CANG, quite unexpectedly, has pirouetted into the rather posh position of the 4th largest public Bitcoin miner by hash rate, leaving seasoned competitors like Riot Platforms and Bitfarms scratching their heads, wondering if they’d mistakenly signed up for the wrong production of “Dancing with the Miners.” And, have you heard? They’ve swapped their executive team faster than a game of musical chairs, with an ensemble cast seemingly pulled straight from Bitmain’s old backstage. Intrigued? Good! Grab your towels, folks; we’re diving into this cosmic jumble of ownership, leadership shuffles, and connections deeper than a Vogon’s poetry readings. 🪐

Cango Jumps Straight Into the Bitcoin Mining Spotlight

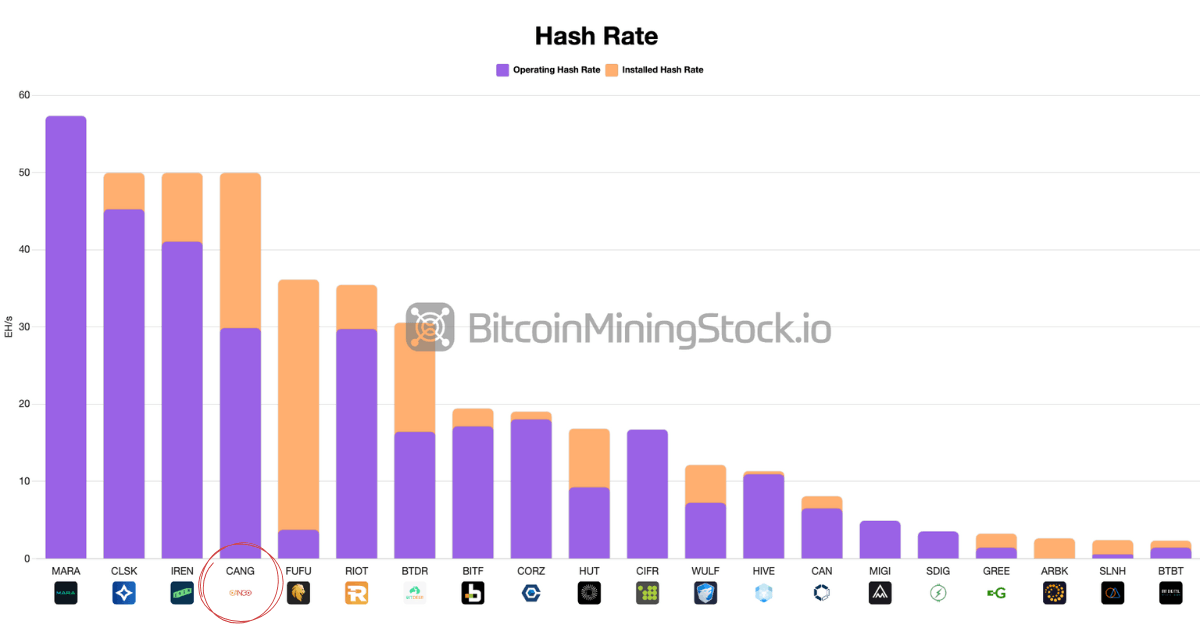

In a move that could easily be described as “hold my beer,” Cango has wrapped up a rather important secondary acquisition. This, of course, catapulted them to being the 4th largest publicly listed Bitcoin miner by hash rate. Bravo! A standing ovation was warranted, only slightly overshadowed by the concern of what might come next. After all, they’ve freshly minted a brand-new executive team, loaded with crypto-whizzes and former Bitcoin miners, while their original masterminds graciously traded their super-voting shares for common stock. This, dear reader, is what experts would likely describe as a “leadership handover” reminiscent of a very serious game of poker.

This isn’t just a casual dabble into the world of mining, my friends; it’s more like a courageous plunge into the deep end of the cryptocurrency pool. 🌊

Back in March, I had the audacity to suggest a few key elements investors should keep their peepers on: the acquisition dilemma, the inconspicuous disposal of its PRC business, and the oh-so-impressive 50 EH/s procurement deal. Those pesky questions have been answered. But one remains: Has Cango transformed into Bitmain’s secret undercover operative? 🕵️♂️

Why on Earth Does This Proxy Question Matter?

Ah, the Proxy Question, the pièce de résistance of this cerebral buffet! The answer could throw a wrench into the entire investment thesis—or perhaps just tickle its funny bone. If it turns out Cango is merely a front for Bitmain, then emerging concerns about transparency, independence, and geopolitical risk might just have to be chiseled into stone tablets for all to see.

Picture this: in a universe where nearly every entity is interconnected in a chaotic, yet fascinating tango, the nitty-gritty details begin to matter more than you might imagine. To unravel this cosmic web, I took a deep dive into Cango’s new ownership schema, circled back to the management structure, and attempted not to get lost in the ether.

Voting Control and Management Changes: The Plot Thickens!

As of the latest press release on July 23, our enigmatic buyout buddy, Enduring Wealth Capital Limited (EWCL), now wields 36.73% of total voting power at Cango. Our co-founders, bless their hearts, are down to a minuscule 12.07%. Under the hypnotic March 2025 non-binding prophecy, EWCL not only snagged voting rights but also scored a redo on board and management, all neatly wrapped in their requests. 🎩

Following this delightful deal, a new executive team was ushered in. Enter Mr. Xin Jin, gracing us as the Chairman of the Board and Non-Executive Director, alongside the illustrious Mr. Chang-Wei Chiu, who has also accepted his role as Director. Both have substantial Bitcoin mining experience, with side connections to Antalpha, a crypto financial services chummier of Bitmain.

And here’s where the suspicion begins to fester, like an unpaid bill. 💸

The Antalpha Connection: A Twist in the Tale

Antalpha, a delightful platform crafted just for miners, went public in May. Their SEC filings detail a plethora of financing, technology, and risk management solutions tailored for the big boys of mining. What makes all this the stuff of intrigue is that Antalpha is the primary lending companion for Bitmain and boasts a team with a history of being Bitmain alumni.

- Xin Jin sits as Director and CEO of Antalpha Platform Holding Company (NASDAQ: ANTA) and was instrumental in rolling out miner-oriented financial products—because helping miners navigate the financial landscape is apparently a fun Halloween activity.

- Chang-Wei Chiu previously graced us with his wisdom as Director of Antalpha Platform. Before that, he was firing up capital allocation for Antalpha Capital (BVI) Limited, simply helping direct funds into mining and digital asset wizardry. 🎩✨

And yet, here’s the kicker: Antalpha is not owned by Bitmain, and their recent IPO filing has as much mention of current equity ties as an intergalactic travel brochure. It’s all based on shared stories, personnel shuffles, and partnerships, rather than direct ownership—so we’re still left wondering if Bitmain might have a secret handshake involved or not.

//ir.antalpha.com/static-files/8dbf77e0-355f-42d1-ad40-edf64fc3d77a”>

page 107)

What I’ve discovered at Cango paints a picture of a leadership team fully entrenched in Antalpha’s world and familiar with Bitmain’s cyclical shenanigans, pricing strategies, and financing norms. It’s not difficult to see why the rumor mill is working overtime on this.

Understanding the Curious Case of Enduring Wealth Capital

To add another jubilation of speculation to our colorful mix, we must address the cloudy identity of Enduring Wealth Capital. With an ownership structure more opaque than my Saturday night plans, past associations with Bitmain’s directors have kept the speculation fire burning bright. 🔥

Yet, despite the rampant conspiracy theories, there’s still no documented ownership link between Bitmain and Enduring Wealth Capital. Instead, we can see that EWCL has put together a team that aligns with the grand scheme of Bitcoin mining related to real individuals who could very well have personnel connections to Bitmain. This wouldn’t be particularly shocking in this industry where coincidences abound.

Which leads us to a broader observation of the cosmic puzzle.

How Bitmain Wanders the Industry like a Lost Tourist

The Bitcoin mining realm can be compared to a quaint little village where everyone knows everyone’s business (and, yes, it’s very small and entwined). With Bitmain commanding roughly 82% market share (proving that they’re the “Big Cheese” according to a report from the University of Cambridge), every miner, be they resource-rich or as broke as a galactic hitchhiker, relies on them for ASICs or supply chain access. Personal and business ties are as common as sipping tea on Thursday afternoons.

It appears some other public miners are known for their well-documented friendships with Bitmain:

Bitdeer and Bitmain: A Shared love story

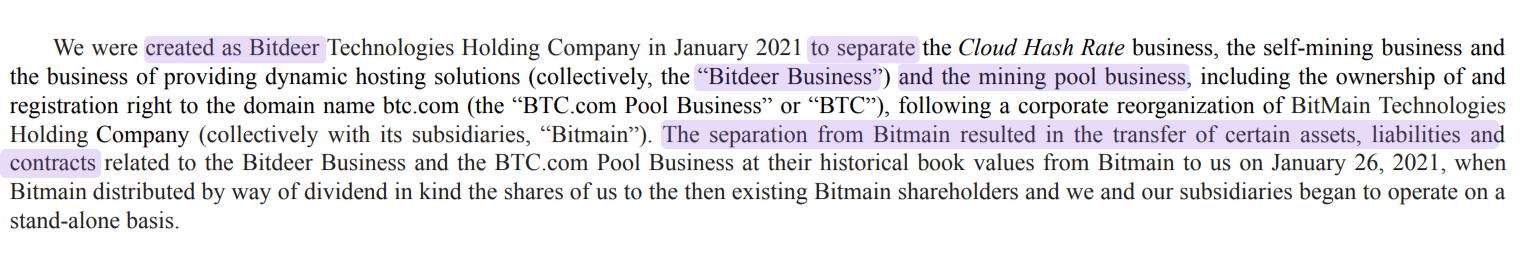

- Bitdeer was conceived as the firstborn of Bitmain, with its founder, Jihan Wu, previously holding the crowns of Bitmain’s co-founder and CEO. How’s that for a family reunion? 🎉

- The enterprise inherited not just the family jewels of Bitmain’s cloud mining operations but also carried over significant talent and infrastructure. Quite the legacy! 🌳

*Bitdeer previously stated in their IPO musings that their business model leans heavily on collaboration with Bitmain. Together they share logistics on everything from hardware provision to technical support, but with Bitdeer cooking up their own SEALMINER hardware, they might be on their way to future independence. 🦸♂️

BitFuFu and Bitmain: A Love-Hate Relationship

- BitFuFu has its relationship even more exposed, like their photos on a public bulletin board. In its SEC scrolls, it’s heralded as a prominent shareholder and strategic partner of Bitmain.

“BitFuFu received seed investment from Bitmain back in July 2021, with further commitments popping up from Bitmain and Antpool in January 2022.” (page 110 from BitFuFu’s SEC scroll)

- Bitmain generously provides most of BitFuFu’s ASIC machines. Talk about a friendly neighbor! 🏡

“BitFuFu is also a S-level client of Bitmain, the peak of client status, granting it privileges galore including miner and hash rate supply favors.” (page 110 from BitFuFu’s SEC scroll)

- The BitFuFu cloud mining platform took its first steps hand in hand with Bitmain and maintains agreements touting hardware coordination and ASIC supply spells.

“BitFuFu has also enchanted themselves into a decade-long collaboration contract with Bitmain, allowing them to secure 300 MW hosting capacity…” (page 110 from BitFuFu’s SEC scroll Page 110)

- Dare I say, there are some familiar faces floating around, where past Bitmain directors now find themselves in significant BitFuFu roles. Talk about mixing the family tree! 🌳🔄

These narratives illuminate that Bitmain has more formal connections than a British politician on social media, and when that’s the case, it’s not shy about showcasing it. 🗣️

So, Is Cango Practically a Bitmain Proxy? The Grand Revelation!

As of this moment and all the wondrous disclosures (or lack thereof), the definitive answer is NO.

Bitmain isn’t the puppet master here—there’s no documented ownership staked in the ground, no direct funding, nor unique business dependencies beyond the standard run-of-the-mill ASIC procurement mechanisms that just about every self-respecting large miner taps into.

Sure, there are connections that could make a good plot twist for a sci-fi thriller. But these ties emerge from past collaborations and executive histories rather than any looming operational or financial strings controlling Cango’s dance routine. 💃

In fact, the influx of executives steeped in prior industry experience—and their brief interactions with firms that have danced with Bitmain—shouts a clear message: Cango is aiming to strut its stuff as a key player in the Bitcoin mining arena. In this industry, having fruitful relationships with Bitmain isn’t merely common; it’s practically a coveted asset. 🏆

Companies rubbing shoulders with Bitmain generally gain VIP access to the next-gen ASICs, featured discounts, and splendid payment terms. But is that enough to label them as proxies? Perhaps it merely makes them more competitive in the grand race.

Final Thoughts: Are We Done Yet?

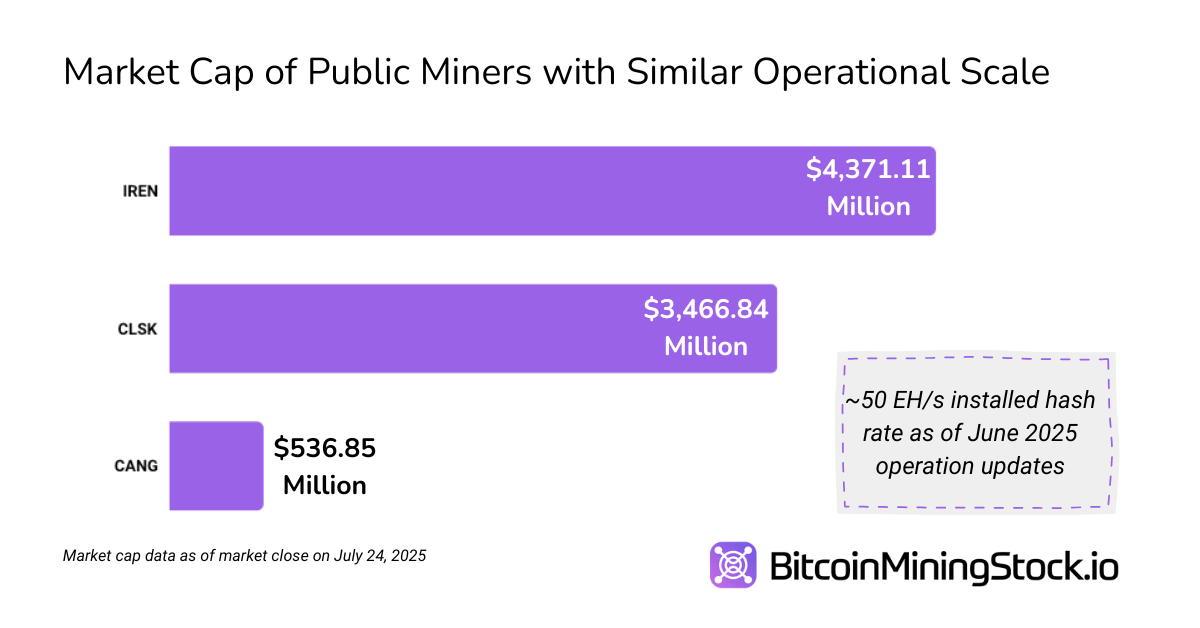

Armed with its newfound 50 EH/s capacity and revamped leadership gaggle, Cango has unmistakably declared that its foray into Bitcoin mining is no casual jaunt; it’s more of a full-fledged strategic waltz. Despite a market cap that still seems to be playing catch-up with competitors of a similar hash rate, it may simply result from lingering curiosity about Cango’s next moves and relationships.

From all we’ve observed thus far, it appears that Cango’s pivot toward Bitcoin mining is thoughtful, resource-rich, and sprinting ahead. For those investors with their eyes glued to the crypto cosmos—especially on the lookout for promising contenders—the time is ripe to keep Cango on your radar. 📡🚀

Rest assured, I shall persist in monitoring how this wondrous saga unfolds—especially if new charters or business arrangements pop up to unveil tighter links to Bitmain in the future. Brace yourselves! 🌌

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CAD PREDICTION

- Bewitching Meme Coins That Will Surely Charm August 2025

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- EUR CNY PREDICTION

2025-07-27 08:00