🎄Congress Can’t Even Agree on Crypto by Christmas! 😩

A bipartisan group of pro-crypto senators, united in their love for blockchain and divided on everything else, now agree that the markup-initially scheduled before Santa’s arrival-will likely be postponed until the New Year, when the only thing thawing will be the Senate’s collective sense of urgency.

Crypto’s $1T Dream: Will It Crash or Conquer? 💥🚀

21Shares, that Swiss alchemist of finance, claims stablecoins will surge past $1 trillion and tokenized assets hit $500 billion by 2026. A prophecy penned in spreadsheets and hope. 📊✨

Gemini’s Crypto Carnival: Trump, Twins, and Titanic Predictions 🚀💰

In a press release as grandiose as a Russian novel, Gemini Space Station, Inc. (GEMI) proclaimed that its subsidiary, Gemini Titan, LLC, has finally secured the coveted approval from the U.S. Commodity Futures Trading Commission (CFTC) to operate as a Designated Contract Market (DCM). This, they assure us, will allow them to offer regulated prediction markets to U.S. customers, a feat as predictable as a Nabokov plot twist. 🧙♂️

💩 Oops! Ethereum Has a Glitch, But Vitalik Ponders: Is It Even a Problem?

Key Intricacies Dressed as Takeaways

🇦🇺 ASIC Unchains Stablecoins: Kangaroo Country Hops into Crypto Future 🚀

On a Tuesday, when the world was busy sipping its flat whites and avoiding eye contact with its neighbors, ASIC proclaimed its magnanimity. “Behold,” it declared, “we shall grant ‘class relief’ to those who dare to intermeddle in the secondary distribution of these digital curiosities.” A gesture so grand, one might mistake it for a mirage in the Outback. 🌵💼

Crypto’s December Drama? 🤯

Key Takeaways (or, Things Coinbase Wants You to Think)

Bitcoin Bulls Caught in a Wallet Wreck 🐆💥

December has been a month of tempests and tides for the crypto colossus, following two consecutive months of losses. By the time it breathes, it’s already gasping-for air, for $89,885, for a 2.7% drop in the last day alone. Even the Federal Reserve’s rate cut, a typically cheerful lullaby for crypto, failed to sway the market. Why? Because the music ain’t where the dancers are.

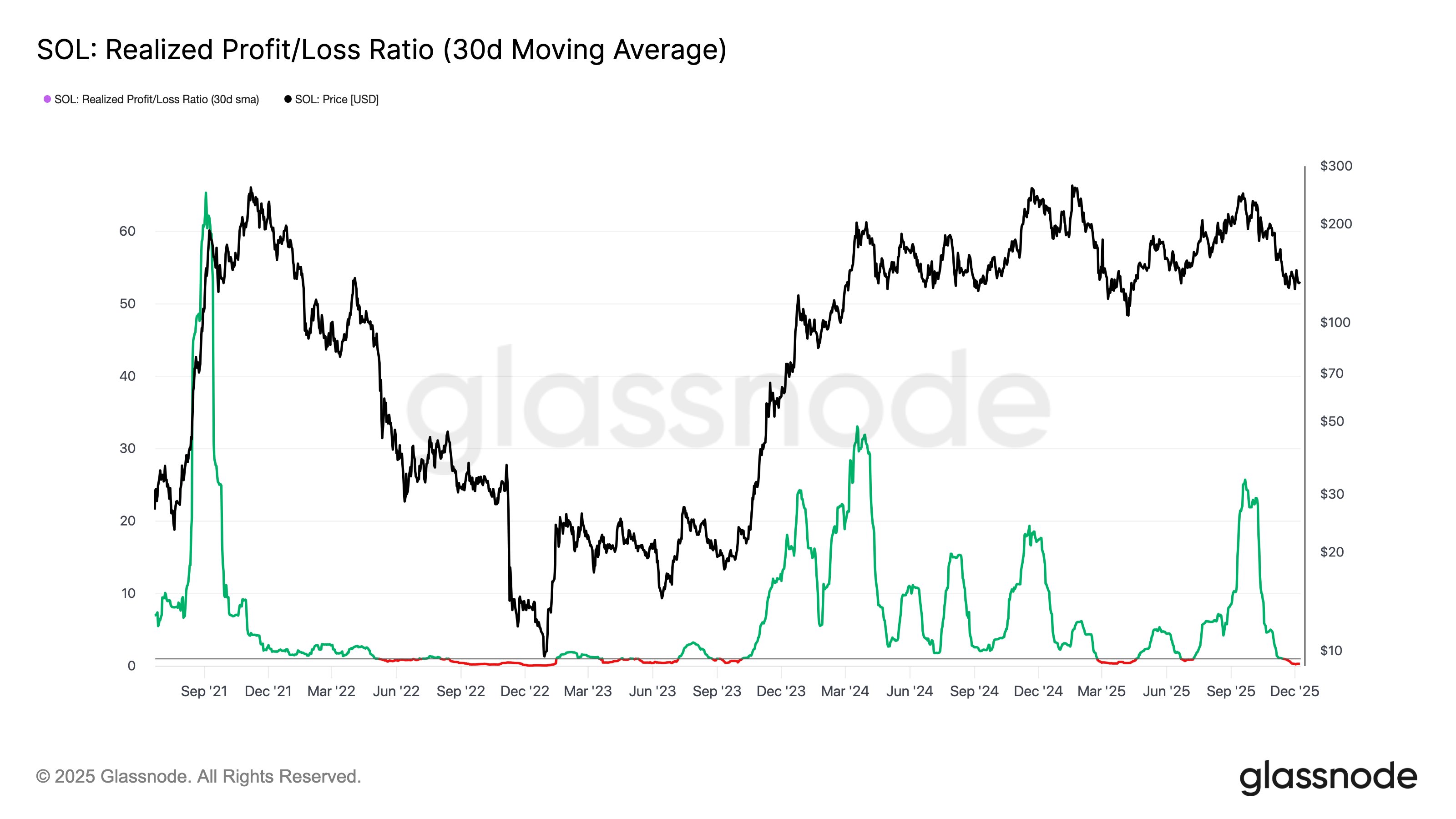

Solana’s Fiasco: Be Bearish Before It’s Too Late! 🐻💸

According to the confessions of the digital oracle, Glassnode, the illustrious liquidity of Solana has bonded quite unexpectedly with the dreary figures of past bear markets. As you may well guess from your prior explorations in logic and mathematics, the Realized Profit/Loss Ratio is their magical divining rod.

Bitcoin Doesn’t Care 🤷♂️ Markets Remain Calm!

Bitcoin, that digital enigma wrapped in a blockchain, spent the morning quietly pretending the Federal Reserve’s rate cut even happened, sticking resolutely above $91,000. It seems acknowledging central bank actions is beneath it. The Fed, bless their hearts, admitted things are a bit… uncertain. Which, let’s be honest, is putting it mildly. It’s like admitting the sky is occasionally blue.