It is with the utmost astonishment that one must report upon the Norwegian sovereign wealth fund, under the discerning stewardship of Norges Bank Investment Management (NBIM), having, in a most indirect manner, augmented its holdings of the so-called “digital gold” to 7,161 BTC, a sum valued at nigh upon £862.8 million as of the 30th of June, per the estimable analysis of K33.

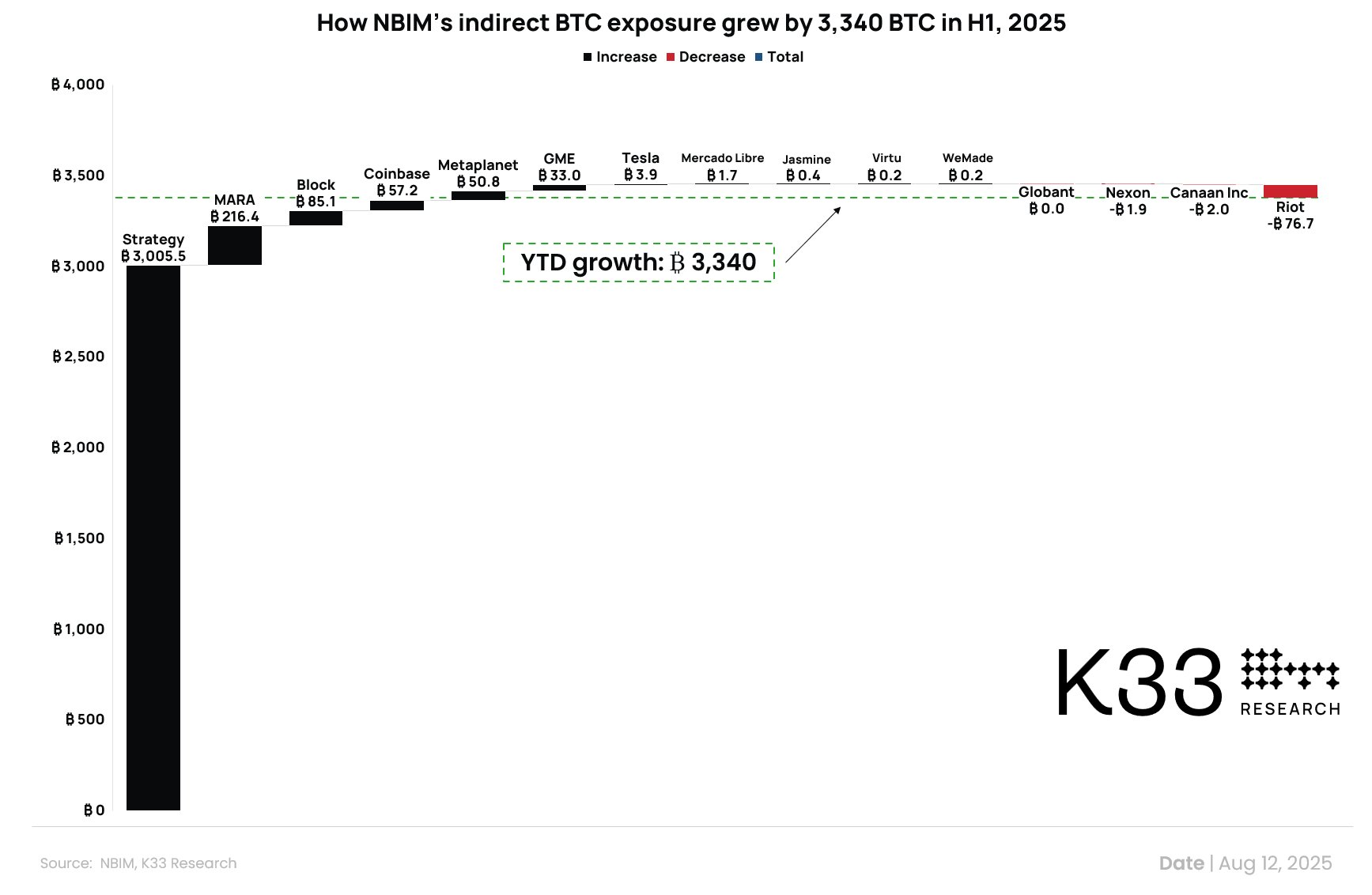

This, dear reader, represents an increase of 87.7% in but six months, and a staggering 192.7% since the same time last year. Such meteoric growth is attributable, in no small part, to the fund’s investments in companies whose treasuries are liberally sprinkled with Bitcoin, including Strategy, Block, Coinbase, Marathon Digital Holdings (MARA), and the rather enigmatic Metaplanet.

K33’s esteemed Head of Research, Mr. Vetle Lunde, has kindly elucidated that these calculations are derived from NBIM’s shareholdings in said firms, multiplied by the Bitcoin they hold. One might say it is a most mathematical approach, though I confess I am no mathematician.

Though Mr. Lunde opines that this exposure is likely the consequence of NBIM’s broad, diversified investment strategy rather than a deliberate wager on Bitcoin, he does concede it to be a most telling example of how BTC has insinuated itself into the very fabric of mainstream financial portfolios, often with nary a thought given to the matter. A most curious phenomenon, indeed.

Growth Driven by Strategy Holdings and Corporate BTC Accumulation

The most notable contributor to NBIM’s burgeoning Bitcoin exposure is its stake in Strategy, a firm whose primary occupation appears to be the accumulation of BTC. NBIM’s ownership therein has risen to 1.05% of its shares, a sum valued at £1.18 billion as of June’s end, up from a mere 0.72% (£514 million) at the close of 2024. Strategy itself, in its relentless pursuit of BTC, has added 145,945 BTC to its coffers in the first half of 2025, thereby bestowing NBIM with an additional 3,340 BTC of indirect exposure.

Further exposure, one might say, is the result of holdings in other public companies whose BTC reserves are, to say the least, rather substantial. Firms such as Block, Coinbase, MARA, and Metaplanet-names which might have once been dismissed as mere speculators-have either maintained or increased their BTC balances, thus contributing to this upward spiral of digital wealth.

Mr. Lunde has further observed that, per capita, NBIM’s Bitcoin exposure now amounts to approximately 1,387 Norwegian kroner, or roughly £138, for each Norwegian citizen. A most egalitarian distribution, though I suspect the citizens themselves are none the wiser.

Broader Market Context and Currency Considerations

Mr. Lunde has also noted that this growing indirect exposure aligns with a broader market pattern: any investor with a diversified equity portfolio is likely to possess some degree of Bitcoin exposure through corporate holdings. A most convenient arrangement, though one might question whether such exposure is a boon or a folly.

He anticipates this trend will only intensify as more companies adopt BTC as part of their treasury strategies. “Odds are high,” he remarked, “that any index investor or broadly diversified investor currently holds a modest BTC exposure through proxies,” adding that this phenomenon is likely to accelerate. A most optimistic prognosis, though I daresay not all investors will be equally pleased with the outcome.

The report also situates the fund’s Bitcoin exposure within the context of BTC’s recent market performance. In US dollar terms, BTC reached an all-time high of over £123,000 in July, a 11.9% increase from its January 20 level. However, gains in other currencies are less impressive, with BTC up but 1.5% against the US dollar index and still languishing below January’s highs in euros. Mr. Lunde has observed that €105,600 remains a key resistance level for BTC in euro terms, a detail which underscores the capricious nature of currency fluctuations.

NBIM’s growing indirect stake in Bitcoin serves as a most compelling illustration of how exposure to this peculiar asset class can expand organically within large, diversified portfolios. Whether by design or happenstance, the trend reflects Bitcoin’s deepening presence in global financial markets. A most unexpected union, to be sure.

Featured image created with DALL-E, Chart from TradingView

Read More

- USD CNY PREDICTION

- Gold Rate Forecast

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Silver Rate Forecast

- USD VND PREDICTION

- Shiba Inu Shakes, Barks & 🐕💥

- Shocking! Genius Act Gives Crypto a Glow-Up – Jokes, Dollars & Digital crazy!

- Bitcoin Miners Go Green as AI Deals and Bitcoin Surge Create Perfect Storm

- EUR USD PREDICTION

2025-08-14 04:31