Oh, the market’s sages now whisper that the storm may have passed, and the MSTR stock’s recovery may spring forth at any moment! 🌩️📈 The optimism comes as the venerable Michael Saylor, the Strategy’s patriarch, declared on the 22nd of December that the firm’s USD reserves have swelled to a staggering $2.19 billion! 🎉💰 Furthermore, the data, which is as reliable as a drunken monk, reveals that institutional ownership of MSTR shares has surged like a river in spring! 🌊📈

MSTR Stock Recovery Can Happen Anytime

Crypto oracle Fred Krueger declares that Strategy (MSTR) now trades at a modest premium to its Bitcoin holdings, a mere 10% as per his calculations. 🧮 This will be a boon for MSTR stock should Bitcoin’s price decide to ascend, which it may or may not do, as per the whims of the market. 🧐

According to Krueger, MSTR is currently valued at roughly a 10% premium to its net asset value (NAV). He added that the company has approximately 20% effective leverage based on a comparison of about $60 billion worth of Bitcoin BTC $87 807 24h volatility: 2.2% Market cap: $1.75 T Vol. 24h: $39.89 B on its balance sheet versus a market capitalization of roughly $50 billion. 🧮💸

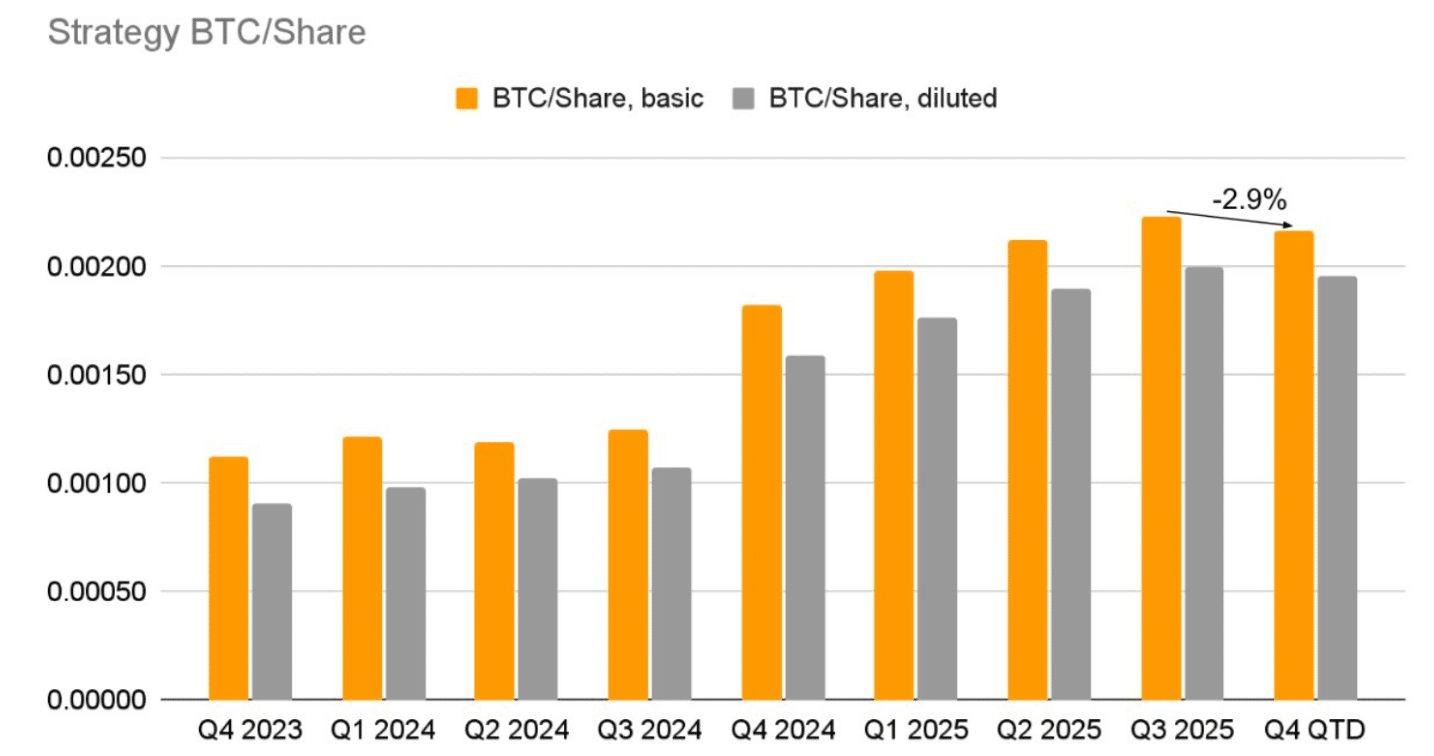

With Strategy increasing its USD reserves, Kruger noted that the firm has close to three years’ worth of cash runway. Strategy (MSTR) has seen a modest dilution in its Bitcoin-per-share metric due to the buildup of a $2.19 billion cash reserve. 🏦📉

Bitcoin per Share MSTR | Source: Mark Harvey 📊

However, analysts like Mark Harvey believe this move will strengthen the company’s long-term financial position. The larger cash balance reduces Bitcoin exposure on a per-share basis in the near term. However, it provides Strategy with greater resilience during longer Bitcoin drawdowns. 🧠🛡️

The cash reserve also helps to ease refinancing and liquidity pressure linked to the company’s outstanding convertible bonds. This helps in improving the company’s overall credit profile. 🏦✨

Market observers note that this added financial flexibility could support a more favorable assessment from credit rating agencies such as S&P Global. 📈💼

S&P Global says Strategy needs more USD liquidity.

A month later we have a USD cash reserve.

S&P Global says Strategy needs to prove they can manage it.

Strategy doubles down and now has more than 2.5 years of dividend payments.

They are taking the feedback quickly and moving…

– Adam Livingston (@AdamBLiv) December 22, 2025

Institutional Demand Gathers Steam

A public pension fund in New Jersey has unveiled a $16 million investment in Strategy (MSTR), as per recent filings-proof that even the most cautious investors are now dancing to the MSTR’s tune. 🕺💰 On the other hand, the institutional ownership of the MSTR stock has surged from $155 million last month to now at $165 million. 📈💰

While everyone is crying about $MSTR, institutions have been quietly accumulating.

In the past month, institutional ownership of $MSTR has climbed from 155M to 165M.

• 1461 long. 46 short.

They probably know something about $BTC that I don’t.Watching closely, don’t miss out!

– Bryant (@TheSkayeth) December 22, 2025

Citigroup has still maintained a “buy” call on the MSTR stock. However, it has reduced the target to $325 per share, from its previous target of $485. 📉📈

Read More

- Silver Rate Forecast

- Brent Oil Forecast

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Gold Rate Forecast

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- 🚀 Stellar Plummets Like a Discworld Turtle Off a Cliff! 🌪️

- 😱 Oops! Crypto Shorts Gone Wild: $190M Down the Drain! 🚀

- Bitcoin Stuck in $90k Limbo: Will It Break Free or Crash Harder? 🚀💔

- Solana Resilient? Yeah, Sure, Even Hackers Love It Too!

2025-12-23 14:50