Ah, Bitcoin. Once considered a rock-solid investment, akin to that trusty gold watch your grandfather left you, it now flits about the market like a caffeinated squirrel on a sugar rush. What was once touted as a hedge against uncertainty now moves with all the grace of a toddler at a dance recital – high-risk and just a touch unpredictable.

Signals Of A Growth Asset

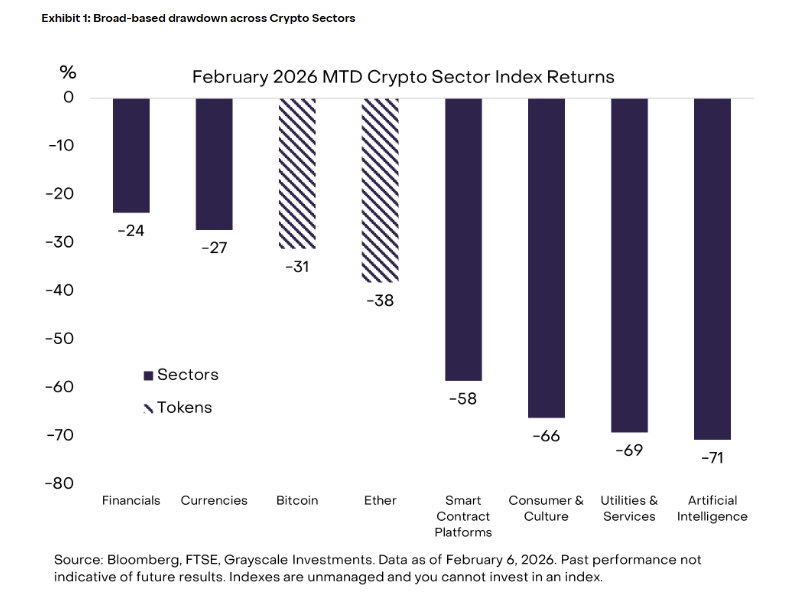

In what can only be described as a dramatic plot twist worthy of a daytime soap opera, Grayscale has reported that Bitcoin is now more closely aligning with software stocks than with its former partner in crime, gold. Yes, the precious metal that’s been around since the dawn of civilization is now being ghosted by the beloved cryptocurrency.

This shift began in early 2024, when institutional investors started treating crypto like the new kid in school, pushing it into the mainstream spotlight. It’s like watching your shy friend suddenly become the life of the party after discovering a love for karaoke.

Investors chasing growth – many inspired by the latest AI craze – have been dumping software stocks faster than I can say “blockchain,” and guess who’s tagging along for the ride? That’s right, our dear friend Bitcoin.

Institutional Links And Market Forces

Reports suggest that Bitcoin’s sudden behavior may be due to its new BFFs in traditional markets. Large firms and exchange-traded funds (ETFs) are like the cool kids at school, and their influence clearly spills over into crypto. Who knew Bitcoin could be so impressionable?

Let’s not forget the active selling from U.S.-based accounts, leaving Bitcoin trading at a discount on some platforms. This mass exodus followed a series of big liquidations, which sounds much scarier than it is, unless you’re one of those traders using leverage. Then it’s basically a horror film.

Where Price Stands Now

Currently, Bitcoin is doing the cha-cha around $66,900, with resistance near $69,900 and support levels slipping below $66,600. These fluctuations are sharper than my mother’s wit during family dinners.

From its peak above $126,000 in October, the market has taken a nosedive, retreating roughly 50% in a series of dramatic waves. It’s like watching the stock market version of a soap opera plot twist – stay tuned for the next episode!

While Bitcoin has been throwing a tantrum, gold has been climbing to new heights, proving yet again that it’s the reliable adult in this market playground. Rising geopolitical tensions are sending investors scurrying toward the safe embrace of metals, leaving crypto to fend for itself.

Traders who thought Bitcoin would act like a fortress against market chaos have learned a hard lesson: it behaves more like a teenager whose mood swings are influenced by social media likes. When fear returns, its value seems to tumble faster than a reality TV star off a podium.

To steady prices, we might need a fresh influx of capital, possibly through ETF inflows or a revival of retail buyers. After all, nothing says stability like a herd of enthusiastic investors.

Research indicates that retail interest is currently engrossed in AI stories and growth narratives, leaving crypto feeling like the kid who stood alone at recess. The concentration of attention matters because, let’s face it, capital flows decide whether these markets swim or sink.

Grayscale claims that while Bitcoin’s recent antics mirror tech stocks instead of gold, its long-term potential as a store of value remains intact. Short-term swings may reflect the whims of market integration and investor activity, but the future will depend on capital flows and broader economic trends. So, like any good investment, it’s all about playing the long game – if you can survive the drama in the meantime!

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- Ethereum’s Price Plummets, But Its Economy Dances Salsa – Here’s the Plot Twist!

- 🚀 LINK Leaps as Grayscale’s ETF Debuts on NYSE Arca! 🤑

- XRP Whales Hoard Crypto Like Scrooge McDuck 😂💸 – Will Market Survive This Greed?

- 🚀 Stellar Plummets Like a Discworld Turtle Off a Cliff! 🌪️

- 😱 Oops! Crypto Shorts Gone Wild: $190M Down the Drain! 🚀

- LINK Soars 20%-Will It Reach $100? 🚀📈

2026-02-11 20:11