Sonnet shareholders approve merger to form Hyperliquid’s first major DAT, boosting HYPE nearly 10%.

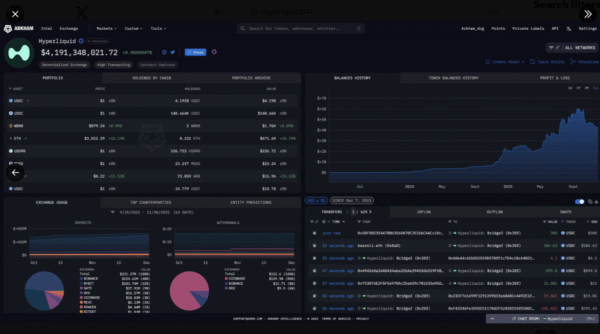

Sonnet BioTherapeutics has confirmed shareholder approval for its merger with Rorschach LLC, and the vote clears the path for creating the first large Hyperliquid digital asset treasury. The decision caused a massive spike in the HYPE token which soared close to 10% with the markets reacting to the incoming institutional demand. The development also augments the momentum for Hyperliquid’s expansion at large. Insert dramatic music here 🎵

Shareholders Approve Merger to Form Major Digital Asset Treasury

The approval came on December 2, almost five months after Sonnet reached an agreement to merge with Rorschach to form Hyperliquid Strategies. Official documents and press releases indicate that the combined entity wants to have $583 million in HYPE tokens and at least $305 million in cash. Therefore, the total projected value for the new treasury is $888 million. Reports from blogs and industry watchers mention that this structure is similar to accumulation strategies in other digital asset treasuries. Who needs luck when you can just print your own? 🪙

Related Reading: HYPE News: Hyperliquid Unlocks 1.75M HYPE Tokens Worth $60M | Live Bitcoin News

Background information points out Sonnet’s strategy of pivoting into digital assets with a regulated corporate framework. This approach also makes Hyperliquid Strategies one of the first large size digital asset treasury structures solely focused on HYPE. The move comes in line with growing institutional interest in blockchain-native treasuries in emerging markets. Because nothing says “institutional” like a name that sounds like a bad acid trip. 🌀

Following the announcement, HYPE rose more than 10% and was trading around $33 on December 3. This gain came in spite of general market fear, which was still high according to the CoinMarketcap Fear and Greed Index. Market watchers say the increase is a reflection of confidence in the expected inflows rather than short-term sentiment. Moreover, the news came at a time of pressure due to the fact that 1.75 million HYPE tokens were scheduled to be unlocked for developers and contributors. *Developers probably dancing like nobody’s watching 🕺.

Trading blogs show that institutional accumulation tends to neutralize temporary selling pressures relating to vesting schedules. Therefore, the positive reaction implies that the market is looking for long-term support with the DAT structure. Analysts also state that secure and committed capital pools tend to stabilise liquidity through volatile phases. Because who doesn’t want their money to survive a bear market? 🐻❄️

Experts See Strong Institutional Signal in Treasury Structure

Industry commentators liken the treasury planned by Hyperliquid Strategies to high-profile corporate accumulation strategies. The approach is similar to the tactics employed by companies investing huge digital reserves in long-term balance-sheet planning. Experts point out that controlled and large-scale holdings represent the stability of demand in the future. They also point out that 65% of the treasury’s value will be in HYPE with 35% being in USD, creating a balanced reserve model. *Because nothing says “balance” like 65% of your money in one token. Bold! 💯

Commentary from digital asset analysts highlights how institutional treasuries can drive the adoption process. They also offer deeper liquidity in trading venues. Reports indicate that, depending on treasury increases, it often influences the market behavior, as it reduces the circulation of supply over long horizons. Because scarcity is just nature’s way of saying “keep it going.” 🚀

The development of Hyperliquid DAT bolsters the expectations of continued inflows into the HYPE ecosystem. Additionally, structured treasuries are often helpful in stabilizing liquidation behaviors because they create predictable capital reserves. As a result, markets can be more orderly in times of stress. Early reactions suggest that this development can support the long-term value growth, assuming the continued accumulation trends. *Let’s assume it continues, shall we? 🤞

By raising a large amount of capital and adopting an institutional treasury model, Hyperliquid Strategies helps HYPE on its journey to deeper market integration. The approval is a significant shift, and it is a sign of growing interest in disciplined digital asset holdings in corporate frameworks. *Because nothing says “discipline” like throwing $888 million at a problem. 🤑

Read More

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Gold Rate Forecast

- Bitcoin Stuck in $90k Limbo: Will It Break Free or Crash Harder? 🚀💔

- Bitcoin Miners Go Green as AI Deals and Bitcoin Surge Create Perfect Storm

- Shiba Inu Shakes, Barks & 🐕💥

- Ethereum’s Rarely Seen Oversold Signal: Rebound or Just a Brief Respite?

- Brent Oil Forecast

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

2025-12-03 15:17