Oracle & IPDN: The Blockchain BFFs Taking Over Finance! 💸

According to a16z and HTX Ventures, the tokenized asset market has surged to $30 billion, quadrupling in just two years. Because nothing says “growth” like a 300% increase. 🚀

According to a16z and HTX Ventures, the tokenized asset market has surged to $30 billion, quadrupling in just two years. Because nothing says “growth” like a 300% increase. 🚀

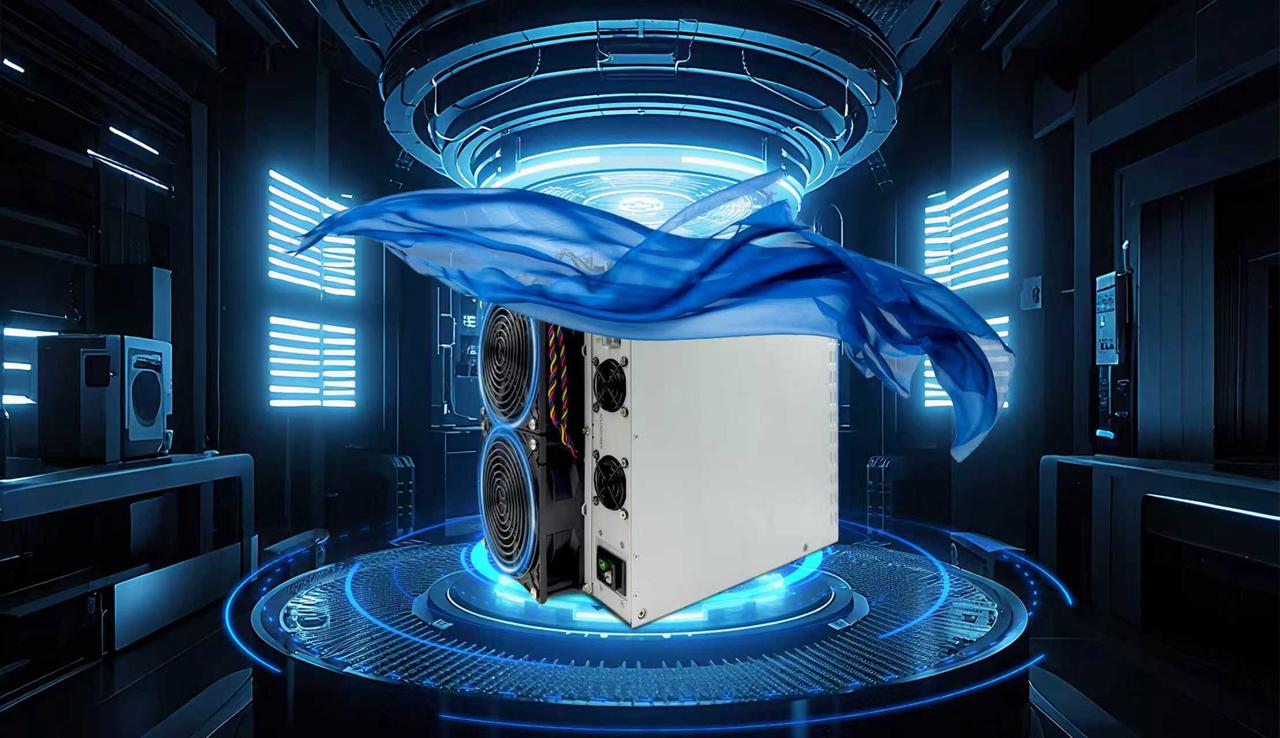

In a world where miners claw at the earth for every scrap of digital gold, the A16XP promises to be the sharper pickaxe. Air-cooled, durable, and reliable-Canaan’s signature traits-this machine is designed to keep operators humming even as the network difficulty climbs higher than a mountaineer’s ego. 🏔️

Bitcoin, that digital alchemist, has been handed a golden ticket (or a golden ledger?) by Mr. Fink himself. During a conference in Riyadh, the BlackRock patriarch, with the gravitas of a man who’s never met a spreadsheet he didn’t adore, proclaimed both crypto and gold as “assets of fear.” One might say he’s giving investors a recipe for panic-baked goods. 🧁💸

If you’re holding Myx Finance [MYX], Aster Network [ASTER], or Humanity Protocol [H], congratulations! You’ve outperformed the rest of the pack like a star athlete in the crypto Olympics. 🏅

Official Trump (TRUMP) hit a high of $8.17 on Monday, Oct. 27, up 78% from its monthly low. That’s a rebound that’ll make your grandma’s apple pie look flat. And get this-the 24-hour trading volume hit $2.2 billion, which is more than its market cap of $1.42 billion. Talk about a tail wagging the dog! 🐕

Enter Éric Ciotti, the man of the hour, who seems to think that banning the digital euro (currently being toyed with by the European Central Bank) is a great idea. Instead, let’s all jump on the crypto bandwagon and promote “the dissemination of euro stablecoins” – which sounds like the world’s least exciting treasure hunt.

If this audacious plan succeeds, France’s 420,000 BTC hoard would dwarf the U.S. holdings, making it the undisputed Bitcoin tsar of the world. 🧑🚀🌍

In a move that can only be described as “flawless,” Solana came back stronger than a Wi-Fi signal after a system reboot. It cleared $200 and made shorts go up in smoke – over $47 million of them, just like that. The biggest hit? A liquidation at $202, which shows how spicy things are getting. The price is cruising above the 7-day and 25-day moving averages like it’s on a Sunday drive. And as long as it doesn’t dip below $194, we’re looking at some solid chances of hitting $210 or even $220. Get your popcorn ready. 🍿

Yet, in this theater of greed and fear, bullish specters emerge from the shadows, their whispers growing louder: November, they say, may yet crown the king. 👑