ICP Takes a Dive: Crypto Market Goes “Eh, Whatever” 🤷♂️

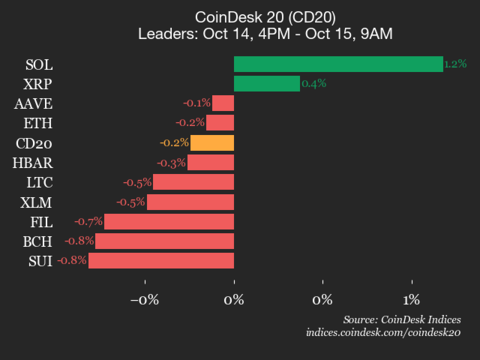

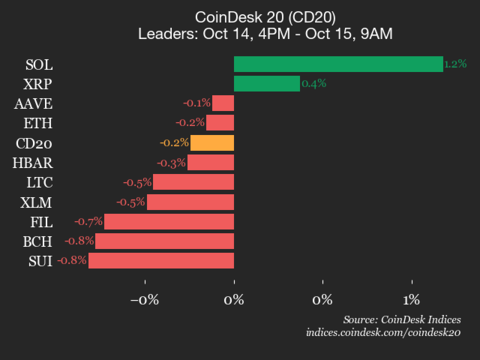

The CoinDesk 20 is sitting pretty at 3775.75, down a whopping 0.2% (-9.16) since 4 p.m. ET on Tuesday. Big whoop. 🥱

The CoinDesk 20 is sitting pretty at 3775.75, down a whopping 0.2% (-9.16) since 4 p.m. ET on Tuesday. Big whoop. 🥱

Ah, the world of futures traders! Like gamblers at a poker table, they’ve donned their bullish hats, counting their chips with a 1.53 long-to-short ratio, all while anticipating an upward tick above the $0.33 mark. The tension in the air is palpable-will it pay off? 🤷♂️

But then, as it often does, reality hit. After hitting that glorious high, ZEC’s price did what every overzealous investment tends to do: it took a breather. Now, the price is chilling around $263, as traders took their well-deserved profits and volatility decided to stop pretending like it was a roller coaster. So, while ZEC was the shiny new toy, it seems the toy’s starting to lose its luster. Who knew?

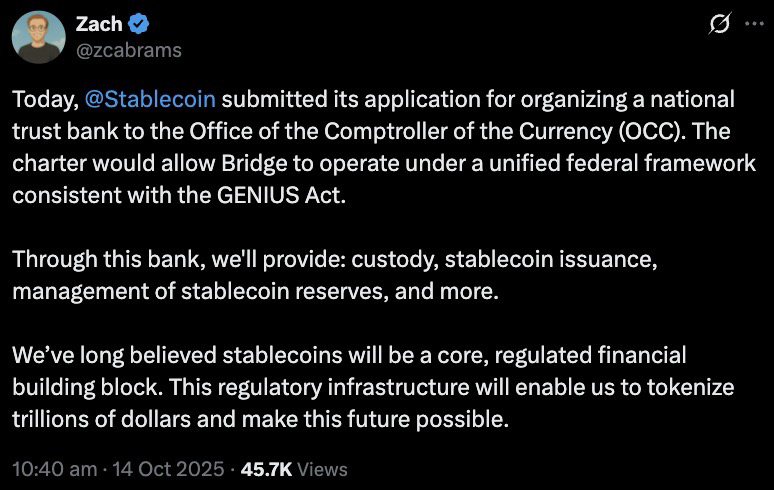

Stablecoins are going legit, and pretty fast. A most surprising turn of events, given their previous penchant for skulking in the shadows of unregulated fintech.

Wondering what hath driven ETH’s outsized gains? Three factors stand out, like three musketeers: ETF inflows, a softer stance from the U.S. Fed, and a technical rebound. These elements give traders fresh optimism, as if they’ve discovered a philosopher’s stone for risk appetite. 🧙♂️✨

Mr. Buterin, of course, has grand dreams of aggregating proofs from various rollups into a single proof, submitted once per slot-no doubt to centralize settlement activity, reduce our reliance on the ever-so-reliable bridge operators, and allow for swift cross-rollup movement of assets through Ethereum. Such a quaint vision of efficiency-though, as always, the devil is in the details.

Lucky’s chart on X paints a tale of woe: a bearish symphony stretching from late 2024, punctuated by failed breakouts and the occasional gasp of optimism. Each upward stumble, a brief flicker of hope, only to be snuffed out by the relentless tide of sell pressure. But lo! A demand zone emerges-a savior in green, ready to absorb the tears of sellers. 🌊

XRP price must flip the 200-day SMA and the $2.70-$2.80 resistance into support for a rally above $3.00. Seems simple enough, right? 😏

Behold the 4-hour chart of our dear $BTC, where the first act of this financial ballet is already in motion. Should this trendline yield to the pressure, a consolidation above $112,000 shall ensue, and the price may pirouette upwards to the $116,000 resistance. A breakthrough here, my friends, could coincide with the second trendline-a faint dotted line, yet one of great significance. Should both barriers fall, Bitcoin may soar once more to its all-time high, guided by the majestic ascending trendline (bold and black, like a well-tailored suit). 🎩

Now, as the market slowly recovers, attention is returning to XRP ETFs. Many investors are asking whether these ETFs could trigger a big price rally or even a parabolic move. 🧠 Let’s just say, if the ETFs were a dating app, XRP would be the “I’m just looking for fun” profile that ends up changing your life. 🤯