Oh, dear reader, let me regale you with a story of such grandeur and misfortune that even the finest Russian novels would pale in comparison! The Gemini Space Station, Inc., a grand enterprise birthed from the fertile minds of the illustrious Winklevoss twins, has decided to take the leap into the vast ocean of public offerings. Yes, indeed, they filed an S-1 form with the mighty Securities and Exchange Commission (SEC) on a Friday, much to the amusement and bewilderment of many.

Going Public, But Not Without a Little Help from Friends

In this tale, we find our heroes, the Gemini Exchange, not quite as financially robust as one might hope. They have, however, secured a lifeline from none other than Ripple, the enigmatic entity behind XRP and RLUSD. Imagine, if you will, a credit agreement so generous, it allows Gemini to borrow sums no less than $5 million, up to an “initial commitment” of $75 million, which could swell to $150 million, all secured by collateral, of course. And should the need arise, Ripple, in their infinite wisdom, might provide additional funding in the form of RLUSD, with an interest rate that is almost as charming as a winter’s day in Siberia-6.50% or 8.50%, payable in good old USD.

But, alas, the financial state of Gemini is not as rosy as one might wish. The company has been bleeding funds at a rate that would make even the most stoic of accountants weep. For the first half of 2025, the net loss has increased by over 85% compared to the same period last year, soaring from a mere $41.4 million to a staggering $282.5 million. Revenue, too, has taken a hit, dropping from $74.3 million in 2024 to a paltry $68.6 million in the first half of this year.

Despite these challenges, the brave souls at Gemini plan to debut on the NASDAQ, with the ticker symbol “GEMI.” If all goes well, they will join the ranks of Coinbase and Bullish, the other two cryptocurrency exchanges that have already made the daring leap into the American stock markets. One can only hope that the market will be more forgiving than the financial reports suggest.

The Exchange, A Shadow of Its Former Glory

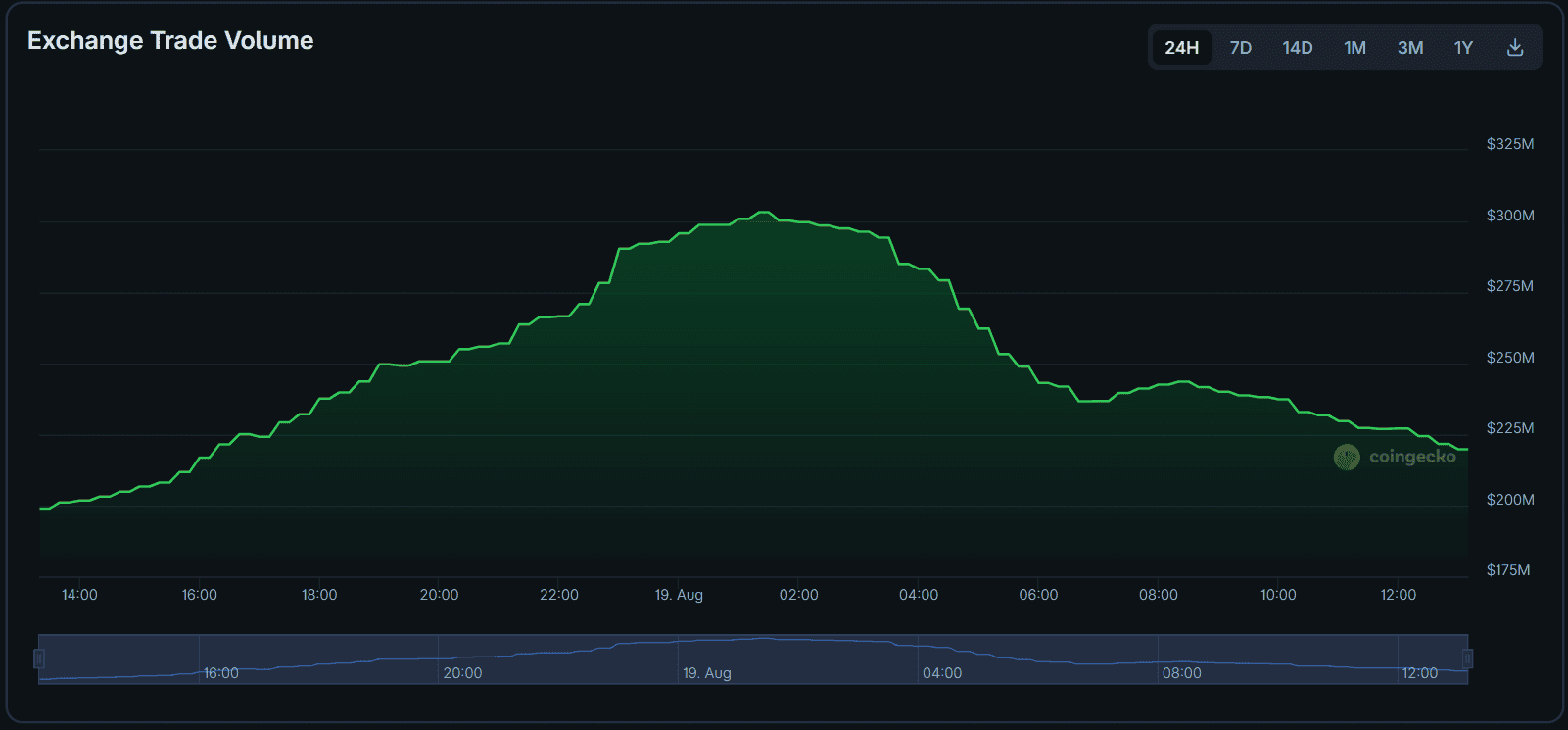

The Gemini crypto exchange, once a beacon of innovation and trust in the digital currency world, now finds itself somewhat overshadowed by its more active peers. According to the ever-reliable CoinMarketCap, it currently ranks 24th in the spot exchange leaderboard and 16th for derivatives. CoinGecko, with its discerning eye, has given it a Trust score of 9/10, and it has seen over $220 million in trading activity within the past 24 hours. A respectable showing, but one that leaves room for improvement, wouldn’t you say?

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- USD THB PREDICTION

- Crypto Chaos: How Hackers Are Pulling Off the ‘Classic EIP-7702’ Wallet Heist

- Bitcoin Plummets Below $98K: Fear Grips Market Like a Bad Soap Opera 🎭

- Bitcoin’s Bizarre Bull Run: ETFs, Elves, and Explosive Tokens! 🚀

- Bitcoin’s Descent: Bounce or Breakdown? 🚀💸

- USD CNY PREDICTION

- DOGE’s Wild Ride: Whales, Flags, and Golden Crosses 🌊🚀

2025-08-19 23:30