Solana’s Quiet Rebellion: Will the Crypto Crowd Finally Wake Up? 😴💥

While BTC stumbles under the weight of its own hype, SOL thrives in the trenches, its RWA surge a testament to fundamentals that outpace the noise. A tale of two chains, perhaps?

While BTC stumbles under the weight of its own hype, SOL thrives in the trenches, its RWA surge a testament to fundamentals that outpace the noise. A tale of two chains, perhaps?

The data, presented at Devconnect Buenos Aires (because where else would you discuss this?), shows that 83-95% of liquidity in top pools like Uniswap v2, v3, v4, and Curve is as active as a rock. 🪨 In Uniswap v2 alone, only 0.5% of liquidity is actually doing something productive. The rest? Just vibing. 🕺

Oh, the drama! Ethereum, poor thing, has dropped below the $2,700 mark, all thanks to some rather too strong US job growth data that dashed any hopes for a rate cut. Who would’ve thought a booming job market could wreak such havoc on our beloved crypto? 😱

Oh, absolutely. While everyone else is panicking and selling like it’s a Black Friday fire sale, spot investors are quietly stacking DASH like dragons hoarding gold. Or slightly confused librarians hoarding overdue books. 📚🤑

Enter “66kETHBorrow,” the crypto equivalent of a person who buys a lottery ticket every time you’re sad. First, they grabbed 57,725 ETH like it’s a Black Friday deal. Then, just hours later, they added 7,837 more. It’s like they’re playing a game of “Who Can Panic Harder?” and the answer is: no one. 🧠💥

Bitcoin Cash strides into the post-quantum era, a knight in shining code. Developer Jason Dreyzehner has conjured Quantumroot, a contract system so elegant, it makes Ethereum’s antics look like a child’s scribbles. 🖋️

Kiyosaki, ever the shrewd investor, disclosed that he first acquired Bitcoin “years ago” when it was trading for around $6,000. Fast forward a few years, and he offloads it for a neat $90,000 per coin. If that doesn’t scream ‘I told you so’, nothing will. And the profits, he claims, are being funneled into his growing empire of, yes, surgery centers and a billboard business, no doubt with dreams of financial domination-because who doesn’t want to make $27,500 in tax-free monthly income by February 2026? 😎

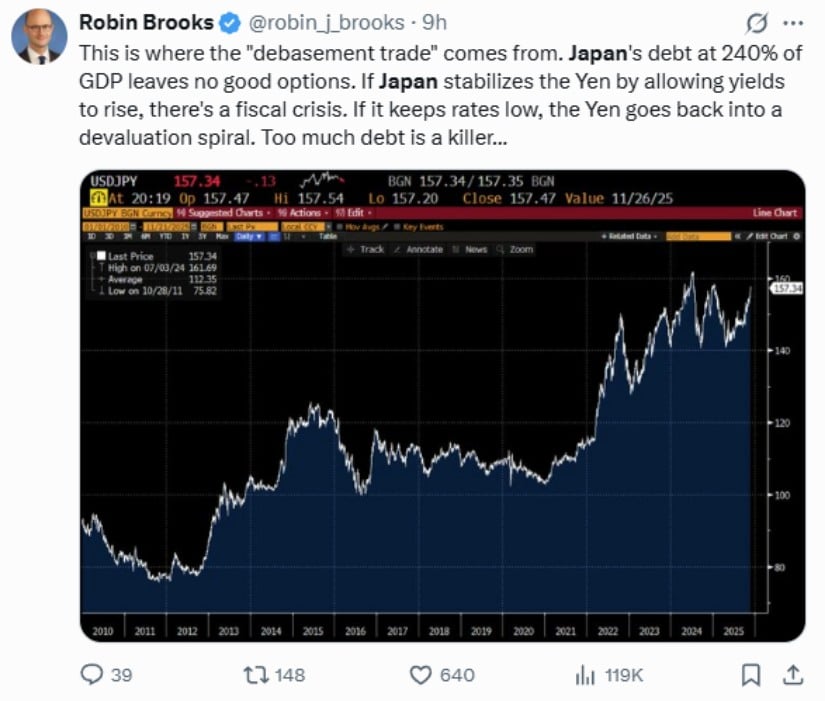

The stimulus announcement sent shockwaves through financial markets, pushing Japanese government bond yields to record highs and weakening the yen to multi-month lows. Meanwhile, Bitcoin continues its painful November correction, having dropped from October highs above $126,000 to around $86,000-$92,000, raising questions about whether the traditional relationship between yen weakness and crypto rallies still holds. 🐍📉

The current turmoil, a cataclysmic slump, has seen BTC plummet nearly 10% in a single day, while the crypto market cap, a once-great empire, has now dipped below the $3 trillion threshold, a number that once seemed as eternal as the pyramids. 🏺