Injective (INJ) dangles precariously at $3.27, a tragic opera of 76% annual loss, as RSI pleads for mercy.

Injective (INJ) flirts with $3.27 on the weekly chart, a far cry from its 2024 zenith above $40-a mere ghost of its former self.

The market, ever the cruel jester, continues to mock INJ, while technical indicators whisper of a desperate plea for respite.

Weekly Price Structure: A Sardonic Waltz of Despair

The weekly INJ/USDT chart paints a portrait of relentless gloom, with lower highs and lower lows since early 2024. A major top, once a beacon of hope, now lies in tatters above $40, as price spirals downward in a macabre dance.

Now, it tests the $3.00 level-a psychological crossroads, where previous reactions have been as fleeting as a candle’s flame. Below, $2.50 and $2.00 await, relics of a bygone era of consolidation.

On the upside, $5.00 looms like a distant mirage, followed by $8.00 to $10.00-a dream for the overly optimistic. A weekly close above $5 would be a mere footnote in this tragedy, if not for the persistent bearish chorus.

RSI and MACD: A Forlorn Soul and a Reluctant Suitor

The weekly RSI, that sardonic waltz of despair, hovers near 29 to 32, a testament to oversold conditions. Yet, in the realm of strong downtrends, even the most desperate pleas can linger.

A dash above 40 would signal a flicker of hope, but for now, no bullish divergence dares to appear. Price, ever the loyal servant, respects the broader downward structure.

The MACD, that reluctant suitor, remains below the zero line, its histogram a fading heartbeat. Weakness persists, yet no bullish crossover dares to interrupt the melancholy.

Related Reading: Bullish: New Injective Governance Vote Could Slash $INJ Supply By Half-a tale as plausible as a unicorn’s promise.

Volume, Performance Metrics, and DeFi’s Grand Spectacle

Trading volume, that fickle companion, has dwindled during the downtrend. No accumulation spike graces the weekly chart-only the echo of a forgotten frenzy.

A sustained reversal would require a green candle with higher volume-something akin to a miracle. Until then, the narrative remains one of quiet despair.

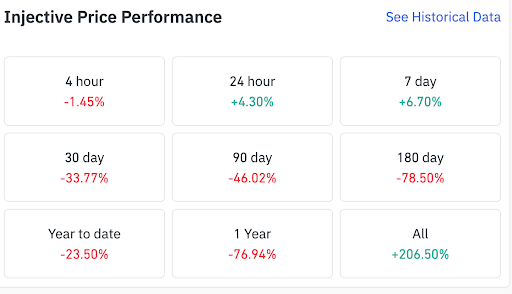

Performance data reveals a curious duality: short-term gains, yet longer-term weakness. INJ’s 4.30% 24-hour surge and 6.70% seven-day climb are but fleeting sparks in a storm.

INJ’s mixed timeframes-a short-term flirtation with hope, a long-term embrace of ruin-echoes Coinglass’s grim report.

Total Value Locked in DeFi hovers near $94.3 billion, a shadow of its 2021 glory. While capital stabilizes, INJ’s price action remains a silent spectator to the spectacle.

Injective now teeters at $3.00, a critical juncture. A sustained defense might birth a range between $3 and $5-a fragile truce. Yet, a breakdown below support risks plunging into $2.50 and $2.00, the abyss of historical despair.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- 7-Year-Old Crypto Tycoon Ditches Bitcoin for Ethereum: A Tale of Digital Fortunes 🤑💰🚀

- Ethereum’s Wild Ride: Will This Crypto Riverboat Reach $4K or Crash a Paddle?

- Top 10 Fast-Growing Blockchains of 2025 – Who’s Gaining Users? 🎯

- STETH PREDICTION. STETH cryptocurrency

- Cardano ETF Drama: Will ADA Make You Rich or Just Confuse You? 🤔

- You Won’t Believe This Cryptic Cash Crunch! 😲💸

- ADA’s Descent: A Tragicomedy of Errors (And a Pennant)

2026-02-19 23:24