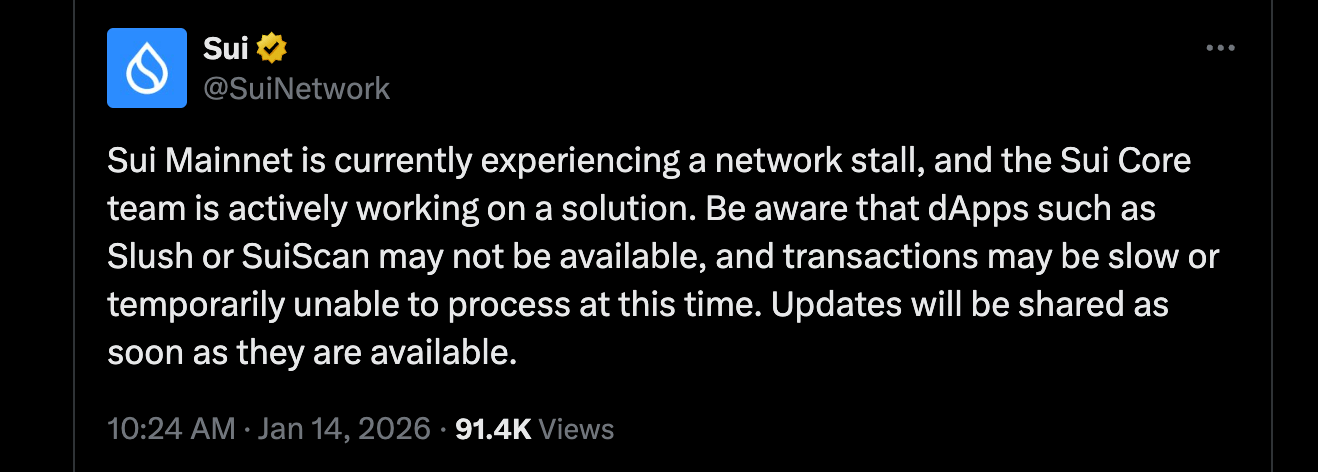

Sui’s Grand Pause: Blocks Frozen, Transactions Bewildered 🤯

At 9:52 a.m. Eastern, the Sui blockchain ceased its rhythmic block-making waltz. By 1 p.m., the network lay in a comatose state, its validators presumably sipping tea and discussing the weather-if only they could communicate.