Tokenized Stocks: Are We There Yet? 🙄

Key Takeaways

Key Takeaways

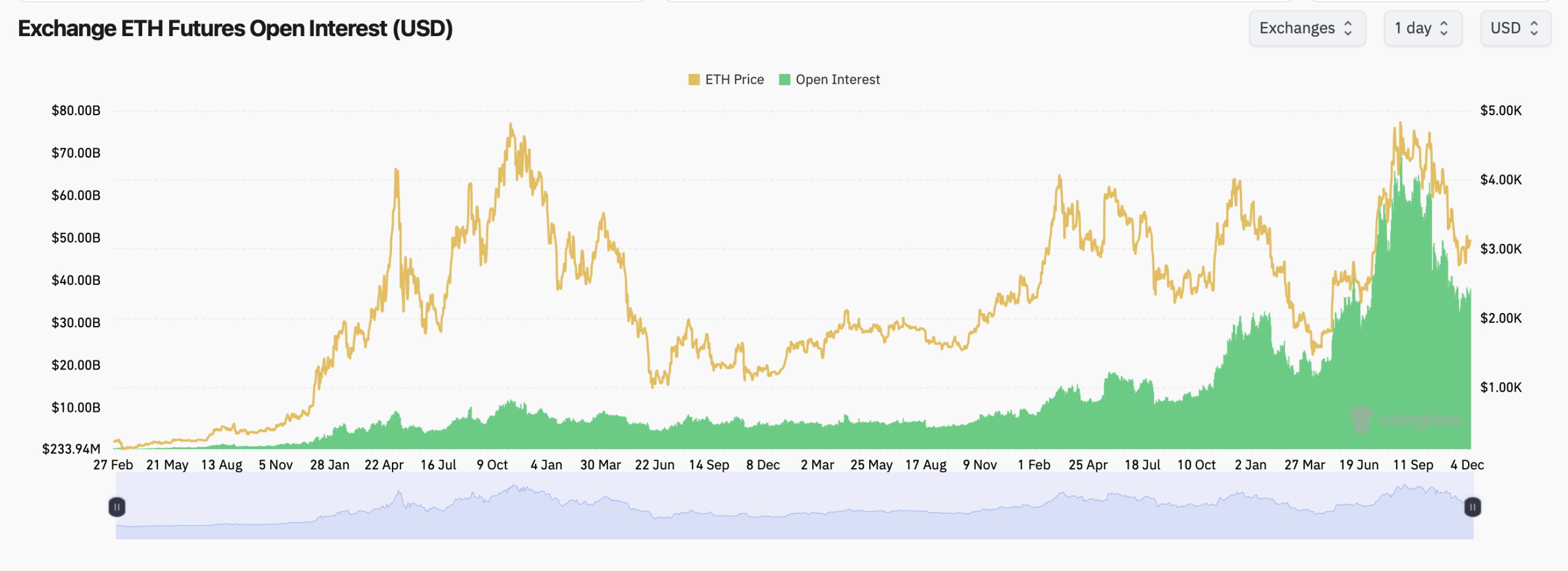

Behold, Ethereum, the proud stallion of the crypto stable, charges toward its resistance cluster, a fortress of numbers and charts. Its recent rally from the $2,700 abyss was no mere stumble but a gallant leap, fueled by the whispers of bullish fervor. 📈✨ Yet, the moving averages, those stern gatekeepers, stand in its path, their arms crossed in judgment. Will ETH scorch them with its fiery resolve, or shall it retreat, tail between its legs? Only the market’s fickle heart knows. ❤️🔥

So, what is the scoop? Well, nearly half of U.S. shoppers are now consulting their trusty AI assistants, and as expected, the youthful rebels (aka Gen Z) are spearheading the charge. They aren’t just swiping cards; they’re swiping with the precision of tech gods on digital wallets and biometrics. 🙄

Telegram and Calendly, those paragons of convenience, now serve as the stage for this farce. A link arrives, glistening with false promises, and the unwary user, perhaps mid-coffee, clicks with the innocence of a child. The result? A malware masquerading as an SDK-a digital confection that devours passwords and private keys with the enthusiasm of a glutton at a feast.

Ethereum’s position in the hearts of institutional investors has waned most lamentably of late. A four-week stretch of outflows in November, a most unremarkable performance, has left many sighing. Yet, amidst the broader market’s recovery, total digital asset inflows reached a modest $716 million last week-a triumph, to be sure, though Ethereum captured but a fraction of this bounty. 📉

Most of Wall Street’s major indexes flashed green on Tuesday, joined by gold and silver gleaming a bit brighter and the crypto market tagging along for the ride. 🧨

Arcane forces unveiled their grandest cartography of privacy networks yet-a modern Prometheus lighting the dark corners of Zcash. With ZEC transactions now branded like cattle, 53% of the network’s whispers are etched into the public ledger. Shielded or transparent, no stone-nay, no cryptographic protocol-is left unturned. The very essence of privacy, once a sacred covenant, now trembles under the weight of revelation.

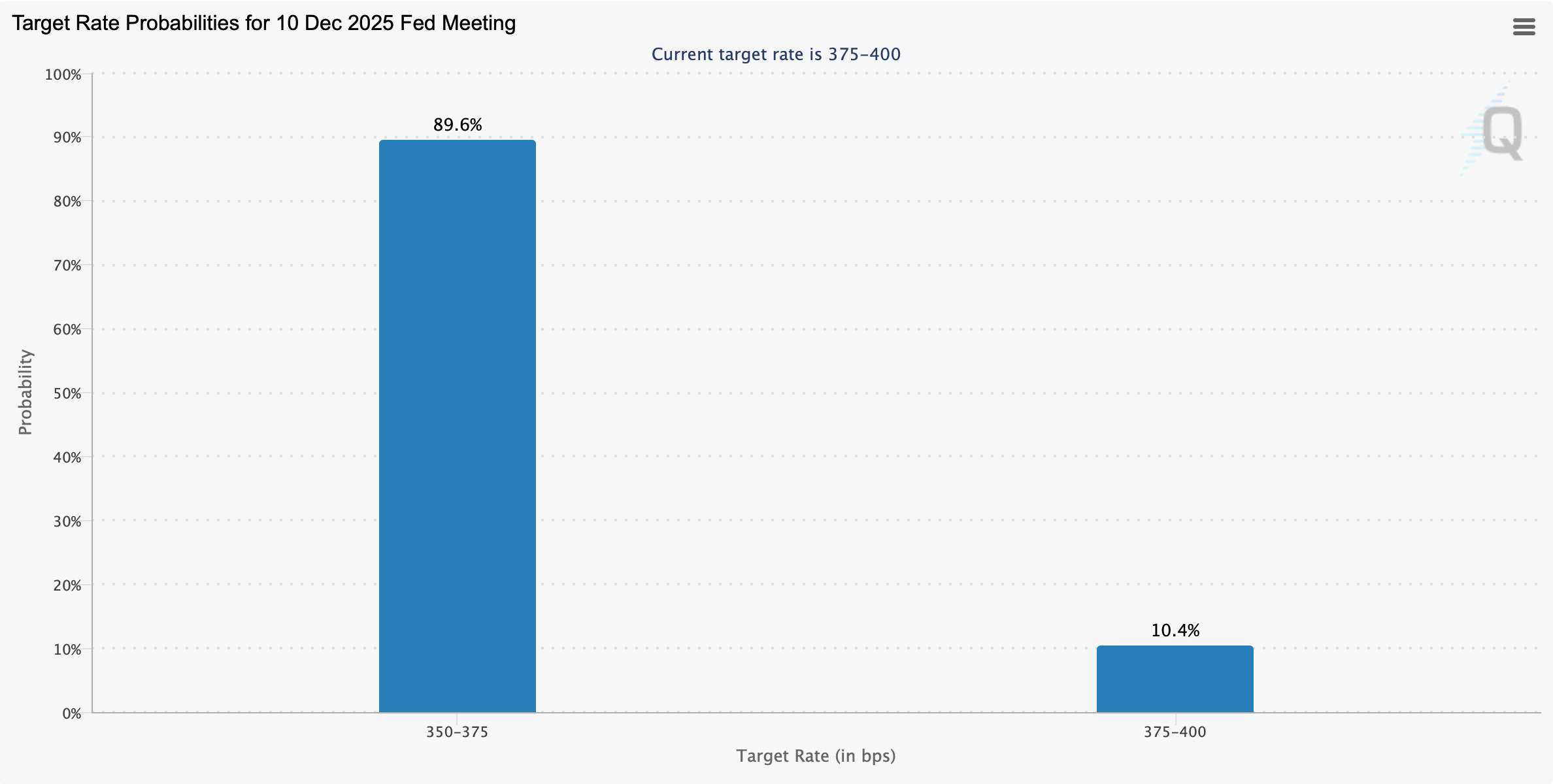

The timing couldn’t be more theatrical, as this surge arrives mere moments before the US Federal Reserve’s next grand announcement on interest rates. One can only wonder whether these traders are betting on the Fed’s benign indifference or a dramatic rate cut that might shake the very foundations of global finance. 🎭

Ethereum is clinging to $3,291 like a toddler holding a candy bar they’re about to drop. Futures open interest? A cool $38B across exchanges, per coinglass.com data. But here’s the kicker: the market’s about as balanced as a three-legged chair. 🪑

Investors and traders are watching closely to see whether the central bank will continue its easing cycle or surprise markets by holding rates steady. As the final policy announcement of the year, the outcome carries considerable weight for crypto markets. 🤔