Ether’s Quiet Rebellion Against Bitcoin ⚡

This is a technical analysis post by CoinDesk analyst and Chartered Market Technician Omkar Godbole, who probably spends more time staring at charts than blinking.

This is a technical analysis post by CoinDesk analyst and Chartered Market Technician Omkar Godbole, who probably spends more time staring at charts than blinking.

This, naturally, allows them to offer what they rather grandly call “regulated stablecoin ramps” across the European Economic Area. In simpler terms, they can now facilitate the conversion between euros and… well, digital trinkets, including their own creation, GHO. The Central Bank of Ireland, a body known for its measured approach to things, granted the authorization to Push Virtual Assets Ireland Limited – a wholly-owned subsidiary. It’s Ireland, you see. A strategically advantageous locale for all things… compliant.

Investors are now gathered in the digital town square, holding candles and asking, “Why, though? Why are we getting jilted again?” Like showing up to your own birthday party and finding out everyone forgot the cake. 😢

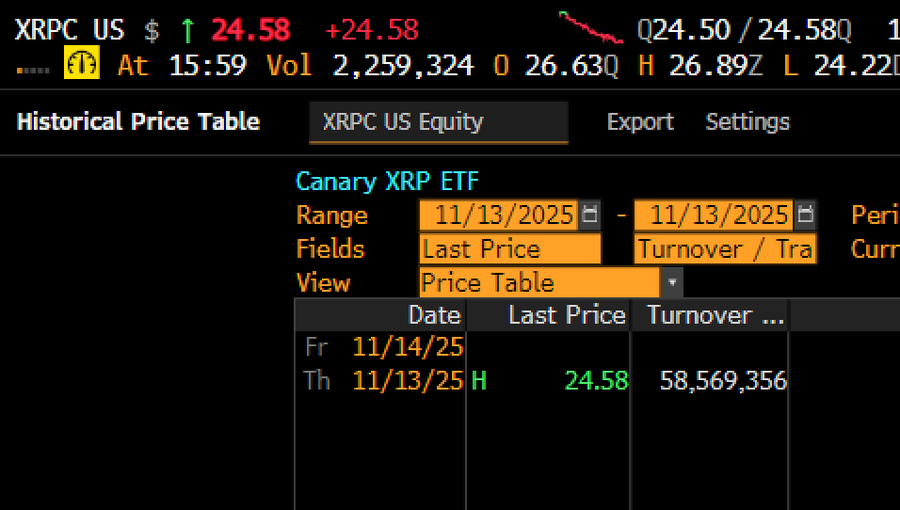

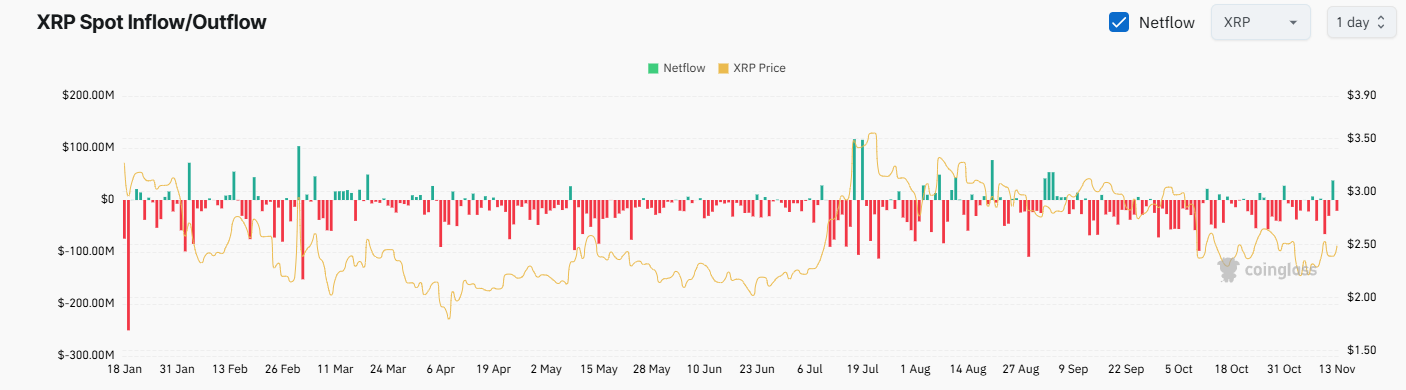

Get this: a new altcoin ETF is outperforming expectations while altcoins are breaking records for sliding faster than Piet, The Flying Dutchman’s, flight when it rains. The star of the lot? Canary XRP ETF, affectionately known as XRPC, which debuted on Nasdaq. On day one, it saw a whopping $58.5 million in volume, just sidestepping the previous record held by Bitwise Solana at $57 million. Over 2.26 million shares were traded, yet the price of XRP couldn’t muster up enough energy to kiss $3.

In a shocking turn of events (well, not that shocking if you’ve been keeping up with this circus 🎪), the Supreme Court decided to spice up our lives by scheduling a January 21, 2026, showdown between Donald Trump and Federal Reserve Board Governor Lisa Cook. Why? Because Trump apparently has nothing better to do than try to fire people. 🤷♂️ Check out the update if you’re into legal drama.

In an unexpected yet unsurprising move (because who wouldn’t want a piece of the crypto pie?), Bitcoin Depot (NASDAQ: BTM) has officially entered the bustling metropolis of Hong Kong on November 12, 2025, marking the grandest debut of its Asian ambitions. This isn’t just any ATM rollout, mind you. These are the mighty Bitcoin ATMs, ready to turn cash into crypto, like a digital wizard casting spells on the financial landscape. Aiming to become one of the top five crypto operators in the region (humble aspirations, right?), the company looks at Hong Kong’s friendly regulatory environment and its insane demand for digital assets as the perfect playground to grow its empire. The move follows a year of meteoric growth, retail partnerships, and international expansions. Next stop, Mars? Maybe.

This day’s expiry is a smidge lower than yestermorn’s $5.4 billion, yet the stakes are mightier, like a bull charging into a china shop, as the market shows the kind of backbone you’d expect from a jellyfish. Therefore, dear traders and investors, let it be known: keep a sharp eye peeled on that ever-tricky max pain levels and positioning, which could skew the market’s short-term mannerisms just as much as Aunt Gertrude’s Sunday pizzeria tips the scales.

This backwards step, in tones of green and red, paints a canvas of a bullish reversal on the chart, reminiscent of old-time farmers eying the sky for signs of better weather. Yet, with boats laden full of large holders setting sail into quieter waters, one wonders if this pattern will truly hold its ground.

BTC is trading between 97K and 98K after a sharp rejection from the 107K to 108K zone, with EMAs fanning down and momentum indicators still bearish. Spot Bitcoin ETF AUM remains strong near 139B, and recent outflows reflect profit-taking rather than structural weakness. Futures open interest sits near cycle highs, showing only partial deleveraging as CME traders reduce risk while offshore platforms maintain elevated leverage. Overall conditions suggest continued downside pressure until a deeper reset emerges. 📉💸

The first key to this riddle? A spot XRP ETF, now dancing on Nasdaq’s stage like a debutante at a ball. Canary Capital’s XRPC, sanctioned by the SEC, offers investors a velvet rope to the token’s world-buy it as one might shares of a tulip, secure in the knowledge that somewhere, a vault holds your digital flowers. 🌸