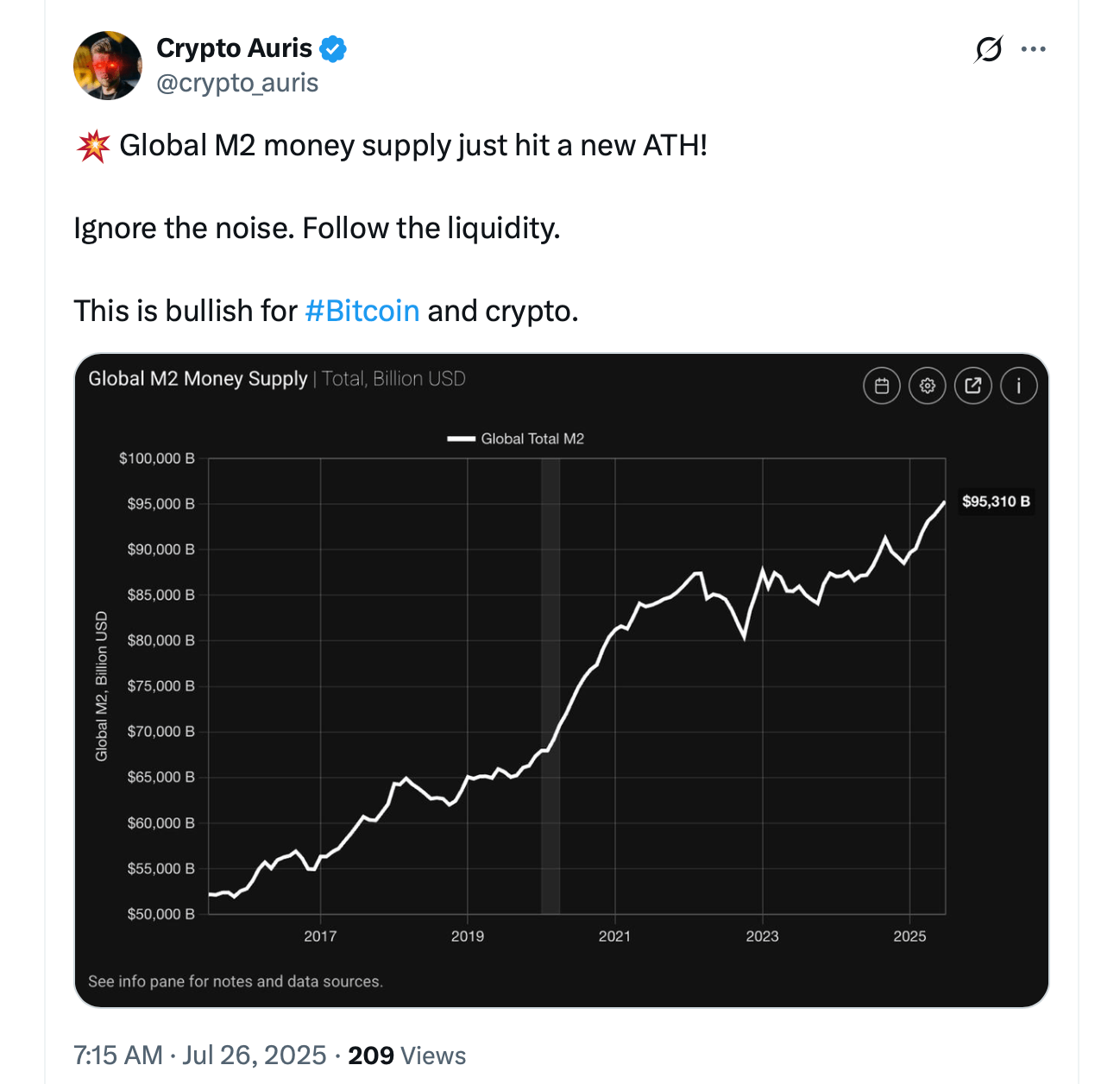

So, get this: the global M2 money supply is climbing higher than a hippo on a rollercoaster, hitting a staggering $95 trillion to $96 trillion! 🎢 And guess what? Bitcoin is bouncing around between $117,800 and $118,102 like it just found out there’s a clearance sale on its favorite snacks. It’s about to explode in 2025 like a piñata at a birthday party! 🎉

M2 Money Mania: Buckle Up, Bitcoin is About to Soar! 🎈

Crypto enthusiasts are betting the farm that this massive M2 balloon will catapult the digital currency to the moon! 🌕 This idea is popping up on Reddit and X like popcorn at a movie; users dissecting how this entire “money flooding” situation is going to play out, like it’s a daytime soap opera! 🍿

So

M1 is like that friend who only talks about cash and checks; M2 is more fun and understands the party-invitation scenario of liquid assets. It gives us a sneak peek into whether the economy’s feeling rich or has just left the buffet with a sandwich. 🥪

Globally, M2 is the ultimate money mix-tape from the big players—U.S. Federal Reserve, European Central Bank, Bank of Japan, and the mighty People’s Bank of China—putting on a show that’s got us all wanting to dance! 💃🕺

This number crunching is also a thermometer for how well the money flows are being handled; central banks tugging at the M2 strings through interest rates, open market operations, and reserve requirements—it’s like a game of monetary twister! 🤸♂️

When M2 struts its stuff, it means there’s more cash floating around, perfect for lending, spending—just don’t get too carried away, or inflation might crash the party like an uninvited guest! 🎉💔

This latest M2 high is like a sugar rush from government stimulus and liquidity operations, with quantitative easing zigzagging through economies like a hyperactive squirrel! 🐿️ Let’s not forget the roll of cash they’re throwing around post-recession—talk about a fiscal fiesta!

China’s money printer is working overtime, boasting an M2 of over $44 trillion—more than double the U.S. is gnawing on! Looking to boost growth like it’s a bodybuilding competition, they’re flexing those financial muscles amid a hefty dose of global trade drama. 🏋️♂️

This isn’t just a casual growth spurt; we’re talking over 8% annually—making waves in international markets faster than a celebrity marriage! 💍

History’s got receipts showing that when M2 blows up, asset prices join the party—stocks, real estate, and yes, beloved cryptocurrencies like bitcoin find a cozy spot at the VIP table! 🥳

Bitcoin has a crush on M2, with correlations showing it dances right alongside its growth—usually taking the lead 12 to 90 days after the money starts flowing. Think of it as love at first sight but for assets, with Bitcoin blushing as fiat loses its charm! 💞

Social media is buzzing; users are linking M2’s rise to Bitcoin’s boogie moves like it’s a dance challenge! “Global liquidity is all the hype,” one user gushed. “When liquidity comes flooding in, BTC doesn’t just sit there! Bitcoin follows the liquidity like a puppy after a treat!” 🐾

Back in 2020-2021, when global M2 took off like a rocket, Bitcoin soared from under $10,000 to a staggering nearly $69,000—who said cash can’t make dreams come true? 🌟 Now our crypto pals are crying for BTC to hit $150,000 with the next wave of cash. Hold onto your hats! 🎩

With M2 reaching new heights and expected to grow like a bean sprout, Bitcoin could have its day in the sun! Historically, liquidity changes its price like a mood ring—expect some serious shifts! While political types are nudging the Fed for rate cuts, hoping to slap some pep in the economy’s step! 🕺

To our Bitcoin believers, this trend continues despite the wild price rollercoaster, as Bitcoin’s supply of 21 million coins stands in stark contrast to endlessly printing fiat, ready to scoop up a chunk of that delicious global liquidity in 2025! 🍩

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CAD PREDICTION

- Bewitching Meme Coins That Will Surely Charm August 2025

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- 💸 Bitcoin’s Bleeding: A Crypto Tragedy with a Side of Dark Humor

2025-07-26 20:57