Ah, crypto legislation—finally, a topic as exciting as a well-timed punchline! Investors, ever the fickle lot, have abandoned meme coins for tokenized real-world assets (RWAs). Cue 21Shares, the financial equivalent of a velvet rope, filing a spot ONDO ETF with the SEC—because nothing says “innovation” like asking a bureaucratic gatekeeper for permission to play with tokens. 🎩🎩

21Shares Files for Spot ONDO ETF: Here’s What It Means

On Tuesday, 21Shares submitted its proposal for the “21Shares Ondo Trust,” a spot ETF that will track ONDO’s price like a lovesick puppy. The fund will hold ONDO tokens directly and use the CME CF Ondo Finance-Dollar Reference Rate for pricing—because who doesn’t want their investments to be as predictable as a soap opera? 🎬

- Custodian: Coinbase—because even the most chaotic crypto needs a babysitter. 🧸

- Structure: Passive investment (no leverage)—just hope, really. 🤞

- Creation/Redemption: Cash or in-kind basis—because why not? 🎯

The trust is engineered to offer institutional-grade exposure to a DeFi token without speculative risk, potentially attracting TradFi investors into the growing RWA sector. Or, as I like to call it, “the financial equivalent of a slow burn.” 🔥

Trump-Linked Platform Is Betting on ONDO

World Liberty Financial, a DeFi platform reportedly connected to the Trump family, has taken a position in ONDO. As per Nansen data, it acquired $250,000 worth of ONDO tokens in December, currently holding 342,000 ONDO valued at about $383,000. Because nothing says “financial stability” like a political dynasty. 🏛️

Yet, this investment remains a small portion (0.2%) of their $208 million portfolio, which is heavily concentrated in stablecoins, Wrapped ETH, and Bitcoin. Because even the wealthy need to play it safe. 🛡️

Ondo Finance Acquires SEC-Registered Broker to Power RWA Push

Institutions Are Taking Notice

According to RWA.xyz, the value of tokenized real-world assets on-chain has surged 58% in 2025, reaching nearly $25 billion. Ethereum dominates with a 55% market share, mainly through tokenized private credit and U.S. Treasury assets. Because nothing says “growth” like turning real estate into digital tokens. 🏡

As more ETF issuers explore RWA-based products, ONDO’s ETF filing could ride the wave of institutional demand. Or, as I like to call it, “the financial equivalent of a slow dance.” 💃

ONDO Price Today and Market Sentiment

Following the ETF news, ONDO price rose 2.3% to $1.12, with a market cap of $3.5 billion and 3.1 billion tokens in circulation. Still, ONDO remains down 48% from its all-time high of $2.14 in December. Because even the best stories need a twist. 📖

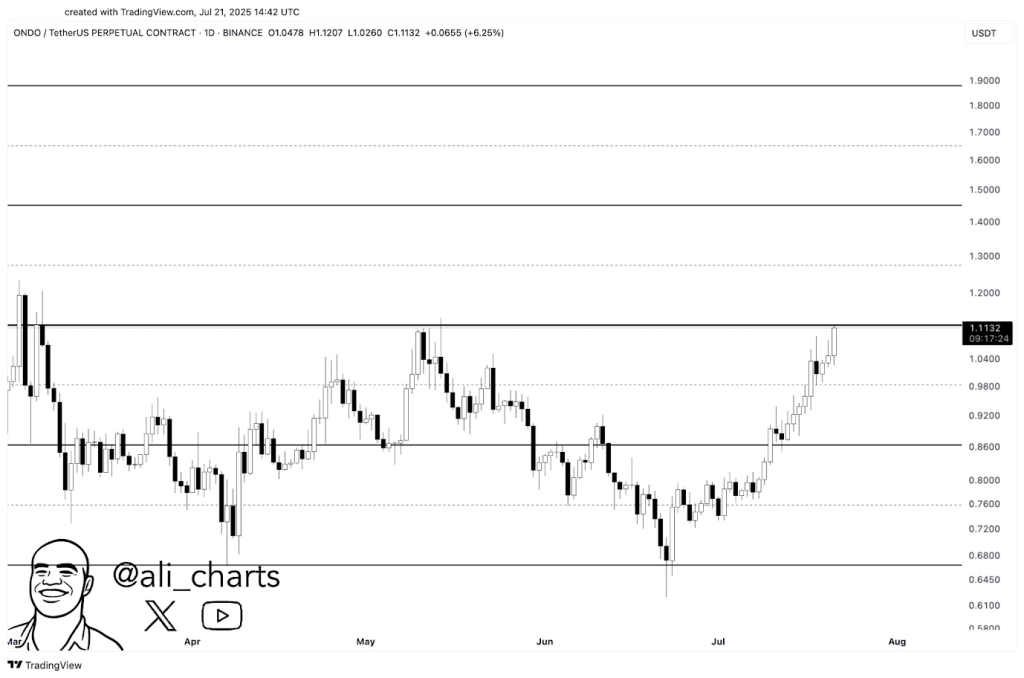

Key Technical Levels (Ali Martinez, via X):

- Resistance: $1.15 (previous rejections in March and April)—because even the best plans have their limits. 🛑

- Breakout Level: $1.26—because who doesn’t love a good financial rollercoaster? 🎢

- Upside Target: $1.50—because dreams are free, but markets aren’t. 💸

- Downside Risk: $0.98–$0.80 zone if momentum weakens—because panic is always an option. 😱

What is the 21Shares ONDO ETF?

It’s a proposed spot ETF that will track the price of ONDO tokens via a passive investment trust held by 21Shares. Or, as I call it, “the financial equivalent of a safety net—just in case.” 🪑

How High Will ONDO Price Go in 2025?

Analysts see strong resistance at $1.15. A breakout above $1.26 could lead to $1.50, while failure could pull price back to $0.98–$0.80. Because the market is a fickle lover. 💔

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- SEI PREDICTION. SEI cryptocurrency

- Cardano ETF Drama: Will ADA Make You Rich or Just Confuse You? 🤔

- SPX PREDICTION. SPX cryptocurrency

- FET PREDICTION. FET cryptocurrency

- Crypto’s Fancy New Suit: Institutions Crash the Retail Party 🎩💼

- EUR USD PREDICTION

- GBP EUR PREDICTION

2025-07-23 10:10