Finance |

Ah, Hong Kong’s Bitcoin bash! Everyone’s buzzing-except for those Digital Asset Treasury (DAT) guys looking like they just lost the lottery. Their crypto returns? About as exciting as watching paint dry… in Hawaii.

“Just buy an ETF,” the genius-er, CEO Matt Cole-says on stage, like it’s as easy as ordering a cheeseburger. Well, Matt, in Japan it’s more like ordering a sushi platter: complicated but deliciously profitable if you know the secret ingredients.

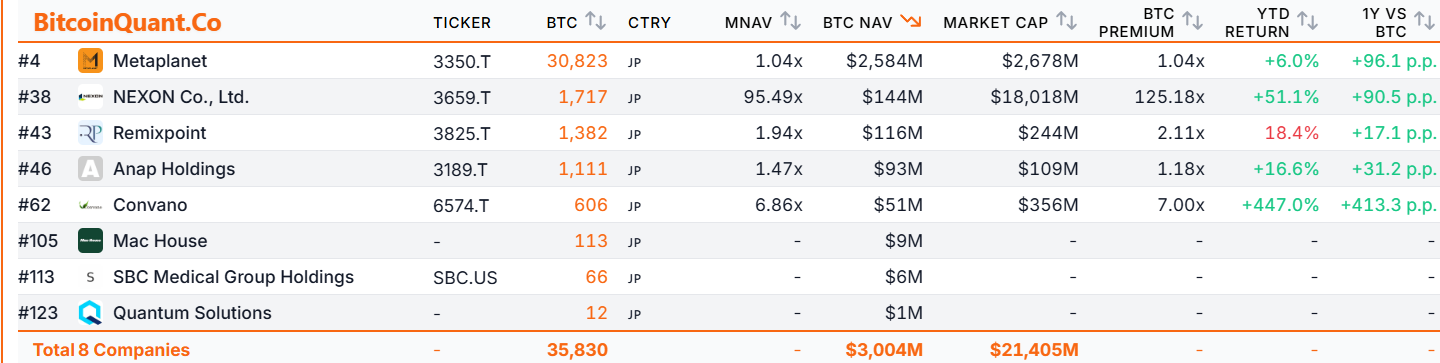

For Japan, those DATs are outperforming bitcoin because of the tax game! The government plays favorites-equities get the VIP treatment while crypto is stuck in the back alley, taxed up to 55%. Ouch! 🎯

Crypto profits in Japan? They’re lumped in with your salary, taxed like that weird uncle at family dinners-up to 55%. Losses? Forget about it. Cannot offset, cannot carry forward, just pay up, sir! Meanwhile, stocks enjoy the red carpet, taxed at a cool 20% with fewer headaches. It’s like choosing between a hangover or a spa day.

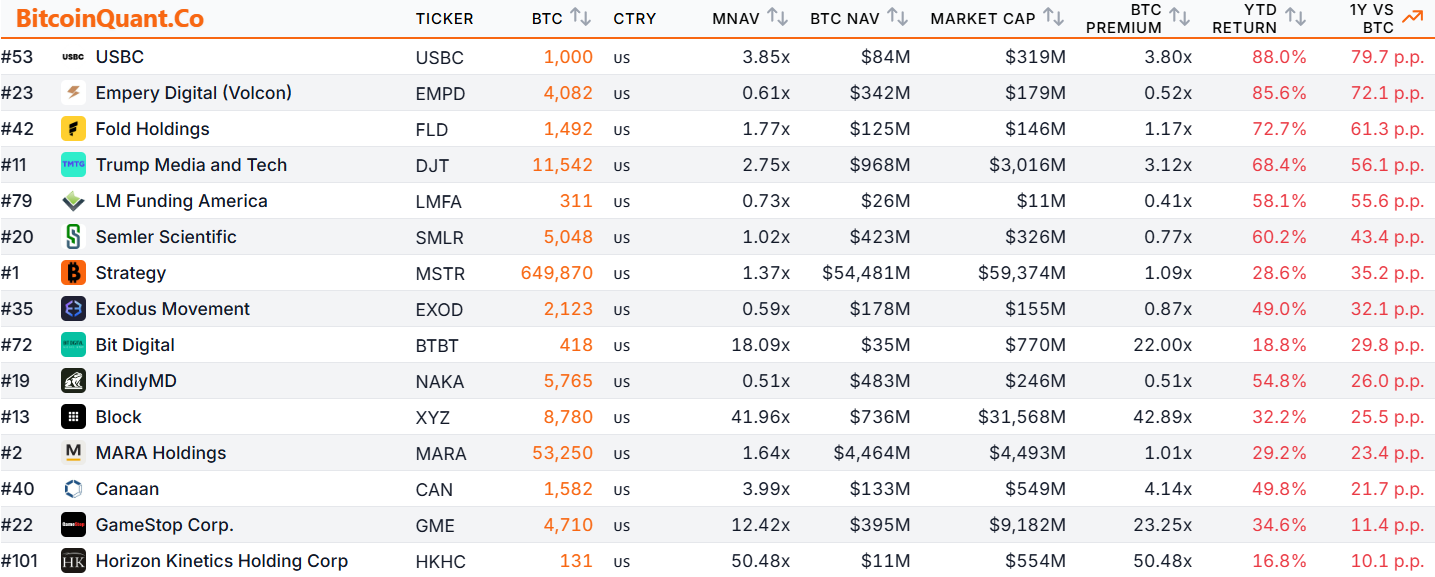

So, what do the clever investors do? They just buy stocks of companies holding Bitcoin, because the tax man isn’t looking over their shoulder-yet. Americans? They play the neutral zone: their stocks hover around their Bitcoin stash, indifferent as a cat on a sunny windowsill.

But wait! The Japanese authorities are sniffing around-they’re worried about the chaos these tax rules are causing. Backdoor listings, tighter audits, the whole shebang. Looks like the DAT magic show might soon be curtains down. 🩸🎭

And it’s not just Japan-Hong Kong, India, Australia-they’re all watching, raising eyebrows. The big question: will Japan ditch its crypto favoritism? If they do, those DATs will turn into yesterday’s news faster than you can say “ETF, please!”

Meanwhile, the wise guys are whispering, “Just buy an ETF.” Yep, that’s the new secret sauce for beating the taxman and sleeping easy at night. Cheers! 🥂

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- USD CAD PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- TIA PREDICTION. TIA cryptocurrency

- XRP ETF Crushes Solana – First Day Madness! 🎉🚀

2025-11-21 21:13