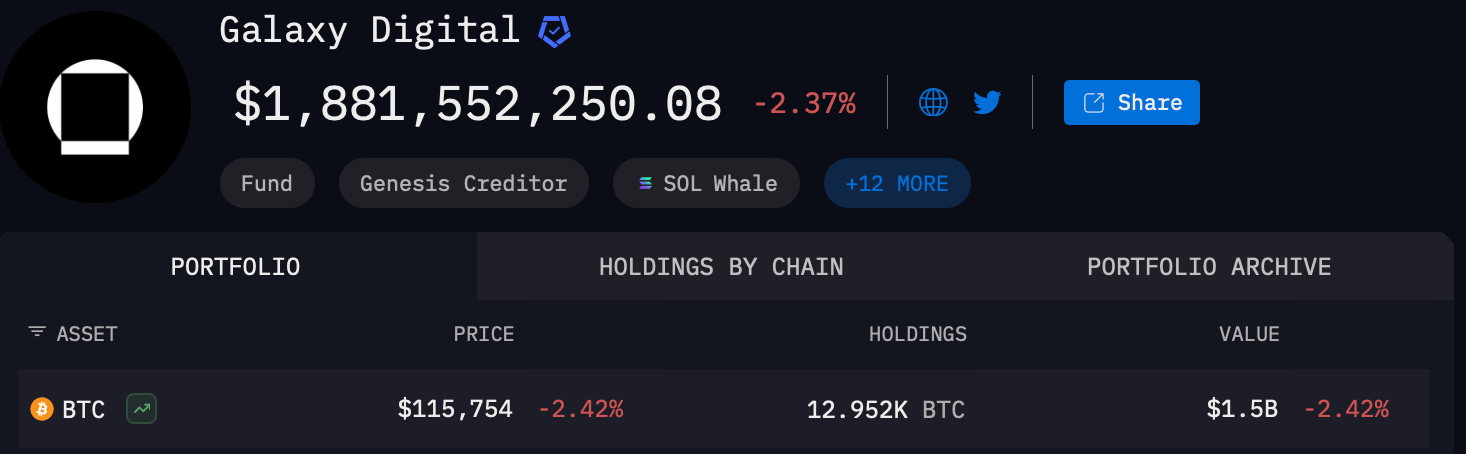

As of 2 p.m. Eastern on Friday, data from Arkham Intelligence reveals that Galaxy’s flagged wallets still boast a princely sum of 12,952 BTC, worth a staggering $1.5 billion. In addition to its BTC, Galaxy has its fingers in several other pies, controlling a tidy $381 million in ETH, SOL, USDT, USDC, and even S— with a rather curious $42.59 million connected to Coinbase’s wrapped bitcoin token. The scale and fancy timing of these transactions suggest a dash of strategic intent, tinged with a hint of intrigue, hinting at some advanced maneuvers happening behind the scenes.

Whether this marks the commencement of a grander scheme or merely a whimsical reshuffle remains to be seen; market observers will undoubtedly be chewing over these flows for a scone or two in the weeks to come.

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Brent Oil Forecast

- USD CAD PREDICTION

- Gold Rate Forecast

- Bitcoin Frets and Fears: The Great Crash of 2025! 🚨💥

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- USD THB PREDICTION

2025-07-26 01:02