3 Altcoins to Watch Before the Fed’s Big December Decision (Spoiler: FARTCOIN Wins)

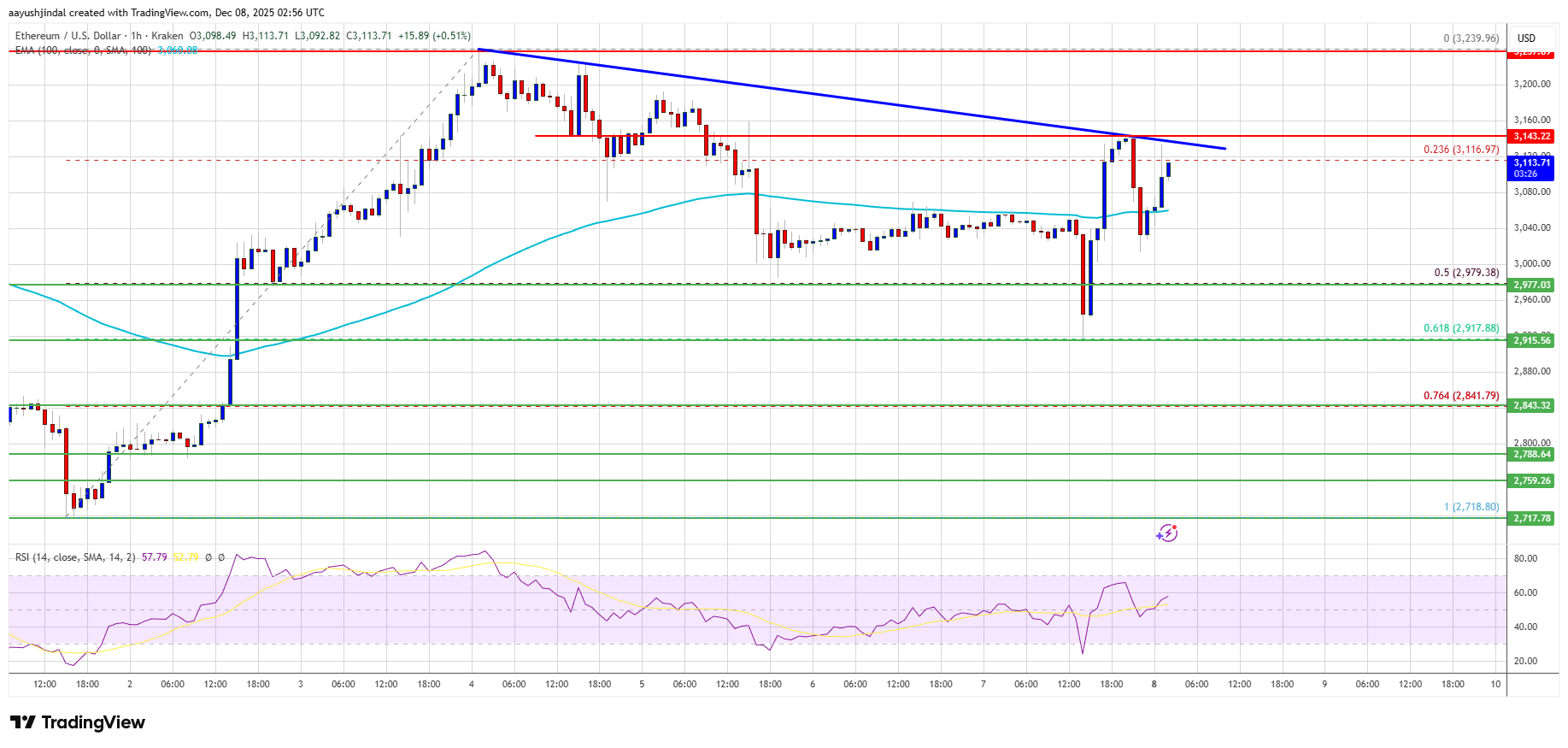

At the moment, the probability of a rate cut is sitting at 87.2% while a 12.8% chance of no interest rate slash exists. If the former occurs, cryptocurrencies could rise as Lower rates typically drive capital into risk assets like crypto. However, a hawkish surprise could suppress demand, especially with Bitcoin down 20% over 90 days. 🚀