Strategy, erstwhile MicroStrategy, climbed to the summit as the world’s grand hoarder of digital gold–Bitcoin-yet, when the S&P 500 gods rebalanced their celestial weights, our corporate Prometheus was denied entry to Olympus.

A curious twist, this; the crypto villagers sharpened their pitchforks, expecting Michael Saylor-chief zealot of Bitcoin-to be crowned alongside America’s pantheon of stock tickers. Irony had its last laugh: Robinhood, the digital bazaar for degenerate traders, slipped in while Saylor’s saga remained exiled.

What did Strategy do to offend the keepers of the S&P gates?

The S&P Dow Jones Indices, masters of opaque rituals, divulge their standards with all the clarity of Siberian mist. Positive earnings, they demand-quarter by quarter, like bread rations in the camp. Strategy, frantic with Bitcoin fever, falls short: its ledger swings like an axman who’s had too much vodka.

2020: Strategy renounced earthly logic, embraced Bitcoin as its creed. Thus began a performance without curtain calls: profits soared when BTC ascended, then crashed to infernal depths when the coin stumbled. In one quarter, the gods smiled: a $10 billion net profit. By the next, fate reversed its hand, and a $4.2 billion net loss dragged the company into financial tundra.

Stability? Not in this play. The stewards of the index prefer accountants’ tranquil arithmetic, not Saylor’s fever-dream accounting ballet.

“MicroStrategy’s finances swing like Dostoevsky’s moods-unrealized gains and losses toss its earnings from delirium to despair each quarter,” mused crypto analyst Vincent Van Code on X, probably from a pub.

And what is at stake, you ask? Not just pride. The S&P 500 is no provincial registry; it is the axis around which trillions in funds and ETFs revolve. A nod from these gatekeepers unleashes a deluge of institutional cash-enough to buy a new yacht or three.

Strategy, already bulging with 636,505 Bitcoins like a paranoid squirrel with too many acorns, could harness such legitimacy to lure the Wall Street suits into crypto’s casino.

Of course, not all in the crypto trenches cower before tradition. Revolution is in the wind, and some call for the index to awaken from its fiat slumber.

“S&P 500 needs MSTR, MSTR doesn’t need S&P 500. Bitcoin: the new bread in every retirement account,” declared the Vice President of Bitcoin Strategy at Strive, Jeff Walton, before, presumably, boarding his rocket to the moon.

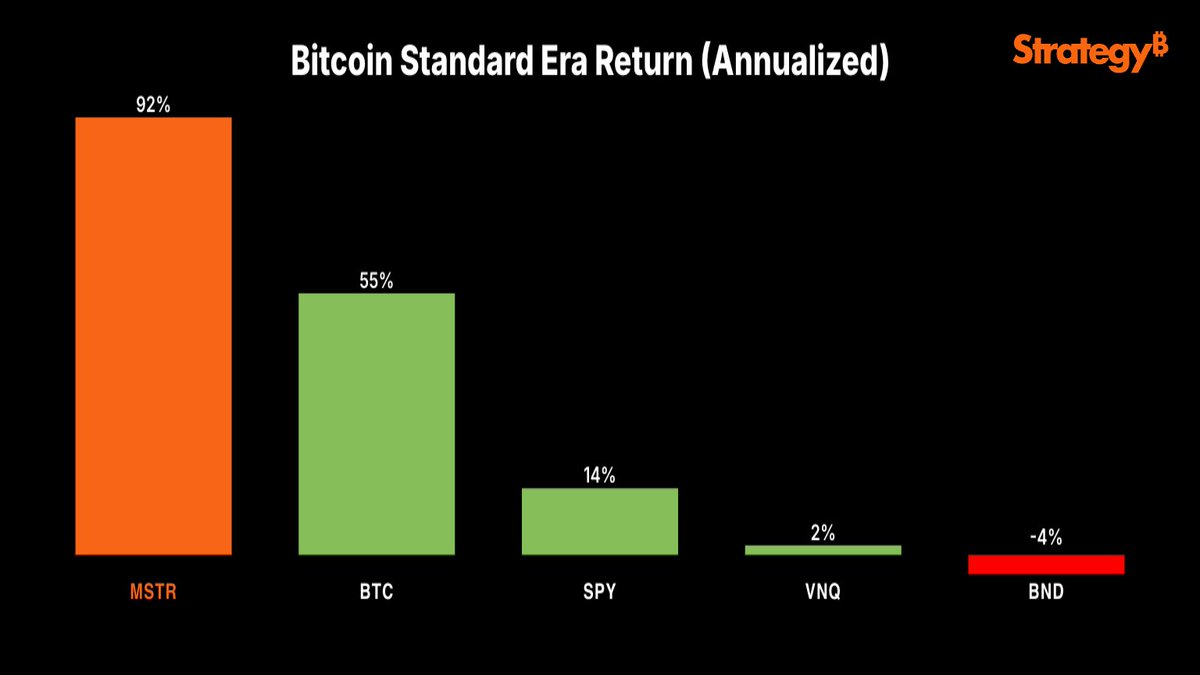

Saylor himself, not one for humility, boasts that his company’s stock has outpaced the very Bitcoin it hoards; he claims it has trampled the venerable S&P 500, like Napoleon at Austerlitz.

The next chapter arrives in December, when the high priests of the index hold their quarterly seance.

Until then, Strategy’s omission stands as a parable-a clash between ancient financial dogma and the untamed, volatile frontier of digital assets. The solar winds of Bitcoin still blow, and somewhere, Michael Saylor is probably tweeting.

Read More

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Bitcoin Miners Go Green as AI Deals and Bitcoin Surge Create Perfect Storm

- Gold Rate Forecast

- Bitcoin Predictions: Dead Cat Bounce or Bullish Bliss? 😹💰

- Cardano vs. Quantum: Charles’ ‘Clinic’ Chaos

- LINK Soars 8.9%! CoinDesk 20’s New Star 🚀

- Top 10 Fast-Growing Blockchains of 2025 – Who’s Gaining Users? 🎯

- Kevin Hassett: The Unlikely Fed Kingmaker 🤝💸

2025-09-06 12:52