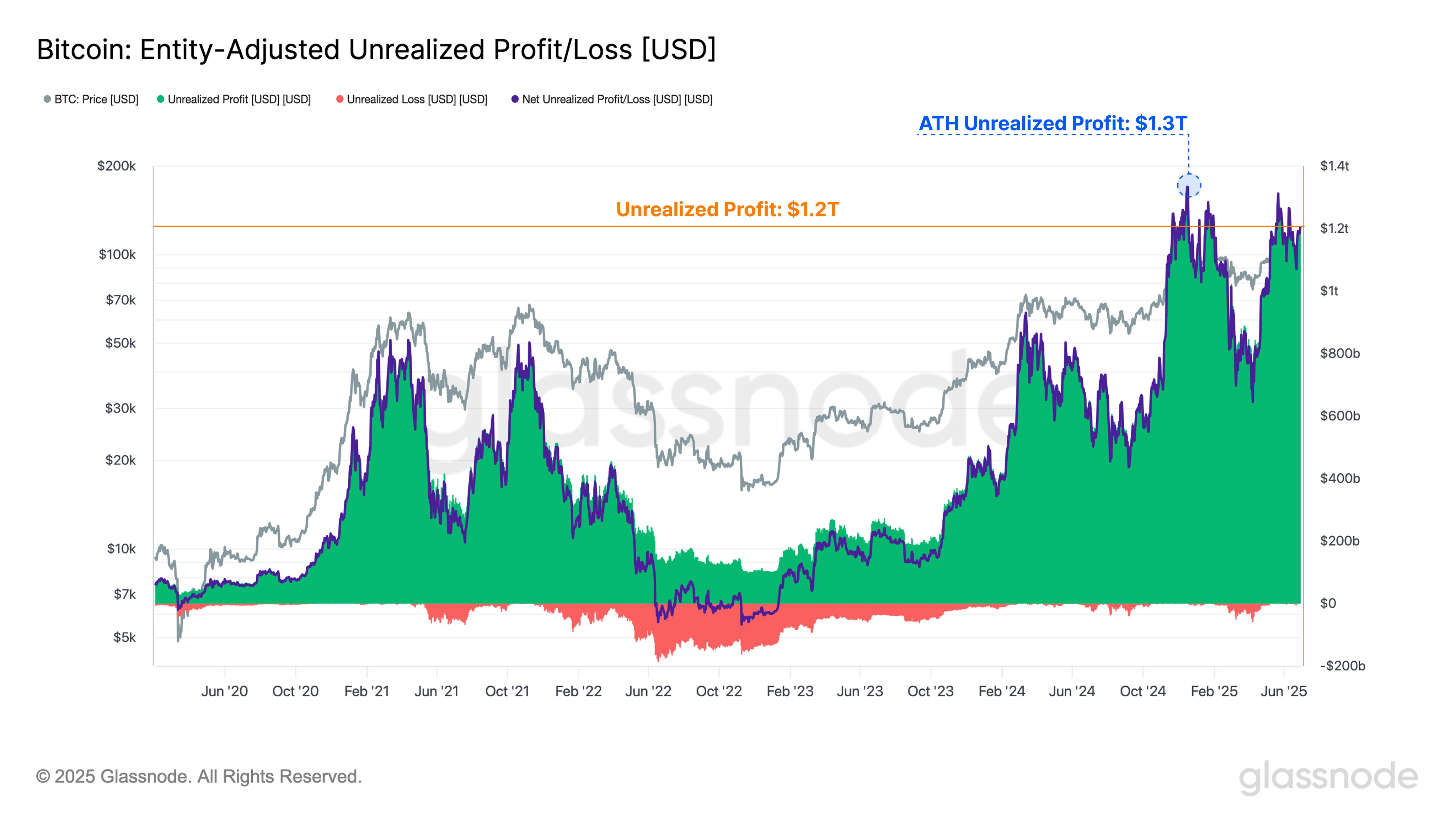

Bitcoin’s Wild Ride: 93% of Holders Laughing All the Way to the Bank! 🤑💰

And if that wasn’t enough to make you do a happy dance, Bitcoin’s dominance has shot up to 64%, thanks to CoinMarketCap. 🚀 But what does that mean, you ask? It’s like Bitcoin is the captain of the crypto football team, and everyone else is just trying to get a spot on the bench. 🏈🏆