On a rather unassuming August 7, 2025, the US Department of Justice decided to put the proverbial nail in the coffin of Tornado Cash, convicting co-founder Roman Storm of running what they like to call an “unlicensed money transmission business.” In layman’s terms, he was up to no good, akin to selling lemonade without a permit. Apparently, this verdict is the latest chapter in what seems to be an all-out war against the crypto-mixing infrastructure that certain hacker groups have adopted like a fashion trend.

Fast forward a few weeks to August 26, and the FBI, bless their boots, declared that the infamous Lazarus Group had orchestrated the $1.5 billion hack of Bybit – which, I daresay, now holds the title for the biggest crypto theft in history. That’s right, folks; it seems a couple of smart cookies from North Korea decided to go for the jackpot!

“North Korean Hacks” Stretch Across Global Markets

Why Important

The Bybit breach and the Tornado Cash drama reveal the tangled mess where cybercrime meets regulation, kind of like trying to mix oil and water without a blender. For investors and exchanges, this isn’t merely about hackers lifting their crypto assets – oh no! We’re also dealing with rising compliance costs, bouncers at the door in the form of tighter oversight, and an unsettling notion that crypto has gone from being a thrilling financial gamble to a matter of national security. Who knew a digital coin could be quite so alarming? 😱

doing bad things) by Western companies. Their salaries funneled into crypto wallets – what an ingenious method of laundering those greens! This “dual strategy” of steady incomes from IT jobs coupled with windfalls from exchange hacks is helping Pyongyang maintain its financial footing, almost like a very macabre circus act. 🎪

North Korean operatives, it seems, have also decided that their tools need an upgrade. As BeInCrypto reported, they’re now blending advanced social engineering with something known as zero-day exploits – fancy talk for spiffy new hacks that are surprisingly effective against platforms thought to be invulnerable. 😈

Wider Impact

These cyber escapades have sent shockwaves of uncertainty through the industry. European exchanges are reporting higher compliance costs (ugh!), while South Korea has turned the dial up on blockchain forensics. The FATF’s warning had governments tightening their licensing frameworks faster than a soccer mom on a caffeine rush. Oversight is shifting its focus from a financial lens to a security one, which is akin to upgrading from a bicycle to a tank. 🚀

Military Diversion Risks and Policy Reactions

Essential Facts

• North Korea stole $1.6 billion in H1 2025 (TRM Labs).

• The Bybit hack alone cost $1.5 billion (FBI).

• BitoPro lost $11.5 million (Yahoo citing BitoPro).

• DOJ filed a $7.74 million forfeiture action (DOJ).

• Four nationals indicted for $900,000 thefts (DOJ).

• UN monitors have reported that cyber proceeds fund weapons programs.

Looking Forward

Officials warn that Pyongyang is now testing the waters of decentralized finance and privacy coins; thrilling, isn’t it? Analysts are anticipating new sanctions aimed at mixers, custodial wallets, and liquidity pools, because who wouldn’t want a little more regulation in their lives? Without some coordinated efforts though, enforcement gaps are likely to widen like an open trench, leaving unsuspecting investors dangling. 🎢

Data Breakdown

| Date | Event | Amount | Source |

|---|---|---|---|

| May 9, 2025 | BitoPro hack (Taiwan) | $11.5M | Yahoo News |

| June 5, 2025 | DOJ forfeiture action | $7.74M | DOJ |

| June 30, 2025 | DOJ indictment (4 nationals) | $0.9M | DOJ |

| June 2025 | FATF warning | N/A | ICBA |

| May 2025 | IT worker scheme exposed | N/A | Wired |

| Aug 7, 2025 | Tornado Cash verdict | N/A | DOJ |

| Aug 26, 2025 | Bybit hack | $1.5B | FBI |

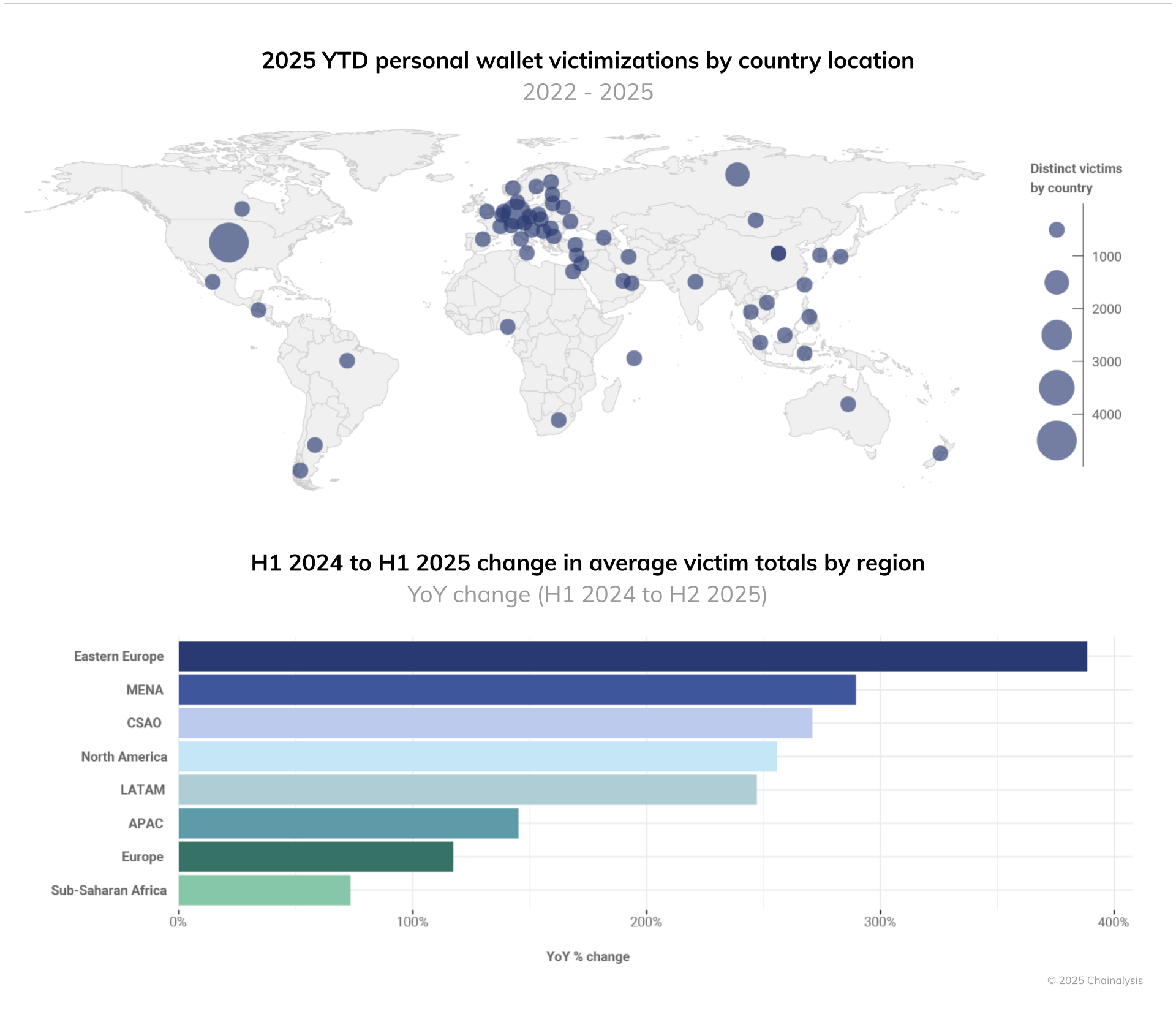

| H1 2025 | Global theft total | $2.17B | Chainalysis |

From Past Heists to Today’s Dominance

Between 2017 and 2022, UN panels estimated that Pyongyang and its merry band of cyber thieves raked in around $2 billion through those delightful schemes known as cyber thefts. By 2024, North Korea was contributing nearly one-third of global crypto crime. In 2025, their reign has expanded with alarming speed, orchestrating most major heists. Truly, their pirating game has undergone a transformation from simple opportunistic swipes to a coordinated, systematic approach, transforming them into the Bonnie and Clyde of the digital age. 👩❤️👨

Possible Risks

While there are murmurs of tightening sanctions, the intriguing world of peer-to-peer transactions in emerging economies poses blind spots – like trying to find a needle in a haystack but the needle is also hiding. As such, the DPRK is likely to shift toward decentralized corridors, raising liquidity risks, inflating regulatory costs, and possibly slamming the door on investors with sudden market restrictions. Just your average Tuesday in crypto land! 🥴

Expert Opinions

“Cybercriminal activities generate about half of North Korea’s foreign currency income and are used to fund its weapons programs.”

– UN sanctions report, June 2025

“These funds enable DPRK’s malign activities worldwide, undermining sanctions and fueling proliferation.”

– US Department of Justice

“The Lazarus Group’s strategy has evolved from opportunistic hacks to structured, state-backed funding operations, making them harder to disrupt.”

– TRM Labs analyst

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- Blockchain Dawn in the Developing World 🌍✨

- AI and Copyright: Mark Twain’s Take on the Modern Patent Circus

- DeFi Meltdown: Yearn Finance’s yETH Pool Drained by a Rogue Algorithm 🤖💸

- USD THB PREDICTION

- Bitcoin Plummets Below $98K: Fear Grips Market Like a Bad Soap Opera 🎭

- UK Oil Company Ditches Tea for BTC: Mining Bitcoin with Stranded Gas 🚀

2025-08-27 04:44