Bitcoin’s Surge to $120K Sparks Explosive Gains in ETH, HYPE, UNI, and SEI!

Bitcoin remains strong as long as it stays above $110,530.

Bitcoin remains strong as long as it stays above $110,530.

According to some clever person on X (no, not the ex, the social media platform 🙅♀️), SUI’s 1-hour chart is looking rather fetching, with the price trading above the 5, 10, and 20-day moving averages. It’s like the ultimate party, and everyone’s invited 🎉. But, as we all know, parties can get out of hand, and the Relative Strength Index (RSI) is warning us of a potential short-term pullback 🚨.

But what struck me most was the sense of calm that pervaded the report. No, this wasn’t a market driven by retail hype and speculation. This was a market driven by institutions, by the big players who had finally decided to take crypto seriously 🤑.

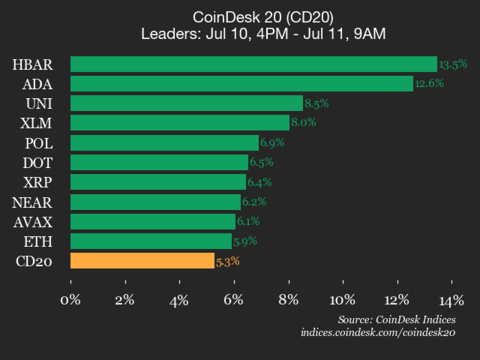

As of this writing, the CoinDesk 20 is frolicking at a merry 3513.86, a full 5.3% (+176.17) higher than its Thursday afternoon slumber. One can almost hear the champagne corks popping and the joyous whoops of investors as they gaze upon their swelling portfolios! 🥂

Even solana 🌞, the darling of the previous drive to record highs, seems to be taking a back seat, rising just 3.9% while the likes of sei 🚀, ethena 🌈, and optimism 🌟 are celebrating gains of as much as 28%.

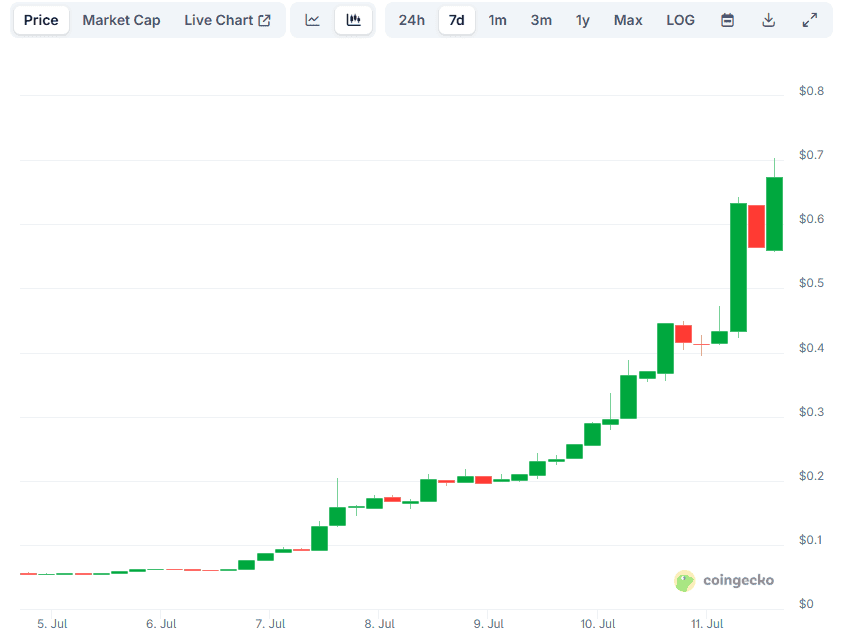

In the grand theater of finance, the newly minted MemeCore (M) has notably captivated the stage, flaunting an impressive ascent of 1,110% — a veritable feat of alchemy that lands it at the esteemed price of around $0.68. Ah, what dreams are spun in the looms of trading!

At the time of this writing, Cardano was trading at $0.74, a modest 18% profit over the past 24 hours. But on the higher timeframes, the cryptocurrency had recorded a 28% profit, outpacing even the swift XRP, which had gained 20% over the same period. It was as if the digital world was tipping its hat to Cardano’s resilience.

This dramatic ascent promises to keep us agog, but let’s not kid ourselves – the real test of this parry now lies in the face of broader supply zones, lest we find ourselves metaphorically up a creek without a paddle in the days to come.

This milestone comes as tokenized RWAs have seen an 800% increase in total value locked in 2025. Across all applications, RWAs TVL is now higher than $65 billion. Blocksquare’s own tokenized assets in real estate are now used across 29 countries and 66 properties. 🌍

On the daily time frame, the pair has closed a candle above the upper Bollinger Band for the first time since March. Ah, but what does it mean, you ask? Well, my friend, that band is not just some arbitrary line; it’s the dividing line between bull and bear, and XRP has just burst through it like a reckless youth at a Moscow ball. 💃