Ah, the digital marketplace, a veritable circus of speculation where the bold and the bewildered dance a macabre tango! Michael Saylor, that ever-watchful oracle of cryptocurrency, has once again cast his gaze upon the world of Bitcoin, unleashing a modest post on X adorned with shimmering “green dots” that twinkle like stars in an otherwise murky sky. Such a revelation has ignited fresh chatter among traders, who now clutch their crystal balls, interpreting this celestial alignment as an omen-perhaps a sign of impending Bitcoin acquisitions that could send prices soaring!

As it stands, Bitcoin flirts tantalizingly just beneath the heavy resistance band of $90,000, a price point so laden with tension that one might liken it to a tightrope walker precariously balancing above a pit of snapping crocodiles. Traders, with bated breath, peer into the abyss, waiting for either a triumphant breakout or yet another rejection that would drown their hopes.

The Market’s Gasp and Whispers

Lo and behold, the mere whisper of Saylor’s green dots sent prices skittering about like startled roaches at the flick of a light switch. Short-term traders, always eager for the next big thrill, dove headfirst into the idea that perhaps a clandestine buyer was preparing their grand entrance, ready to accumulate more Bitcoin than a dragon hoarding gold. Some savvy market participants even sought to draw parallels between this latest signal and earlier proclamations from Saylor that preceded corporate purchases-because, of course, hindsight is 20/20!

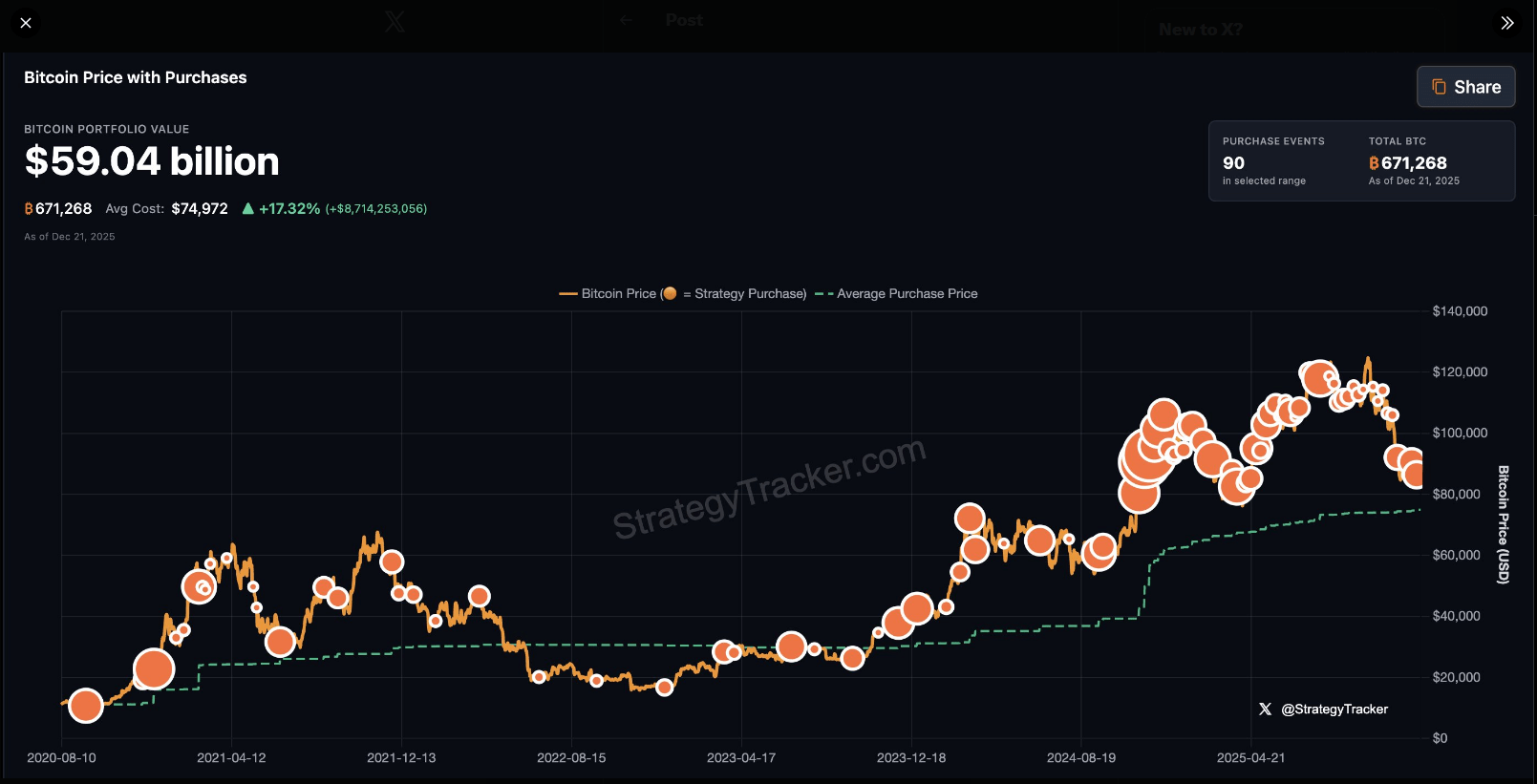

Green Dots ₿eget Orange Dots.

– Michael Saylor (@saylor) December 21, 2025

However, dear reader, before we launch into a frenzy of jubilant anticipation, it must be noted that no formal company filing or treasury update has graced our screens to confirm any new acquisitions. Saylor’s message, flung into the ether without so much as an accompanying press release, has left some desks treading cautiously, like cats on a hot tin roof.

Institutional Intrigue and Omens of On-Chain Activity

Amidst this swirling tempest of uncertainty, reports suggest that institutional flows remain crucial to Bitcoin’s price trajectory. Large spot Bitcoin ETFs and corporate treasuries play a significant role in this theatrical performance, adding layers of intrigue that traders eagerly dissect in search of meaning behind Saylor’s high-profile hints.

On-chain metrics-the mystical runes of the blockchain-are being scrutinized for coin movements into custody accounts. The holy grail of evidence that might sway market conviction would be a definitive transfer into an exchange or ETF custody wallet, followed by a public proclamation. Until such an event occurs, Saylor’s green dot post remains a tantalizing signal rather than an irrefutable proof.

What Are Traders Peering At?

Liquidity gathers near $90,000, with orders clustering around this psychological barrier like moths to a flame. Should a significant buyer dare to venture beneath this wall, the sellers might be swept aside, propelling prices higher into the stratosphere. Yet, if selling pressure prevails, we could find ourselves in a sideways limbo, dragging on for several sessions, a purgatory of trading.

Traders, ever vigilant, monitor order books, funding rates, and ETF balances for signs of life. Volume spikes paired with observable custody inflows would constitute a signal far mightier than a mere social media post alone-after all, in this game, context is king!

Michael Saylor, that notable figure in the realm of Bitcoin, has historically been a beacon of buying fervor, his public utterances wielding the power to sway sentiment like a conductor guiding an orchestra. Reports linking his posts to subsequent purchases have circulated through the market media, and traders, ever the opportunists, rely on this storied history to imbue the current message with gravitas. One wonders, then: what will the next chapter in this ongoing saga reveal?

Read More

- Brent Oil Forecast

- Silver Rate Forecast

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Gold Rate Forecast

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- Bitcoin Stuck in $90k Limbo: Will It Break Free or Crash Harder? 🚀💔

- 🚀 LINK Leaps as Grayscale’s ETF Debuts on NYSE Arca! 🤑

- XRP Whales Hoard Crypto Like Scrooge McDuck 😂💸 – Will Market Survive This Greed?

- Steak ‘n Shake & Bitcoin: Utterly Baffling!

2025-12-22 21:12