Crypto’s Great Debate: Bulls, Bears, and a Dash of Drama 🐄🐻💥

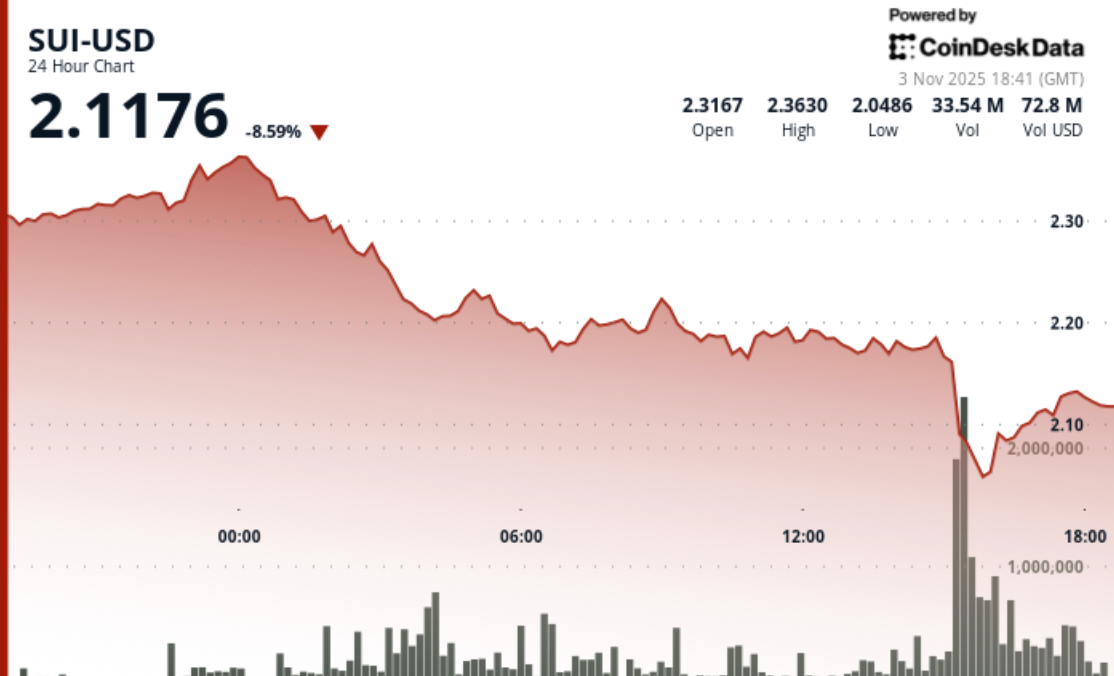

The first bear pillar, the “AI bubble,” is like a dinner party where everyone insists the main course is a soufflé-until it collapses into a puddle of custard. Nvidia’s brief $5 trillion jaunt in October was a reminder that some valuations are built on sand, not stone, and that the market’s appetite for AI infrastructure may be more appetite than substance.