Crypto Chaos: Samourai Wallet Founders May Face Jail Time 😬💸

Samourai Wallet became the ultimate criminal hangout spot for laundering money and dodging sanctions. 🕵️♂️💸

Samourai Wallet became the ultimate criminal hangout spot for laundering money and dodging sanctions. 🕵️♂️💸

With central banks and governments playing big brother, everyone’s rushing to privacy protocols like they’re last-minute Black Friday deals. DCR’s secret sauce – hybrid consensus, on-chain votes, and the Treasury that funds itself – has the crypto world’s attention. Sure, regulation might be lurking in the bushes, but hey, who cares when the market’s basically doing the cha-cha?

The DeFi world, already as stable as a one-legged troll on a tightrope, was sent into a tailspin. XUSD hit a new all-time low of $0.30, according to the ever-watchful CoinGecko. That’s right, folks-it’s cheaper than a pint of dwarfish ale at the Mended Drum! 🍺

No, really. Their Twitter team took the kids to the park: “Our external fund manager said we’re down $93 million, so we’re turning off withdrawals and deposits while we ‘investigate’ adulthood. Keep calm, chill out, and maybe don’t send your kid’s college fund here.” To consult lawyers?ходят Keith & Joseph-real heroes who’ll solve this by “watching the tapes… in Bitcoin Core.” 🕵️♂️ Contract addresses, meet your new best friends.

On this peculiar November day, a press release unfurls, revealing that Ripple, that indefatigable pioneer, aims to broaden its custody infrastructure, extending its digital embrace to fintechs, corporates, and those enigmatic crypto-native firms. They all stand at the precipice, needing secure havens for their digital treasures.

SUI, my dear reader, is flirting with destiny-or so the analysts would have us believe. A symmetrical triangle, you say? How utterly mundane yet dramatic! Since October 2024, this crypto charmer has been forming a pattern so predictable, it’s practically a Victorian novel. Volatility tightens, institutional interest rises-oh, the suspense is almost palpable. 🧐📉

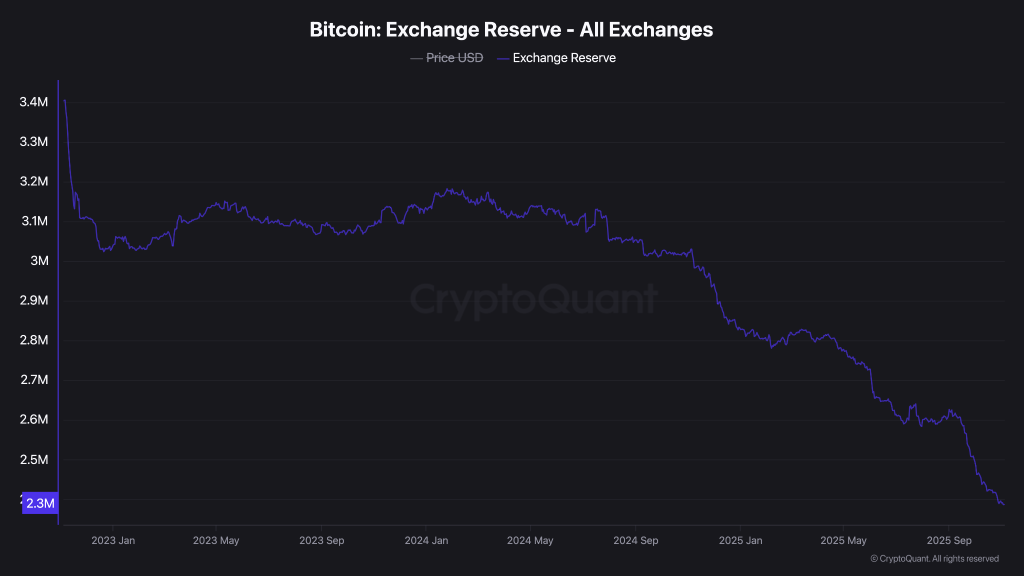

Exchange outflows, those cryptic indicators of investor sentiment, have been speaking volumes. A rising trend suggests indecision, while a declining one hints at optimism. Enter CryptoQuant, whose data reveals that the balance on exchanges has plummeted to 2018 levels. Nearly 209,000 BTC-worth over $14 billion-have been whisked away from centralized exchanges over the past six months. 🏃♂️💨

In case you missed it, Solana has failed to stay afloat above $185, much like Bitcoin and Ethereum when they’re having an off day. It dipped below $182 and $180, setting the stage for what could only be described as an entertaining descent.

According to The Bull Theory (which sounds like something a drunk bloke in a pub would come up with), November is Bitcoin’s “best month ever” – or at least statistically less rubbish than the others. Apparently, Bitcoin averages a 40-42% gain this month, which is basically like finding free money in your winter coat pocket. 🧥💸

The first bear pillar, the “AI bubble,” is like a dinner party where everyone insists the main course is a soufflé-until it collapses into a puddle of custard. Nvidia’s brief $5 trillion jaunt in October was a reminder that some valuations are built on sand, not stone, and that the market’s appetite for AI infrastructure may be more appetite than substance.