Delicious Tidbits of Wit:

- Oh, darling! Ethereum might just upstage Bitcoin within a delightful span of 3–6 months, according to the ever-charming CEO of Galaxy Digital, Mike Novogratz.

- Corporate glitterati are throwing their coins at Ethereum like it’s the latest fashion trend—who could resist a delectable purchase from BitMine and SharpLink?

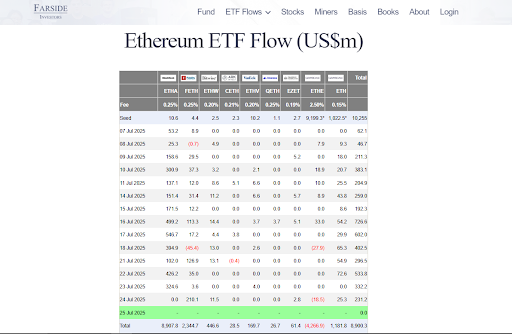

- In a fabulous twist, over $726 million waltzed into Ethereum ETFs in a single day, setting a record that would put any Hollywood premiere to shame.

Ethereum (ETH), my dears, is truly on the rise! Our dashing Galaxy Digital CEO Mike Novogratz recently graced the airwaves of CNBC, where he flirted with the idea that this sassy cryptocurrency could soon surpass our beloved Bitcoin.

With a twinkle in his eye, Novogratz mentioned that institutional interest could have ETH strutting its way to the $4,000 level—perhaps even breaking the glass ceiling entirely in just a scant three to six months.

The Dazzling $4,000 Breakout Beckons

Holding court, Novogratz pointed out the rather paltry supply of Ethereum—like a fancy restaurant with only a few tables. “There’s hardly any ETH around,” he noted, implying that a sudden rush from the upper-crust could create a delightful supply shock!

Galaxy CEO Mike Novogratz: “I dare say ETH has every chance of trumping Bitcoin in the next 3 to 6 months.”

— Crypto News Hunters (@CryptoNewsHntrs)

“If ETH bursts through the $4,000 barrier, we enter the realm of true price discovery,” he quipped. At the time of this grand pronouncement, Ether was flirting with $3,618—an 8.5% leap into the great unknown!

While still not lounging at its all-time high of $4,878 from that glamorous 2021 ball, Ethereum’s recovery this year indicates that it’s ready for even more thrilling escapades.

Corporations Are Flocking to ETH Like Moths to a Flame

The juicy momentum behind Ethereum largely springs from corporate treasure chests. Two companies, BitMine Immersion Technologies and SharpLink Gaming, have giddily scooped up over $3.3 billion in ETH—talk about a coin-craze!

BitMine has claimed the title of the grandest corporate Ethereum holder, flaunting an impressive 566,776 ETH, fancying itself at a princely sum of around $2.03 billion. Cheers, darling!

SharpLink Gaming isn’t left in the dust either, with its own collection of 360,807 ETH (worth about $1.29 billion) strutting on its balance sheet. This marked a fabulous new phase for the institutional embrace of Ethereum, much like Bitcoin’s rise with the likes of MicroStrategy.

Adding another pearl to the necklace, Ether Machine is preparing to take center stage on the Nasdaq, twirling under the ticker “ETHM,” with more than 400,000 ETH ($1.5 billion) ready to mingle on launch day.

The ETFs Are Fanning the Flames

Institutional confidence in Ethereum is just sparkling, darling! The performance of ETH-based ETFs has been positively scintillating. After winning the U.S. SEC’s approval last year, these ETFs have drawn attention like a siren’s song.

Last week, in a particularly showy display, these funds attracted a staggering $726 million in net inflows in a single day—a record-breaking feat worthy of a standing ovation! For the entire week, total inflows soared above $2.1 billion, signaling strong demand from our traditional financial circles.

This ETF frolic not only boosts Ethereum’s market performance but also sprinkles a bit of legitimacy in the eyes of investors and regulators, how splendid!

Ethereum’s Might Against Bitcoin is Growing Ever-So Lovely

While Bitcoin continues its reign as the grandest cryptocurrency by market cap, Ethereum is striding forward in terms of relative strength. The ETH/BTC ratio, elegant and poised, has ascended by 36.5% over the past 30 days, darling.

This ratio currently sits at a delightful 0.03116, and the trend indicates Ethereum is starting to take the lead in this mesmerizing dance of performance metrics.

Nevertheless, our gallant Novogratz has not cast aside Bitcoin entirely! He believes BTC could twirl its way up to $150,000 before the curtain falls this year, especially in a lavish macro environment with lower interest rates. “It feels like we simply must go higher,” he says with a wink.

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Brent Oil Forecast

- USD THB PREDICTION

- Gold Rate Forecast

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- UFC & Polymarket: Fists, Foresight, and Frenzy!

- 🚨 XRP Whales Flee: Is the Tide Turning for Ripple? 🌊

2025-07-25 18:06