After an interminable period of price stagnation, the asset, like a caged bird, finally broke free in early July, igniting a fervent bullish crusade 🦜. The breakout has pushed HBAR’s value significantly higher, supported by rising volume and sustained accumulation. This shift in structure now places the $0.38 level within reach, as momentum continues to build across key timeframes. 🚀

The breakout, a veritable tempest of bullish fervor, has propelled HBAR’s value skyward, sustained by a crescendo of volume and relentless accumulation. This shift in structure now places the $0.38 level within reach, as momentum continues to build across key timeframes. 🌪️

The Breakout Above the Falling Wedge: A Bullish Reversal, or Merely a Mirage?

A chart, presumably crafted by the enigmatic @BanksToBitcoin, unveils the pivotal event that sparked this rally. HBAR had been trading inside a descending channel for an extended period, marked by gradually lower highs and consistent support retests. 📈

In early July, the asset broke above the upper trendline of the wedge pattern, initiating a strong upside move and signaling a potential trend reversal. Falling wedges are historically recognized as bullish reversal structures, and this breakout followed the pattern closely. 🌀

Following the breakout, HBAR recorded a 71.91% rally, climbing from approximately $0.14 to over $0.26 within less than two weeks. This sharp move confirmed the strength of the reversal while marking a clear shift in sentiment. A profit zone has now formed between $0.26 and $0.37, with a visible target at $0.37748 based on previous price levels and Fibonacci projections. 🧮

Analysts point to a rising volume profile during the breakout as further confirmation of buying conviction. Currently, HBAR is consolidating just above $0.27, with prior resistance zones at $0.20 and $0.176 now serving as support. 🧠

The current consolidation range indicates that market participants are absorbing supply after the rally. Price remains above the former wedge’s upper trendline, which now acts as dynamic support. If this structure holds, HBAR may resume upward movement toward the next resistance band between $0.30 and $0.38, a region aligned with historical highs and projected targets. 🧭

Daily Chart Activity Reinforces Positive Structure

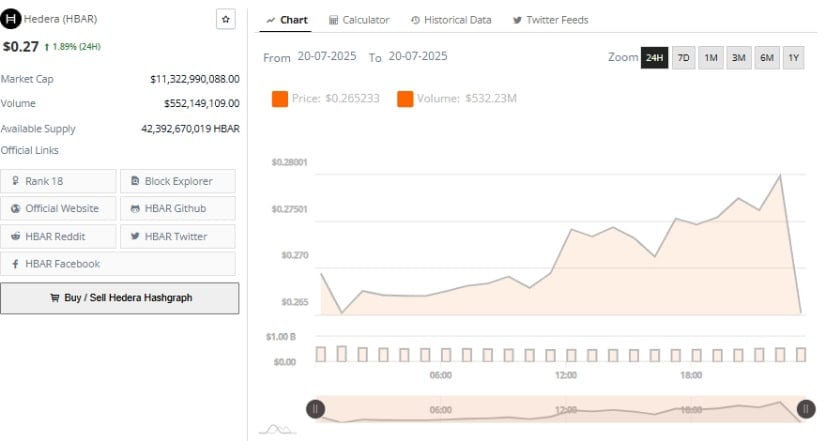

The 24-hour chart for HBAR shows a consistent upward trend. Price action throughout the day has remained stable, ranging from a low near $0.265 to a session high just under $0.280. The asset gained approximately 1.89% during the session, with the most significant momentum building during the latter half of the trading day. 🕒

This steady advance was matched with a sustained volume base, reflecting over $532 million in total transactions, which helped support price integrity. 💰

Notably, a brief volume spike near the day’s high coincided with another upward push, indicating that buyers remain active at higher price points. Despite a minor pullback from intraday highs, HBAR held above the critical $0.270 level, keeping the short-term structure intact. The price movement suggests that any dips are being absorbed quickly, limiting downside volatility and maintaining buyer control. 🕊️

HBAR’s market capitalization currently stands at approximately $11.32 billion, supported by a circulating supply of more than 42 billion tokens. This places the asset firmly in the mid-cap segment of the market, drawing increased attention from buyers seeking technical strength. If volume remains elevated and price continues to trade above $0.270, the next area of interest lies in the $0.285 to $0.30 range, with $0.38 as a longer-term technical target. 📊

Hedera Price Prediction: Indicators Remain Supportive of Uptrend

At the time of writing, HBAR is trading at $0.27664, with the recent high marked at $0.35437. The daily chart continues to show a strong sequence of green candles, indicating persistent upward momentum. The breakout from the previous consolidation zone appears to have set the tone for sustained gains, backed by steadily increasing volume. 🌿

Momentum indicators further support the ongoing rally. The MACD histogram, a steadfast sentinel, stands at 0.00893, its line at 0.02937, towering above the signal line at 0.02044. This structure indicates that bullish momentum remains intact and has not yet shown signs of weakening. 🕵️♂️

Additionally, the Chaikin Money Flow (CMF) is positioned at 0.05, confirming steady capital inflow. A CMF value above zero signals net buying pressure, which continues to support the bullish trend. As long as these technical indicators remain favorable, HBAR is well-positioned to approach the $0.30 resistance and potentially extend gains toward the $0.38 mark. 🧭

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- SEI PREDICTION. SEI cryptocurrency

- FET PREDICTION. FET cryptocurrency

- Cardano ETF Drama: Will ADA Make You Rich or Just Confuse You? 🤔

- SPX PREDICTION. SPX cryptocurrency

- Bitcoin Plummets Below $98K: Fear Grips Market Like a Bad Soap Opera 🎭

- Is Crypto Going to Lift You Higher or Slam Dungeon? 🌠

- Bitcoin Wakes Up, Pretends It Has Its Life Together ✨📉🚀

2025-07-21 21:10