Cronos Surges: Whales Throw a Party – Market Shakes Its Head in Disbelief

Bullish SMI and MACD crossovers, whale accumulation, and rising exchange outflows all sign up for the long haul. Who knew market sentiment could get so sentimental? 😅

Bullish SMI and MACD crossovers, whale accumulation, and rising exchange outflows all sign up for the long haul. Who knew market sentiment could get so sentimental? 😅

Crypto analyst Tracy Shuchart-she’s not just some random person on Twitter, okay-has actually laid out a very clear reason for this mess. It’s not just one thing; it’s a bunch of things crashing at once. It’s like when everything goes wrong on a road trip: flat tire, wrong turn, and then, of course, the GPS dies. She’s saying Bitcoin might just tumble all the way to $80,000. So, there’s that… 🙄

Behold, the OCC, in its infinite wisdom, hath issued a new policy guidance-Interpretive Letter 1186, no less-declaring that banks may hold and use cryptocurrency to pay those pesky “gas fees.” A nod to the GENIUS Act, which, in its convoluted prose, outlines when banks might deign to manage such fees for their hapless customers or in their stablecoin escapades. Oh, the folly of it all! 🤡

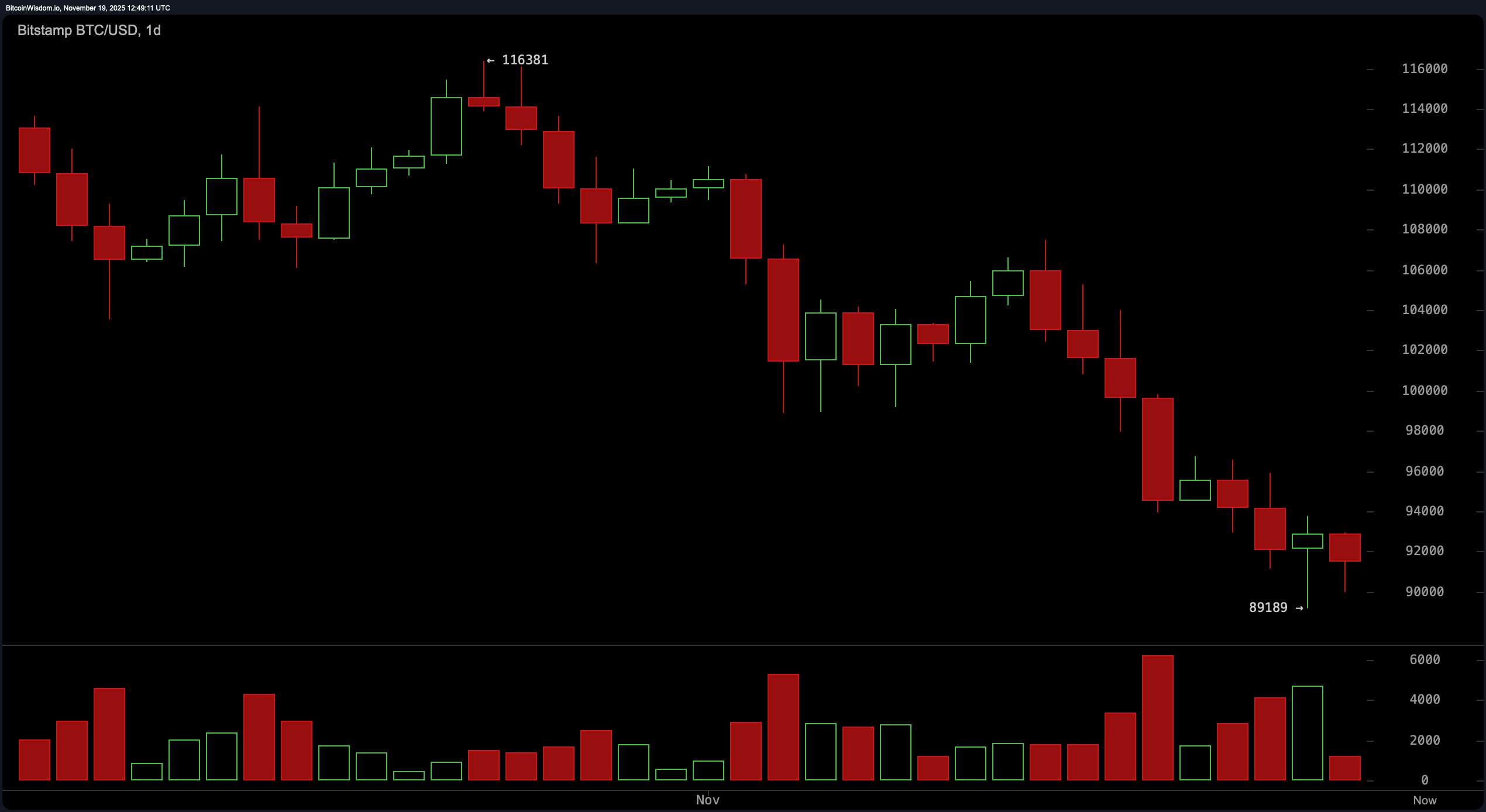

In the past 24 hours, Bitcoin took a tumble below $90,000, and wouldn’t you know it, $568 million in liquidations followed suit-mostly from those poor souls who went long. And just when you thought it couldn’t get any uglier, along comes the dreaded death cross. Sounds like something out of a ghost story, don’t it? But no, it’s just the tech folks’ way of saying the short-term average dipped below the long-term one. Spooky? Maybe. Predictive? Well, that’s about as certain as a weatherman’s forecast. 🌪️

According to CoinMarketCap (yeah, I checked, don’t judge), the RSI on the one-hour chart is 39.92. 🕰️ On the 24-hour and weekly charts, it’s 36.68 and 35.51, respectively. Basically, it’s like SHIB is teetering on the edge of a cliff, but still has a toehold above the 30 mark. So, not oversold, but definitely not winning any awards. 🏆🤡

Now, darling, amidst all this chaos, Cronos is trying to look sprightly thanks to some buzz around Trump Media’s “Crypto Blue Chip ETF”-a fancy little scheme with a 5% CRO slice, provoking some sparks. Meanwhile, the ecosystem’s blossoming like a garden gnome in spring-DeFi TVL hits a new high, and their AWS partnership keeps the developer cubicles buzzing with activity. Oh, the drama! 🏦✨

The flagship cryptocurrency rallied as positive sentiment returned, reaching an intraday high of $93,688 before losing momentum again and falling to $90,013 on Wednesday. BTC is up 1.50% over the past 24 hours, trading around $90,850.

Altcoins, those resilient little scoundrels, have reminded us all that they’re not quite ready for the grave. 🪦

Oh, the analysts are jittery! They’re clutching their tea cups as USDT.D breaks a long-standing barrier. Usually, such a dramatic leap screams “Uh-Oh! A big correction or perhaps a lengthy bear market crash is brewing!” Imagine that – market doom, just around the corner! 💥

The daily chart tells a tale of glittering $116K glory now drowned in a sea of red volume bars, like a sinking ship with no lifeboats. The subsequent green candles? More of a polite cough than a roar. The trend remains bearish until Bitcoin reclaims the mid-$96K range, which currently feels about as likely as a snowball surviving in a sauna. For now, the $89K-$90K band is a flimsy raft in a storm, and any rally toward $96K-$100K risks capsizing on the rocks of past failures.