Telcoin: From Zero to… Slightly Less Zero? 🚀

Apparently, it’s been generally going up for a while now, triggered by some news in November. News! The old-fashioned kind. Who knew that still worked?

Apparently, it’s been generally going up for a while now, triggered by some news in November. News! The old-fashioned kind. Who knew that still worked?

Remember 2021? When China said, “Crypto? Not in my house!” Well, they’re back with a mic drop. 🎤 “Virtual currencies are illegal now, later, forever,” they declared. Because obviously, when you’re running the third-largest mining operation, you need a committee. Or five.

Lo, at the close of Q3 2025, Tether’s coffers swelled to a staggering $215 billion, while their stablecoin liabilities lingered at a mere $184.5 billion. “Behold,” Ardoino proclaimed, brandishing Tether’s attestation report like a holy relic, “we have $7 billion in excess equity, $23 billion in retained earnings, and profits that flow like a river of borscht! Yet S&P, in their infinite wisdom, hath ignored our grandeur!” 😤💰

It is with great deliberation that the esteemed Central Bank of Kazakhstan contemplates a most audacious venture into the realm of cryptocurrency, a sum of three hundred thousand pounds, no less, amidst the tempestuous tides of market fluctuations. One might say it is a dance of prudence and ambition, though the latter may yet falter under the weight of uncertainty. 🤑

Oh, the leverage! A cruel master, now yoked, leaving the system healthier, less drunk on debt, and more sober than a monk in a monastery. But is this a blessing or a curse? The market, once a tempest, now a cautious whisper, anchored by the fundamentals-those stubborn, unyielding rocks in a sea of chaos.

The annum kicked off with great drama: Ripple’s kitchen, led by the illustrious Brad Garlinghouse, proclaimed a grand finale to the long-drawn legal tête-à-tête with the SEC. Gratefully, Ripple settled for a fee far less ruinous than the $2 billion appetite initially whetted by the U.S. regulator.

In the sultry air of São Paulo, where the coffee is strong and the blockchain buzzes louder than a carnival drum, Cristiano Castro, BlackRock’s Brazilian maestro, let slip a revelation that would make even the most stoic Russian nobleman raise an eyebrow. BlackRock’s Bitcoin ETFs, he declared, are now the crown jewels of the company’s global empire. For an asset manager with $13.4 trillion in its coffers and 1,400 ETFs to its name, this is no mere footnote-it is a thunderclap in the financial steppe. 🌩️

According to a post on the ever-eloquent X (formerly Twitter), the core issue was “failed to complete the required fund setup,” which honestly sounds like a company memo masquerading as a technical explanation. One might speculate that the SEC’s operational prerequisites are as easy to satisfy as convincing a cat to take the written word seriously. 🐱📚

The inimitable Reece Merrick, Ripple’s Middle East & Africa director, took to the digital stage this week to proclaim the obvious: crypto is the new black. 🖤 “Sub-Saharan Africa & Turkey are adopting crypto faster than one adopts a witty retort at a Wildean salon,” he quipped, his words dripping with the gravitas of a man who knows his audience. “In regions where inflation is the uninvited guest and currency crashes the main event, crypto is not merely a trend-it’s the lifeline one clings to with a martini in hand.” 🍸

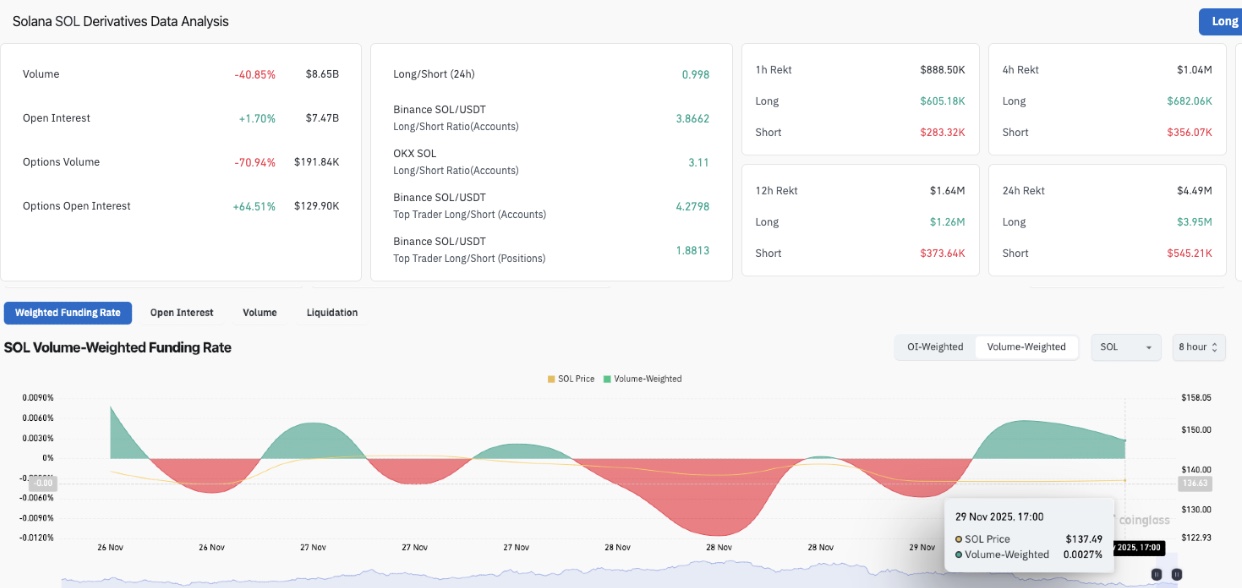

Solana open interest creeps up 1.7% as 21Shares throws in the towel on its SOL ETF dreams. | Source: Coinglass