SHIB’s Weekend Woes: When Bulls Cry and Bears Roar 🐻😢

The price of SHIB has taken a little tumble, down 0.8% since yesterday. I guess some of us are just not morning people. 🕒😴

The price of SHIB has taken a little tumble, down 0.8% since yesterday. I guess some of us are just not morning people. 🕒😴

The exodus harks back to the glory days of Q1 2020, when everything was being sold except perhaps one’s own grandmother. Robert Tipp, high priest of bond wisdom at PGIM, offered this ominous gospel: “It’s a volatile environment, with inflation misbehaving and the government churning out IOUs as only a government can. People are nervous at the long end of the yield curve, though they do appreciate the coffee at Fed meetings.”

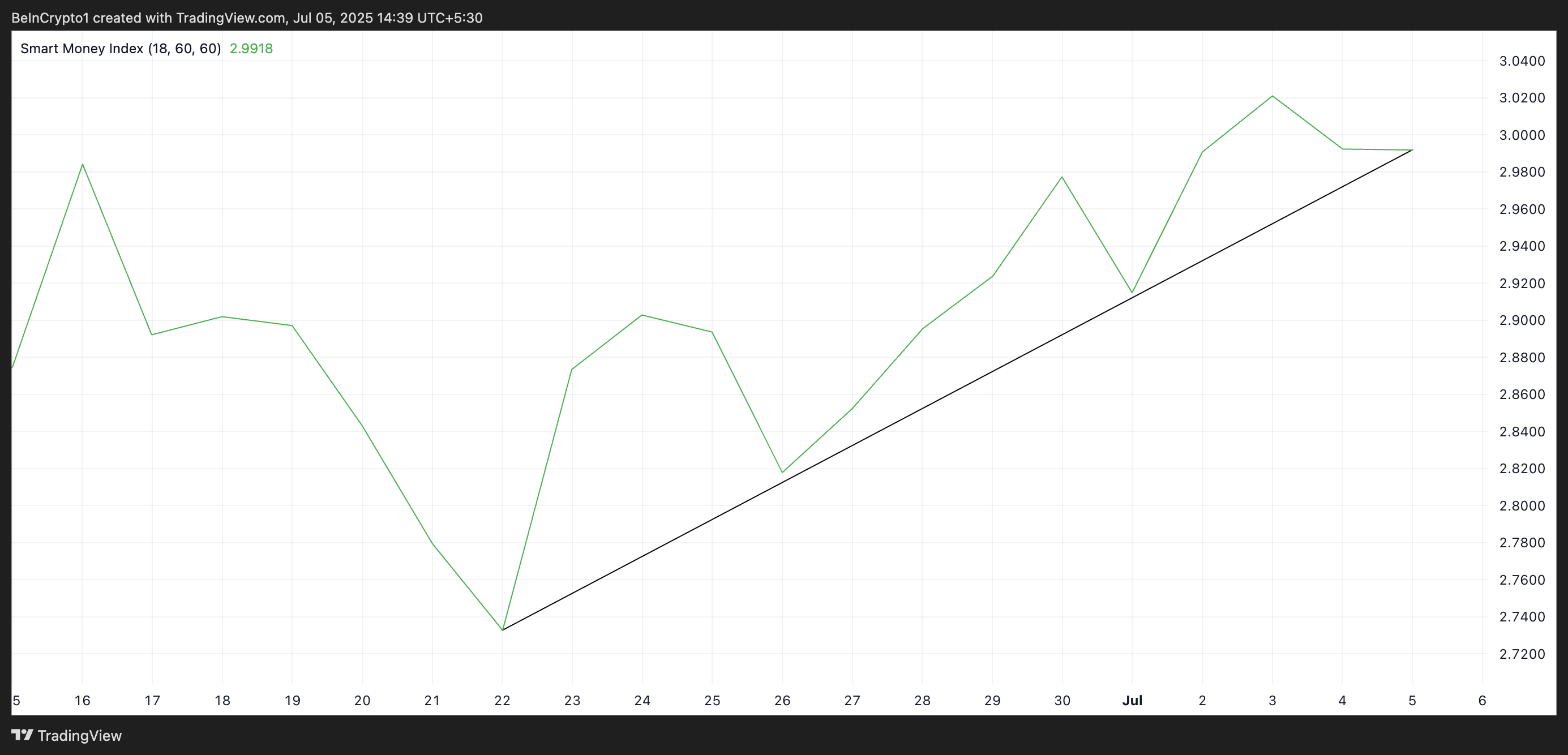

The price recovery, though marked by constant dips, appears to be driven by renewed investor confidence, especially from experienced market participants. This analysis holds the details.

The coin’s price has mostly concentrated on its downwards interpretive dance since the brief joyride sparked by post-election euphoria in November, which—surprise—turned out to be a temporary sugar rush for the whole market.

In a recent video update, the crypto trader, with a following of 170,000 YouTube subscribers, delves into the historical precedents that suggest the top crypto asset by market cap is poised for a meteoric rise. 🌠

So, latest cosmic update: Bonk, ever the enthusiastic pup, has leapt approximately 6.42% (statisticians love decimals) toward the legendary price of $0.000018. This possibly has something to do with vague mutterings about strong ETF “buzz” and feverish token burning. That last one’s not literal, in case you were hoping for a fire show.

Meanwhile, as the global stablecoin bazaar swells beyond $250 billion (the kind of sum that would keep old Karamazov up for three days straight, plotting mischief), aging financial institutions, with their creaky ledgers and porcelain teacups, feel the creeping horror of irrelevance. The times, they are a-changing—but not, regrettably, the wallpaper at the bank headquarters. 📉🏦

Deep within the chatter-halls of the internet, whispers rattle: Tuttle Capital may unleash a 2x BONK ETF, doubling not just the price but, presumably, the heart rates and hopes of retail investors everywhere. Is it real? Is it illusion? Does it matter when the masses are already handing over their sanity for a ticket to the express ride? There’s nothing quite like unconfirmed rumors to flood a market with optimism—and memes.

The Blockchain Recovery Investment Consortium, a group that sounds like it was formed to right the wrongs of the crypto world, brought this legal case forward in August 2024, alongside Celsius. The complaint alleges that Tether, in a move that would make a used car salesman blush, sold Bitcoin that was supposed to be held as collateral in a 2022 transaction. Celsius claims that, due to the current price of Bitcoin, they are now over $4 billion in the hole, all thanks to Tether’s liquidation antics. On July 2, 2025, the court ruled in favor of proceeding with the case, effectively telling Tether that their jurisdictional challenges were about as effective as a screen door on a submarine. 🚤🚫

An XRP enthusiast with the Twitter handle @XrpHodL_ shared some juicy screenshots from a stenograph of a court session between the SEC and Ripple. In it, Ripple CTO and XRPL co-creator David Schwartz dropped a bombshell: he thinks Satoshi might have held a ton of XRP back in the day.