Amidst the bustling chaos of the financial world, where the echoes of profit and loss reverberate through the halls of the market, the Bitcoin price, that enigmatic and capricious creature, has been cooling off on low timeframes. Meanwhile, the altcoin markets, like a chorus of opportunists, have seized the moment to trend higher. The top cryptocurrency, Bitcoin, has been grappling with the weight of major holders taking profit at its current level, a scene reminiscent of a grand tragedy where the protagonist is momentarily thwarted by the machinations of fate.

At the time of writing, the Bitcoin price trades around $118,800, with a 2% gain over the last 24 hours and a 9% gain over the past week, according to data from CoinGecko. In stark contrast, Ethereum, XRP, and Dogecoin have seen gains north of 16% on similar timeframes, a testament to the ever-shifting tides of fortune in the crypto world.

Following a major upside push from below $100,000, the Bitcoin price broke a persistent downtrend and managed to hit a fresh all-time high, a moment of triumph that seemed almost too good to be true. However, as the report from on-chain analytics firm Glassnode claimed, an increase in profit-taking from short-term holders has cast a shadow over this victory. These players, with their eyes on the prize, exited the market, taking over $3.5 billion in profits in just 24 hours, causing the Bitcoin price to lose steam and begin moving sideways. While Bitcoin has been on a violent bull run, the specter of a major pullback from the $118,000 area to the support zone at around $110,000 looms large, a reminder that even the mightiest can fall.

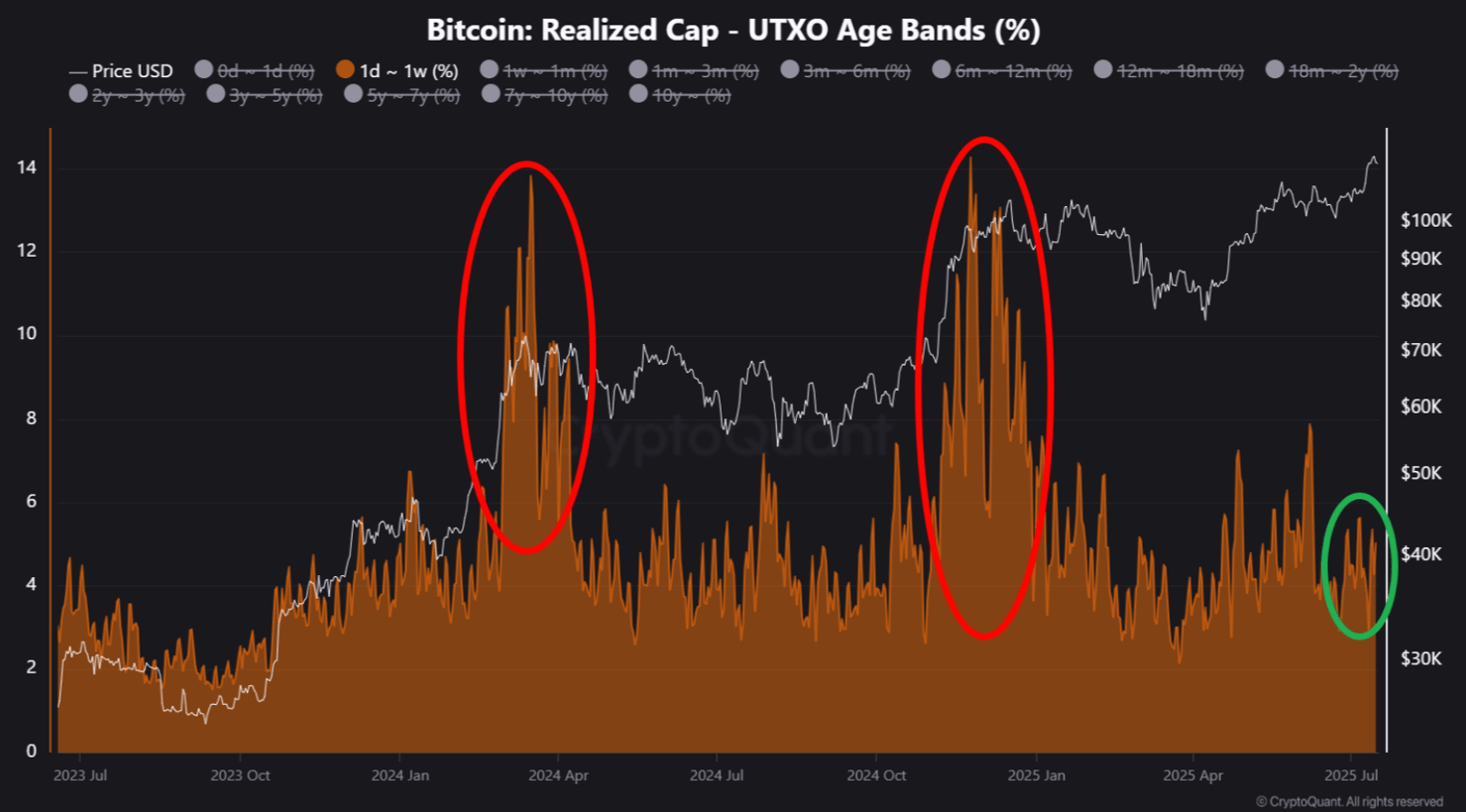

However, a report from CryptoQuant, with data from top analyst Crypto Dan, suggests that the Bitcoin bull run still has some room for another leg up. As seen in the chart below, the current BTC market is nowhere near the overheated levels recorded in March and December of 2024, a glimmer of hope in the midst of uncertainty.

The CryptoQuant post stated the following, sharing an insight from Crypto Dan:

(…) unlike in March and December 2024, on-chain data indicating market overheating shows that the market still hasn’t reached an overheated state.

Despite the price rising even higher, the fact that overheating has significantly decreased compared to previous short-term peaks suggests that Bitcoin could continue to break all-time highs and rise significantly in the second half of 2025, leaving strong potential for growth.

In this context, and if the bulls are able to sustain the momentum, Bitcoin is likely heading for higher ground. As NewsBTC covered earlier, a prediction from a top analyst claims that the levels of BTC adoption are unprecedented, a sign that the ‘real Bitcoin move’ is only about to begin. The analyst stated:

I have a high degree of confidence that we’ll see $400k by the end of this year. This target might be too conservative.

Cover image from ChatGPT, BTCUSD chart from Tradingview

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- USD CNY PREDICTION

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- Shiba Inu Shakes, Barks & 🐕💥

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

- Cardano vs. Quantum: Charles’ ‘Clinic’ Chaos

2025-07-17 04:18