In the shadowed corridors of market machinations, Hyperliquid has clawed its way back from the $37 abyss, a phoenix reborn through $4 million in daily buybacks and revenue figures that hum with the zeal of a Soviet five-year plan. The platform’s audacity to maintain such fervent reinvestment, even as markets flounder like drunken bureaucrats, has sparked whispers of revolution among token holders.

The Buyback Blitz: $4M a Day, a New Dogma

Hyperliquid’s daily ritual of $4 million in buybacks is not mere financial alchemy-it is a manifesto. This is a protocol that worships at the altar of reinvestment, its priests clad in code, their offerings to the ecosystem as relentless as the NKVD’s pursuit of dissent. For the faithful, these figures are not numbers but omens: a token’s value, they insist, is a mirror of its people’s resolve. Or perhaps just a very aggressive algorithm.

To sustain such buyback mania is to defy the chaos of the broader market-a chaos that, for all its noise, cannot drown out the steady clinking of coins in Hyperliquid’s vaults. The question now, like a riddle from a Dostoevsky novel, is whether this mechanical persistence will crack the code of price action. Or will it all collapse under the weight of its own hubris? 🤷♂️

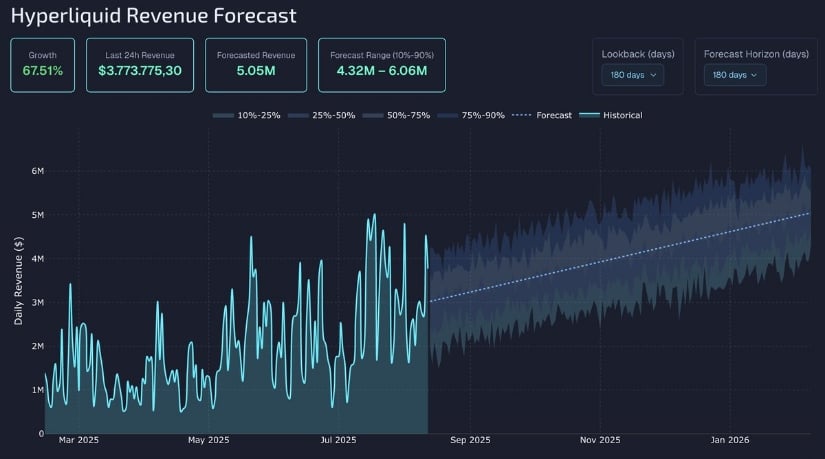

Revenue Growth: A 67.51% Miracle or Market Witchcraft?

Hyperliquid’s revenue, now averaging $3 million daily, is projected to ascend to $5 million-a meteoric rise that would make even the most cynical economist raise an eyebrow. The growth rate, a staggering 67.51%, is not just a number; it is a gospel. And the chart? A siren song of upward trajectories, punctuated by revenue spikes that scream of mid-2025’s feverish trading. One might call it progress. Or perhaps a very expensive illusion. 🚀

Consolidation Zone: A Fortress or a Trap?

Hyperliquid’s price hovers in a “consolidation zone,” a term that sounds as comforting as a gulag’s perimeter fence. RadScalp, that oracle of technical analysis, insists this is a base of strategic importance-a place where bulls might gather their strength to assault the $48.50 to $50.00 bastion. But let us not forget: consolidation is also where dreams go to die. Or, in this case, where liquidity clusters await like wolves in sheep’s clothing. 🐺

The revenue and buyback crescendo adds a symphonic quality to this drama. If Bitcoin, that old market titan, stays stable, the stage is set for a breakout. But stability, as history has shown, is a fragile thing-especially in the crypto wild west. 🤞

The $55 Mirage: Fibonacci’s Final Temptation

JJCrypto_’s Fibonacci extensions whisper of a $54 to $55 target, a siren call etched into the daily chart. The bounce from $37.77, they argue, is no accident but a continuation of a trend that began in mid-year. The channel? Intact. The bulls? Charging. But let us not confuse technical indicators with destiny. After all, even the most precise chart cannot predict the folly of human greed. Or the occasional market crash. 😂

The $45.30 resistance level looms like a sentinel. Break it, and the path to $55 is open. Fail, and the dream dies. A fate as inevitable as it is ironic, given the market’s obsession with control. 🤡

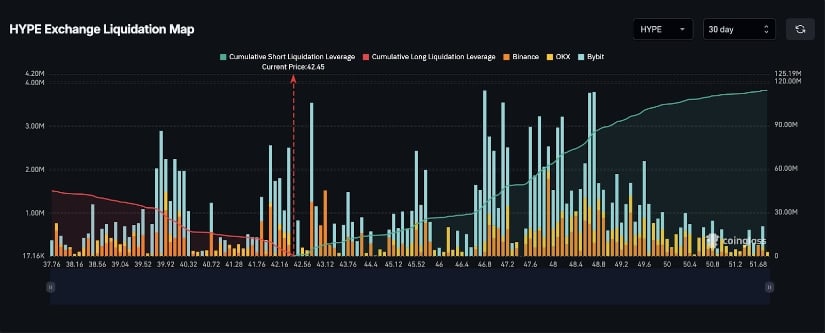

Liquidity Map: $120M in the Crosshairs

The 30-day liquidity map for Hyperliquid, courtesy of HYPEconomist, reveals $120 million in upside liquidity-a treasure trove for the bold. Short positions cluster like flies around the $45 to $50 range, ripe for the plucking. If price momentum persists, these clusters may become the catalyst for a Fibonacci-driven explosion. Or a very public reckoning. Either way, it’s a spectacle. 🎭

Final Thoughts

Hyperliquid’s $4 million buybacks, revenue crescendo, and Fibonacci dreams paint a picture of a project with both the financial might and technical audacity to conquer $55. But let us not forget: markets are not chessboards. They are jungles where even the most polished strategy can be devoured by the unexpected. If the bulls succeed, latecomers may yet scramble to join the feast. But remember-greed is a poor advisor, and history is littered with the bones of those who mistook hope for inevitability. 🐍

If the trend continues, Hyperliquid may test the $50 zone. Or it may not. After all, in this game, the only certainty is uncertainty. 🎲

Read More

- USD CNY PREDICTION

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Gold Rate Forecast

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Silver Rate Forecast

- USD VND PREDICTION

- Shiba Inu Shakes, Barks & 🐕💥

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

- Bitcoin Miners Go Green as AI Deals and Bitcoin Surge Create Perfect Storm

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

2025-08-13 00:51