AI and Copyright: Mark Twain’s Take on the Modern Patent Circus

Mike Rowe, Dirty Jobs

Mike Rowe, Dirty Jobs

Apparently, Dragonfly made an early investment in Tornado Cash, which—spoiler alert—isn’t exactly winning any “Good Samaritan” awards these days. Co-founded by Roman Storm (a name so perfectly villainous it sounds like he should be twirling his mustache while tying someone to train tracks), Tornado Cash is under fire for allegedly helping bad actors launder billions in stolen crypto. And now? The feds might slap some charges on Dragonfly too. Because why not? It’s 2023; everyone loves a good witch hunt. 🔍🧙♂️

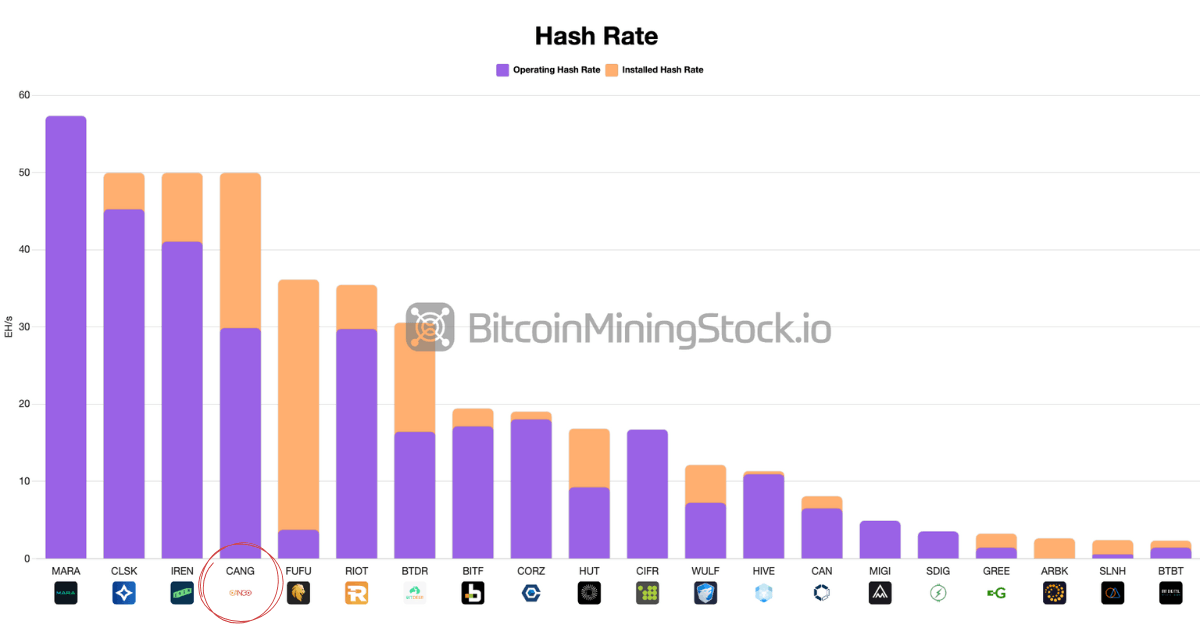

In a move that could easily be described as “hold my beer,” Cango has wrapped up a rather important secondary acquisition. This, of course, catapulted them to being the 4th largest publicly listed Bitcoin miner by hash rate. Bravo! A standing ovation was warranted, only slightly overshadowed by the concern of what might come next. After all, they’ve freshly minted a brand-new executive team, loaded with crypto-whizzes and former Bitcoin miners, while their original masterminds graciously traded their super-voting shares for common stock. This, dear reader, is what experts would likely describe as a “leadership handover” reminiscent of a very serious game of poker.

By Jove, Ripple Labs has taken to the social media platform X (formerly known as Twitter, don’t you know) to issue a jolly fraud alert. Seems there’s been a sharp uptick in XRP-related shenanigans on YouTube. These cads are pinching legitimate channels and tarting them up to look like Ripple’s own, then using them to flog deceptive schemes and fleece unsuspecting viewers out of their hard-earned XRP. Tsk, tsk. Ripple chimed in with a PSA that’s as clear as a bell:

First off, they’re stockpiling XRP in their treasury like it’s the elixir of eternal profit. Then, they’ll slap the XRP Ledger onto a real-time payment system for swift, cheap transactions with everyone from pharmacy pals to vendor foes. It’s positioned as giving XRPL “real utility” in healthcare logistics—translation: let’s see if this digital phantom can actually do something useful without vanishing into thin air. 🤔

Right now, AVAX idles at $24.81, eking out a modest 3.71% gain over the past week, as if it’s trying to impress with half-hearted efforts. Trading volume? Plummeted by 31.84%, signaling that the crowd’s enthusiasm has waned faster than interest in an old Gogol tale. 😴 With altseason supposedly in full swing, AVAX nurses dreams of stardom, recalling its outrageous 1,150% surge back in 2021—ah, the good old days of irrational exuberance. At a market cap of $10.1 billion, it clings to the 17th spot in the crypto hierarchy, a position as precarious as a tightrope walker’s balance. Will it shine or fade? Only time, and perhaps a miracle, will tell. 🍕

As highlighted in our earlier coverage of Crypto Week, the Act passed the Senate on June 17. It received bipartisan support (68–30). The House voted on July 17 (308–122). President Trump’s signature the next day codified the bill as Public Law No. 119-27. 🧱

Now, if one were to refer to BTC/USD chart before and after the ETF, it would look like two entirely different assets—one sprightly and effervescent, the other a rather dull accountant in a beige suit, wouldn’t you agree? 🤭 Our dear analyst shared a revelation on a rather innocuous Friday:

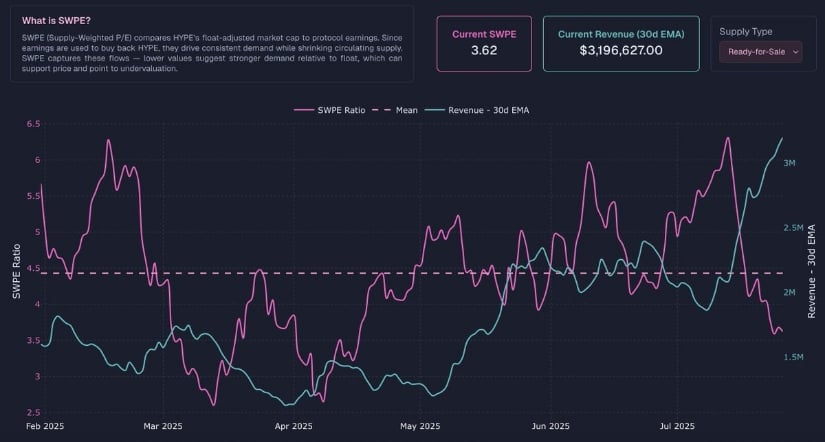

So McKenna’s out here claiming that if Hyperliquid hit its old SWPE ratio, it’d be cruising at $77. Based on some $3.2M revenue EMA—sounds legit, right? But come on, the dashboard shows SWPE at 3.62, way below past highs, even with revenue climbing. It’s like finding a penny on the street and thinking you’re rich. 😂 The gap between price and revenue? It won’t last forever, or so they say, but I’m skeptical—markets are full of surprises, and not the good kind.

This newfound momentum is like a warm wind at the back of PENGU, propelling it forward in both demand and chart performance. Who knew that being pudgy could lead to such success? 😂