Bitcoin’s $1.7M Dream: Gold’s Digital Twin or a Mirage?

Yet, according to Bill Miller IV, a prophet of numbers, the price would ascend to $1.7 million, a number so grand it might as well be a fairy tale.

Yet, according to Bill Miller IV, a prophet of numbers, the price would ascend to $1.7 million, a number so grand it might as well be a fairy tale.

The post, dripping with the subtlety of a sledgehammer, suggested that “ambitious opportunists advocating protocol changes” could jeopardize Bitcoin’s crown jewel: its immutability. Ah, yes, because nothing says “trustless” like a bunch of developers arguing over GitHub commits.

The author of “Rich Dad Poor Dad,” that paragon of financial wisdom, took to the digital pulpit of X this week to declare that silver shall rise like a phoenix from the ashes of fiscal recklessness, while gold, Bitcoin, and ethereum shall bask in the glow of a crumbling dollar, their values as immutable as the laws of thermodynamics-except, of course, when they’re not.

A recent report by Artemis and McKinsey – two names not typically associated with jest – delivers the tragic news: on-chain dollars are, quite simply, party crashers without an invitation. They account for less than 1% of real-world payment volumes. One percent! Less than the tip a British waiter hopes for but never receives.

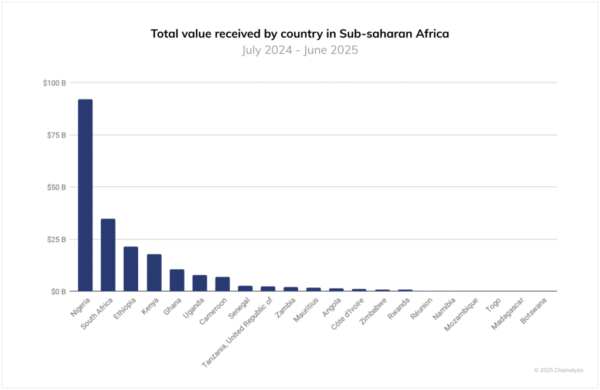

Africa, the land where remittance fees gnaw at the pockets of the hardworking folk, now finds a beacon of hope in the form of stablecoins! Yes, those nifty digital coins are not just shiny baubles; they are cutting down costs and providing an alternative to the lumbering giants of traditional banking. With local currencies wavering like a leaf in the wind, these fiat-pegged marvels are becoming the lifeline for many households and businesses alike. Blockchain data now shows that stablecoins have become the very backbone of financial transactions on the continent-who would have thought?

Take Artificial Superintelligence Alliance [FET], for instance. Down 16.84%. That’s not just a dip; that’s a full-on belly flop into the shallow end of the pool. And Virtuals Protocol [VIRTUAL]? Not much better. A 15.71% slide. But hey, in this game of financial musical chairs, every pullback is just a chance to grab a seat-or so they tell us.

Thirty-five percent down, they say. A trillion dollars vanished, like a migrant worker’s paycheck blown away in a dust storm. Liquidity, once a rushing river, now trickles like a dry creek bed, leaving behind only the parched bones of shattered dreams.

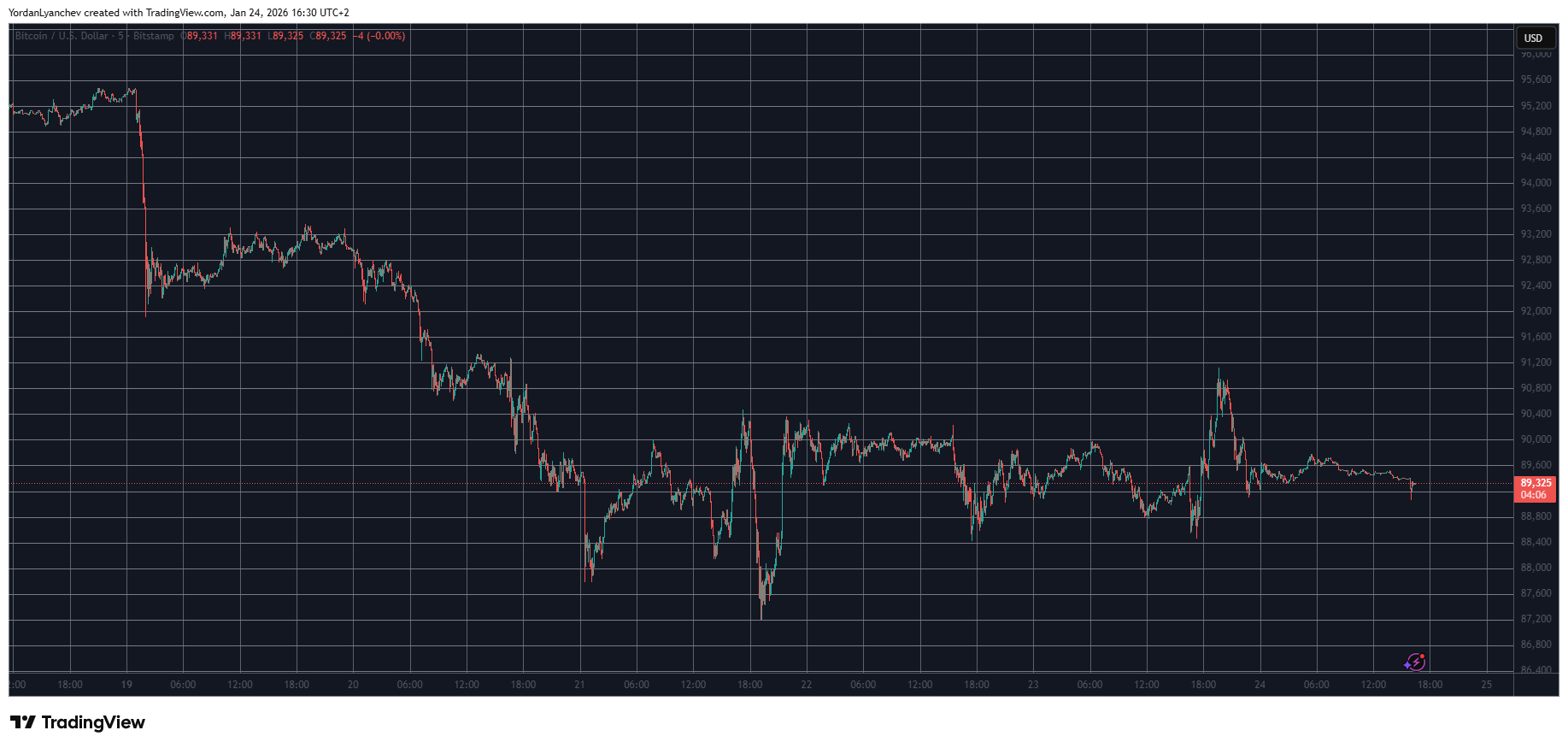

The consequences of such a decree, one might venture to suggest, are not to be taken lightly, particularly for that most modern of curiosities, Bitcoin. History, that steadfast chronicler of human folly, reminds us that the mere whisper of tariffs has sent this digital asset into paroxysms of fluctuation. Thus, it behooves the prudent investor to cast a watchful eye upon its movements in the coming hours, lest they be caught unawares by its capricious nature.

Meanwhile, the yen did a little victory dance, rallying up to 1.75% to 155.63 per dollar, all because someone whispered the words “Japanese intervention” in a crowded room. No official confirmation yet, mind you, but when has a lack of evidence ever stopped a good financial frenzy?