Oh, how the mighty have fallen—or rather, risen—into the arms of digital folly. Metaplanet, once a humble Japanese tech outfit, has pulled off yet another Bitcoin heist, gobbling up 780 coins for $92.5 million. Now, their glittering pile totals 17,132 coins, worth a staggering $2 billion at today’s whimsically inflated prices. Truly, a masterclass in speculative excess. 🚀😂

Stock Jumps on Bitcoin News

The market, ever the sycophant, rewarded this latest escapade with a 5.6% leap in shares, hitting 1,247 yen on the Tokyo Stock Exchange. Year-to-date, the stock’s ballooned a ludicrous 258%, leaving Japan’s stodgy indices in the dust. From a floundering hotel chain to Bitcoin baron—how quaintly transformative. Who knew pixels could be so profitable? 📈😏

This audacious pivot has turned Metaplanet into a crypto colossus, boasting a 449.7% Bitcoin yield for 2025. CEO Simon Gerovich, with all the gravitas of a carnival barker, brags about acquiring Bitcoin at an average of $101,030 per coin. Now, with prices hovering around $119,300, he’s sitting on unrealized gains that must make his accountant weep with joy—or terror. Either way, it’s a riot. 💸🤡

Asia’s Bitcoin Leader

Metaplanet now lords over Asia as the top Bitcoin hoarder among public companies, ranking seventh globally. Spare a thought for MicroStrategy (or whatever it’s calling itself these days), the American trailblazer with its 600,000+ Bitcoin stash worth over $70 billion. But Metaplanet’s caught the bug with a distinctly Japanese twist—think tea ceremonies with blockchain. Fidelity, that old Wall Street warhorse, has jumped on board, snagging 12.9% of shares for $820 million. How positively symbiotic. 🌏🤝

Ambitious Growth Plans

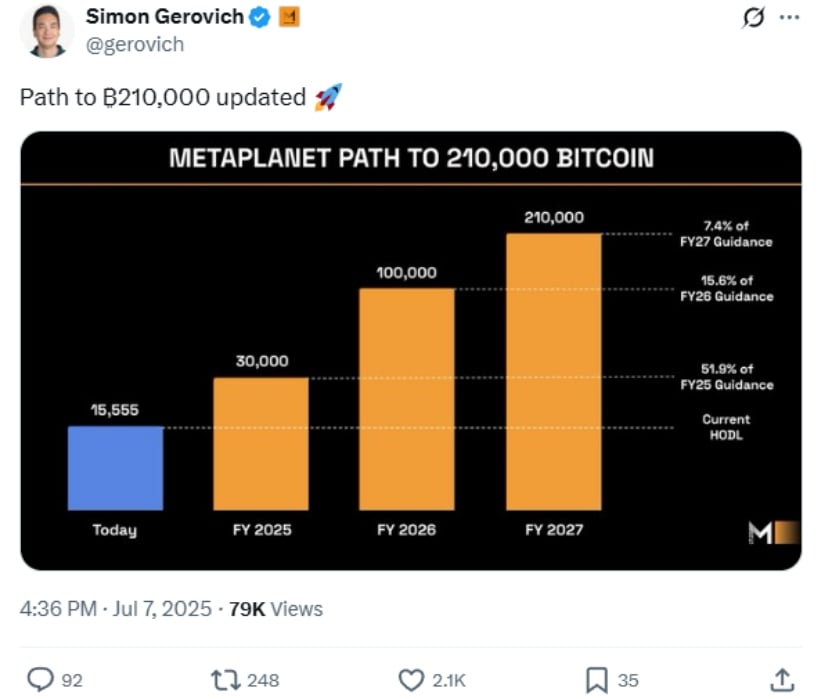

Never ones for modesty, Metaplanet eyes a future where they clutch 210,000 Bitcoin by 2027—that’s a full 1% of the total supply. Funding this madness? A cocktail of bond redemptions and share issuances, raking in $86.7 million in July alone. Their Bitcoin ops even spat out $7.6 million in revenue last quarter, up 42.4%. And why stop there? They’re plotting to pawn these digital trinkets for a digital bank or other cash cows. Bold? Undoubtedly. Sane? Debatable. 🏦😜

Bitcoin’s been on a tear, up 10% in the last month, flirting with $119,000. This has puffed up corporate treasuries everywhere, with Metaplanet clocking a 22.5% yield in July. It’s all very American in spirit, but with a Japanese veneer of propriety—think samurai swords sheathed in code. While Western firms charge ahead, Metaplanet’s carving its niche in Asia’s buttoned-up finance world. Charming, really. 📊🙄

Looking Forward

This latest Bitcoin binge only cements Metaplanet’s role as the enfant terrible of corporate crypto. Buying at higher prices? Pure conviction—or perhaps a dash of lunacy. With dreams of empire-building via digital assets, they’re redefining treasury tedium. As more companies eye the Bitcoin bandwagon, Metaplanet’s farce might just become the blueprint. Heaven help us all. 🔮😅

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Brent Oil Forecast

- SEC’s Quantum Quandary: Is Your Bitcoin Bristling with Risk?

- Gold Rate Forecast

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- UFC & Polymarket: Fists, Foresight, and Frenzy!

- USD THB PREDICTION

2025-07-29 03:53