ETH Hits $4K? PepeNode’s Gamified Mine-to-Earn Gambit 🚀💰

L’ETH est en chasse, mais sans succès. Après des échecs répétés près de $3,700, la liquidité reste bloquée entre $4,000 et $4,100, tandis que les ours gardent leur position. 🐻

L’ETH est en chasse, mais sans succès. Après des échecs répétés près de $3,700, la liquidité reste bloquée entre $4,000 et $4,100, tandis que les ours gardent leur position. 🐻

They say if LINK’s price climbs above $16, we might see a bullish comeback-like a boxer-survivor ready to throw a punch. But if it flops and stays below, say, $11.60, it might just take a nap and drift further down, dreaming of better days.

Despite a few fleeting attempts to show some spark, HBAR remains stuck in a narrow range, much like your friend who says they’ll “get around to it” but never does. It’s the cryptocurrency equivalent of walking in place, while everyone wonders if the ‘next big thing’ is actually coming-or just an elaborate prank.

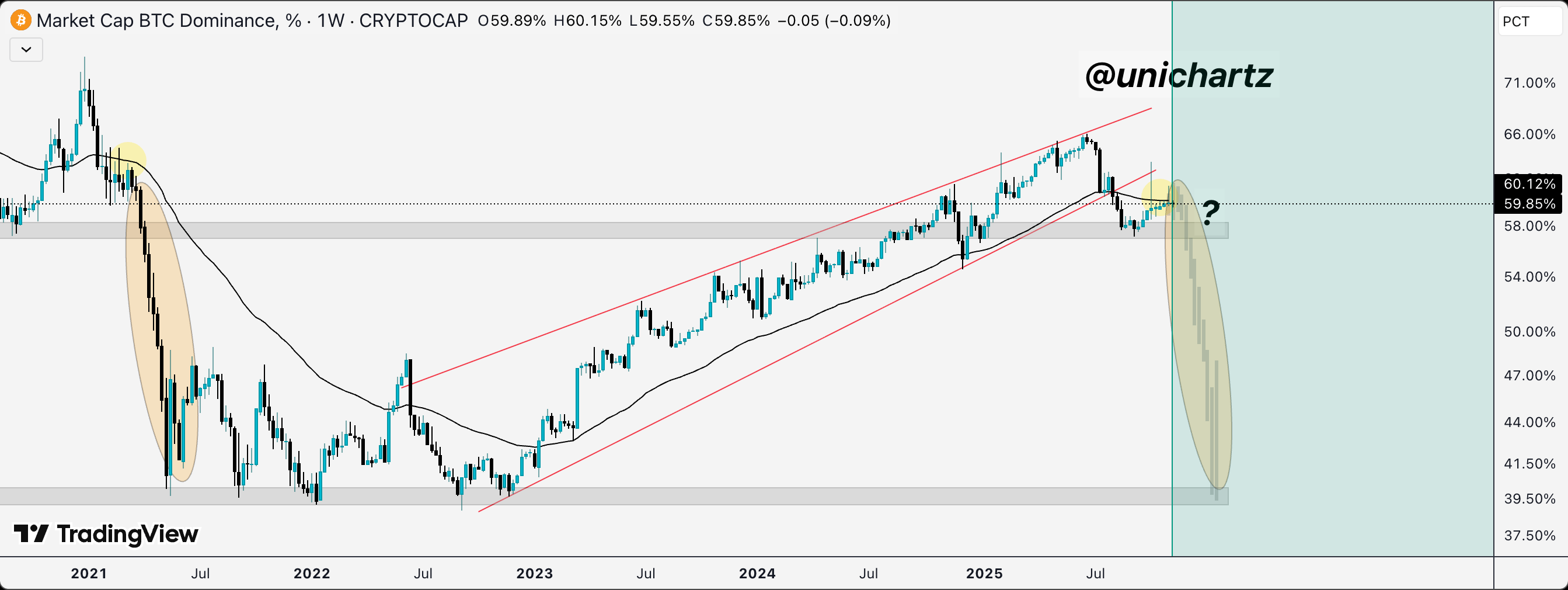

Since 2023, Bitcoin’s dominance has hovered above the 50 EMA like a helicopter parent, stifling altcoins’ dreams of ever becoming “relevant.” 🚫💸 Imagine the 50 EMA as a speedbump-Bitcoin dominance just ran over it barefoot. The October 10 crash? More like a group therapy session for the emotionally unstable crypto market. Now it’s been sulking below the EMA for a whole month, as if it’s finally realized it’s not the main character. 😢

The plot thickens as BB&T (just kidding, it’s Bloomberg) unveiled this grand tale on the 12th of the eleventh month. This pioneering endeavor heralds a new epoch where public blockchains slyly flirt with the ways and means of real-world banking.

Crypto Candy-because who trusts financial advice from someone named after sugar?-notes that Bitcoin’s price action is unfolding like a predictable rom-com. It held strong in the $99K-$101K zone (very mature), setting the stage for a rebound toward $107K-$108K. But now? It’s stuck in a classic will-they-won’t-they with resistance.

Julio Moreno, that sage of on-chain analytics, has unveiled the latest twist in this tale of digital gold. “Production” and “inventory,” they say, are the twin musketeers of this metric, yet here we are, dancing on the edge of a speculative cliff! 🧠

On a crisp November morning, as the leaves turned gold and the coffee grew cold, DBS and Kinexys by J.P. Morgan announced their latest endeavor-a collaboration so bold, it might just make the financial world blush. 🌟 Their mission? To build a bridge where tokenized deposits can prance between public and permissioned blockchains, 24/7, like well-dressed guests at a never-ending soiree. 🌉✨

Hayes, who co-created BitMEX and then took long walks away from the spotlight, now finds himself holding a portfolio that’s shrunk from the moon to a modest $17 million. But don’t worry-he’s still a heavyweight, holding Ethereum, Ethena, USDC, Lido, and other crypto curiosities. Meanwhile, UNI’s price has gone on a tear, up nearly half-fancy that-just in time for Hayes’s grand reentry. The price? Sitting comfortably at $8.64, having jumped 20% overnight. Market cap? About $5.45 billion-because crypto investors love a good rollercoaster and a big number to talk about. 🎢💰

The platform, called CT Settle (a fancy acronym that sounds like something you’d find in a spy movie), will let financial institutions trade crypto and stablecoins while pretending they’re still in the “traditional” finance game. It’s like telling your parents you’re going to work from home but you’re actually just binge-watching Netflix in pajamas.