Trump to Unleash Crypto Chaos on Retirement Savings: Will Your 401(k) Become a Bitcoin Bonanza or a Financial Fiasco? 🤔

your golden years funded not by stodgy stocks and bonds but by the whimsical dance of Bitcoin and Ethereum. 🕺💃

your golden years funded not by stodgy stocks and bonds but by the whimsical dance of Bitcoin and Ethereum. 🕺💃

Mark your calendars for Wednesday, July 23, folks. That’s when the XYZ stock will officially join the big leagues, rubbing shoulders with Coinbase Global Inc., which slipped into the club back in mid-May 2025. One can almost hear the champagne corks popping—or maybe that’s just Bitcoin enthusiasts celebrating. 🎉

But amidst this financial ballet, some fascinating data has emerged from the depths of CryptoQuant. Brace yourselves, comrades, because Bitcoin’s Realised Cap – a fancy way of saying the total value of all coins based on their last sale price – has hit a new all-time high. A trillion dollars, folks. A TRILLION. 🤯

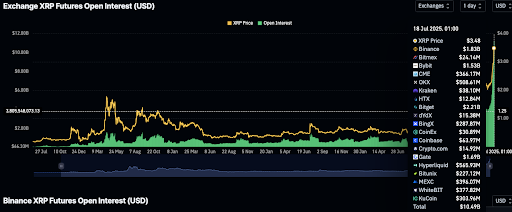

As chronicled by the brave scribes at Coinglass, the Open Interest in XRP futures has not merely ticked upwards; it has erupted like an overzealous volcano, now plumbing the depths of $10.49 billion. Traders have flocked like moths to a flame, pouring their treasures into the derivatives roulette! And let us not forget Captain Redbeard—yes, you heard that right—who heroically reported this triumphant surge on that micro-blog where thoughts fly like confetti.

So, what’s the tea? Well, the 21Shares FTSE Crypto 10 Index ETF is basically the popular kid at school, tracking the top ten crypto assets by market cap. Meanwhile, its shy but equally intriguing sibling, the 21Shares FTSE Crypto 10 ex-BTC Index ETF, is like the cool indie band that doesn’t play with Bitcoin. 🌟🚀

This Mr. Crypto Kaleo – a distinctly anonymous fellow with a following of over seven hundred thousand on that X platform (sounds frightfully modern, doesn’t it?) – has pronounced that Dogecoin (DOGE, if you’re taking notes) will be soaring to a price tag of nearly seven dollars a pop. Seven dollars! That’s a rise of over two thousand six hundred percent, you know. Almost enough to buy a rather decent hat. 🎩

Wilson was on Bloomberg Television, spouting off about how Q3 is going to be the “quarter of risk” – because who doesn’t love a good risk, am I right? 🤔

Ethereum Classic (ETC) was dancing like its supply chain depended on it, soaring 20% in just 24 hours—resurrecting the memory of January 2025 highs (yes, I know, it feels like a distant galaxy). Outpacing its friends in the top 100 and leaving Bitcoin’s little sibling in the dust, this altcoin has clearly embraced its inner party animal. 🥳

On the eighteenth day of the seventh month, in the year of our lord two thousand and twenty-five, Brahma, a startup of considerable repute in the realm of crypto credit, declared its sacred pact with Euler Labs. The fruit of this liaison is Swype, a card both virtual and mighty, enabling the gentry of DeFi to access their lending positions for payments in the mortal world, without the sacrifice of assets or the perilous crossing of blockchain boundaries.

Ripple co-founder Chris Larsen is back in the spotlight (again), having shuffled $26 million worth of XRP into Coinbase while the market was busy throwing confetti. This little maneuver coincides with XRP jumping 32% in days, hitting $3.6 faster than you can say “blockchain.” But let’s not kid ourselves; when someone moves that much crypto around, they’re probably up to something. Selling? Maybe. Buying yachts? Definitely possible.